There's a secret phrase that turns any credit card into a financial self-defence superhero. "Section 75" laws means your plastic must protect anything you buy over £100 for free, so if there's a problem or the company goes bust you can still get your money back. Plus there's help for purchases under £100 with the Chargeback scheme.

There's a secret phrase that turns any credit card into a financial self-defence superhero. "Section 75" laws means your plastic must protect anything you buy over £100 for free, so if there's a problem or the company goes bust you can still get your money back. Plus there's help for purchases under £100 with the Chargeback scheme.

This full detailed Q&A; guide, shows you how to maximise protection, when you're not covered and includes free template letters for claiming.

In this guide

Quick links

While every effort's been made to ensure this article's accuracy, it doesn't constitute legal advice tailored to your individual circumstances. If you act on it, you acknowledge that you do so at your own risk. We can't assume responsibility and don't accept liability for any damage or loss which may arise as a result of your reliance upon it.

What is section 75?

It's a vital law that was made in the seventies that means your credit card company must take responsibility if things go wrong in a purchase. In a nutshell...

Pay for something costing between £100 and £30,000 on a credit card and the card issuer's equally liable if something goes wrong.

This isn't the credit card company being nice, it's a legal protection put in place so that you're never in the position of paying debt for something you didn't receive or wasn't as it should've been. Whether it's a flight, kitchen, computer or anything else, pay on the card and the card company's responsible too.

Watch the Video Guide

Courtesy of five TV. Originally from It Pays To Watch!

The law behind this

This all comes from Section 75 of the Consumer Credit Act 1974, hence why this is sexily named Section 75. It rather impenetrably says…

75. — (1) If the debtor under a debtor-creditor-supplier agreement falling within section 12(b) or (c) has, in relation to a transaction financed by the agreement, any claim against the supplier in respect of a misrepresentation or breach of contract, he shall have a like claim against the creditor, who, with the supplier, shall accordingly be jointly and severally liable to the debtor. Read it in full

(3) Sub-section (1) does not apply to a claim:

(a) under a non-commercial agreement, or

(b) so far as the claim relates to a single item to which the supplier has attached a cash price not exceeding £100 or more than £30,000.

(4) This section applies notwithstanding that the debtor, in entering into the transaction, exceeded the credit limit or otherwise contravened any term of the agreement.

(5) In an action brought against the creditor under sub-section (1) he shall be entitled, in accordance with rules of court, to have the supplier made a party in the proceedings.

When should I use it?

This piece of legalese is fantastic protection, particularly during these credit crunch times. It means if you order something and if the retailer goes kaput, you can still claim your money back from the card company.

Plus even if the problem is just non-delivery or faulty goods, you have exactly the same rights from the credit card company as from the retailer or flight company or supplier.

Some typical examples….

- You order a vase from a store overseas that never arrives.

- You buy flight tickets direct from an airline that goes bust.

- You buy a radio from a shop take it home and it's faulty.

In all of these your card lender is jointly liable for a refund.

Therefore if you're buying something or ordering tickets or flights worth over £100, pay for some or all of it on the card to ensure you're protected. Though do keep your receipts as well as the credit card statement to make it easier.

It's worth remembering that sometimes you might not be able to protect yourself, for example if you pay a monthly fee of under £100 to a company that goes into administration. Yet the maximum loss should be £100 and a bit of inconvenience, which in the wider state of the economy at the moment is not such as bad loss. Always check the options below in case though.

Here's a success story to give you some inspiration...

I ordered and paid £15,991 in full for a new car but before I took delivery the trader went into liquidation.

Thankfully I had paid the first £100 deposit on my Barclaycard Goldfish credit card. So I made a Section 75 claim. It took 6 months but this week I received a credit to my card of the whole amount, just from having paid the first £100 on my card.

Does it apply to other credit?

While the bulk of claims are made to credit card providers, the law also applies to other types of credit agreement (except where the supplier is also the creditor, eg for some car finance).

Personal bank loans specifically for large items do not get Section 75 protection, even though the loan's a regulated agreement. This is because to be covered the finance must be properly linked to an item (known as a Debtor-Creditor-Supplier agreement) so that the finance company can see a clear relationship between the money and the goods.

Paying by credit card is paying directly for goods, meaning the relationship's clear, whereas bank loans, even if ostensibly for a car, could actually be spent on anything.

Which card should I use?

Just to clear this up, this protection only applies to credit and store cards, NOT debit cards, cash spending, using cheques or charge cards. Therefore you have to use a credit card to be protected.

Yet credit card companies do, of course, make their money by charging you interest. And frankly the interest cost is so large it often overrides the protection, so follow…

Always set up a direct debit to pay the card off in full each month, so you'll never pay interest.

If you don't have a credit card or have debts on a card, and need another specially for these purchases so you can pay it off in full each month, then it's time to apply for a new card. In which case the two best choices are:

- A cashback credit card. These pay you each and every time you spend on them. With a direct debit set up so there's no interest, this can add £100s a year to your income, without any hassle, so you get a double whammy. Full info and best buys in the Cashback Credit Cards guide.

-

A 0% for spending card. Borrowing in the current climate isn't a good idea. Though if you are going to spend on a card you can't repay in full, at least ensure it's as cheap as possible. A number of cards offer 0% interest for a year on all your spending, full info and best buys in the 0% Interest Cards guide.

If your credit score isn't good enough to get one of these, read Section 75 without a credit card.

Are there any exceptions?

As always with these things there are a few things that escape the safety net. First is anything to do with the purchase of land as this is controlled by regulation from the Financial Services Authority. Three further areas, caused by the indirect nature of the payment are as follows:

When the primary card holder does not pay Additional cardholders etc.

If you have an additional card for a partner, child or friend and this card is used to make payment for a item you subsequently need to claim for, you'll need to show the item provides some benefit to the primary cardholder to be covered.

So if it was a family car or gift for the main cardholder this is likely to be ok, but a solo flight for the 'plus one' isn't.

This isn't tecnically written into the legislation but is based on a ruling (62/02) by the Financial Ombudsman in 2007.

-

When you buy through third parties. Travel agents, paypal etc.

You're usually unlikely to be covered when payments are made to a company that isn't the one providing you with the good or service because the credit card company must have a direct relationship for them to be equally liable.

The first main area is paying via an online processer such as PayPal, WorldPay or Google Checkout. Though these can have their own refund systems, they aren't as strong as the legal protection of Section 75.

There have also been recent cases where people buying goods on Amazon through other suppliers, have been turned down for Section 75 claims by credit card companies. Much opinion is these SHOULD be covered by section 75, but it may be a fight to make it happen.

The other is buying through a Travel Agent, where it is simply directing you to get a flight from an airline or package holiday from a Tour Operator. You should have ATOL protection for package holidays anyway (see Cheap Package Holidays) but flights don't usually have protection elsewhere. If you're not covered elsewhere, as many travel companies act as an agent of the tour operator, a claim against your card provider could be successful, so give it a try.

-

When you don't pay on the card. Credit card cheques, credit card cash withdrawals etc.

Pay with credit card cheques and according to the Financial Ombudsman Section 75 doesn't apply as it's an indirect form of payment.

It's also worth pointing out, that if you withdraw cash on the card, a bad thing to do anyway as you'll pay interest even if you clear the card in full, then the protection doesn't apply for things you buy with the cash.

One other point to make is the purchase of gift vouchers on a credit card may be counted as a cash payment, and while this would get Section 75 protection, you may be charged interest from the purchase date. Check your card's terms and pay off the card sooner if this applies to you.

Don't miss out on updates to this guide Get MoneySavingExpert's free, spam-free weekly email full of guides & loopholes

What if I only pay the deposit on the card?

The law's very specific, you get the protection for the whole thing even if you only pay for a part of it on the card, provided what you pay for costs more than £100 (and less than £30,000).

Here's a quick example of how it works…

Savvy Salma spots the high tech TV she's been planning to buy at half price for £500 including delivery in a high street sale. Yet she's only got £10 left on her card limit (don't worry, it's a cashback card, she's going to pay it off in full).

Salma pays £10 of the cost on her credit card and the rest on her debit card. Sadly the next day the store goes bust, before her telly is delivered. Yet she can claim the WHOLE £500 back from the credit card company, because she paid in part on the card.

Therefore if you want protection…

As long as it costs more than £100, pay for even a fraction on a credit card and you're protected.

Should the bill or the item cost over £100?

This is where it gets quite tricky. The law is plain; the £100 is for the cash value of a 'single item' (so excluding any fees, and charges such as delivery). Yet, single items aren't always that straightforward.

Here are a couple of examples to help:

- Fly to Traveltown with Holidayair on flights costing £99 outbound and £9.99 back, and while it's over £100 in total, as no single ticket was over £100 you're not protected. Yet if Holidayair had only sold return journeys and you bought a specific £109 return ticket then you would be covered.

- Alternatively, if a suit jacket and trousers are individually priced at £60 each, you're not covered, but if you buy the suit as a whole for one price of £120, you are covered.

Sadly this rule defeats Section 75 claims for mobile phone cashback, as each monthly bill payment is considered a separate amount, so unless your monthly agreement is £100 or more a month, you can't claim against your credit card company for your cashback money. For alternative techniques, read the Mobile Cashback Collapse guide.

This can get more complicated though. If the company links the transaction together, for example by giving a special offer if two flights are purchased together, then you should be covered.

This hasn't been tested yet

This information is based on conversations with eminent legal brains and Trading Standards yet this part of the law doesn't have any case law behind it.

Therefore, if in doubt it's always worth contacting your credit card company to make a claim and if you consider it to be a ‘single item' do ensure that's how you phrase it to the card company. Please report your experiences in the single item claims thread to help others in a similar boat.

Are overseas and web purchases protected?

Yes. This used to be a hot potato, but in 2006 this got to the Court of Appeal and it confirmed this applies to everything you buy. Whether it’s in the UK, abroad or on a foreign website, Section 75 applies.

This is a real boon, as often if you buy something abroad it’s much more difficult to get in touch with the retailer. So don’t bother, simply make a claim directly against the credit card company.

Are group purchases protected?

There appears to be some conflicting information on this, but in general if you've paid for a group booking, such as a holiday payment for friends or non immediate family, you should be protected for the full payment. Yet for those who want to play it safe, the best bet is to ask others to pay their own way where possible.

For example if you pay for a whole group of mates to go on holiday with your credit card, and they pay you back their portion, Section 75 protection becomes confused if the holiday company goes into administration as there is some argument over who is part of the credit card contract.

Although Trading Standards told us the payee "is entitled to a compensation of the full amount from the credit card company", the Financial Ombudsman's says there is a chance you'll not be covered for the full amount, possibly only being entitled to your own proportion of the payment. So whilst payments for partners and children are easier, others are not so clear cut.

If this happens to you and your bank won't reimburse the full cost still take your complaint to the Ombudsman as it could agree to your complaint. Details on how the FOS can help are in the Financial Fight Back guide.

How do I make a claim?

The first thing to do is remember this is a legal right. Martin's claimed under Section 75 a couple of times, once it was easy, once they kicked up a fuss, and while card companies are getting better, many will still talk about their own procedures.

To make a claim, you need to contact your credit card company (you can still claim on an account that's closed) not visa or mastercard or amex, e.g. if you've got a Egg Mastercard, you claim from Egg not mastercard. Yet the experience can be slightly different depending on the scenario:

To make a claim, you need to contact your credit card company (you can still claim on an account that's closed) not visa or mastercard or amex, e.g. if you've got a Egg Mastercard, you claim from Egg not mastercard. Yet the experience can be slightly different depending on the scenario:

If the retailer/supplier has gone bust

Here it is quite clear cut, you can't go to anyone else so the only option is to claim off the credit card company. Call it up and politely explain what you're doing, do ensure you invoke the rules though, actually say "I am making a claim under Section 75 of the Consumer Credit Act". It should then send you a claim form in the post.

Sometimes the card company will tell you it will try and reclaim the cash from the company in administration. You can simply answer, "great news, I wish you the best of luck. However you are completely liable for my goods yourself, and I would like the full amount I'm entitled to please, regardless of that claim."

You can make a claim as soon as you know about the administration, even if the good has not been delivered or service has not taken place, under something called 'anticipatory breach' (you know you're going to be out of pocket). If the card provider questions this, tell it you're going to take your complaint to the Financial Ombudsman.

Complaints about a product and the retailer/supplier isn't bust

Here you will commonly be met by a "that's not our business, go to the retailer". Actually you don't have to, it is their business and you've a legal right to redress. The law makes clear that the credit card company is jointly responsible so there's no 'first point of call'.

However, frankly unless you need to (e.g. the supplier/retailer is overseas) it's much easier to deal with the retailer.

If you are claiming from the card company, be firm but polite, and request a claim form. Again, on the claim form state it is a claim under "Section 75 of the Consumer Credit Act".

You could find the call-centre person hasn't a clue what you're talking about, so be polite but firm in the fact that you have a legal right to make a claim. If your card provider tells you to put your request in writing here's a template letter to help:

If your card provider still won't help then contact the Financial Ombudsman to make a complaint. This is completely free and well worth doing, there's a simple claim form on its website and details on how it can help in the Financial Fight Back guide.

Of course if the credit card company went bust, then while you could become a creditor, there is no protection from this. Yet for both the retailer and creditor at the same time to go bust, you'd have been very unlucky.

Don't miss out on updates to this guide Get MoneySavingExpert's free, spam-free weekly email full of guides & loopholes

Can I claim costs?

The law allows you to claim for ‘consequential losses' arising from the problem. In other words, if what went wrong forced you to shell out, the credit card company is liable just like the retailer would be. Obviously it's more difficult to do, but it's still legal.

A couple of examples should help…

Luke Malchance booked return flights under Section 75 rules. Sadly the airline went bust while he was away and he had to buy a flight home. The cost of the flight home should count as a consequential loss and can be claimed for.

Deidre Darling booked a weekend away in a holiday home by credit card. When she arrived, the home was already occupied, she had to drive home, was upset and disappointed, and had wasted her week's holiday. Legally she could even claim the emotional distress is a consequential loss, although this doesn't mean it'd be awarded, but it's certainly arguable.

How to get protection without a card

There is one loophole round this. Prepay cards are special plastic you load up before you spend and anyone can get one as no credit check is needed. Normally these don't get Section 75 protection, as there's no credit, but one specific card does includes similar protection. The CashPlus* prepaid card's provider has confirmed it provides protection similar to section 75 although this is NOT legal protection.

The Credit Builder Account. Here you pay £4.95 a month for a minimum of a year (so £60 a year) and you get the facility that helps towards rebuilding your credit rating. There are then no fees for spending on it, but there is a further monthly fee if you do not use or top up the card for four months.

-

The Flexiplus account. Here there's no monthly fee, provided you use or top up the card every four month, but every time you pay for something on the card you pay £1. If you're only getting the card for a few big transactions this is the cheapest way.

Is it worth it?

It's a tough one to answer. If the protection ended up paying out for you, the cost of the card is cheap, otherwise it may feel a waste of money. If you're making a big purchase with a company that worries you, this may give added piece of mind.

It is worth noting, you are reliant on the fact that the card company itself won't go bust to get your money (and for the safety of the cash you load on it). Prepay cards are growing in popularity, so it is likely to have some financial strength, and it'd be quite a coincidence for the card company and retailer to go kaput at the same time, but nothing is 100%.

What are the Chargeback rules?

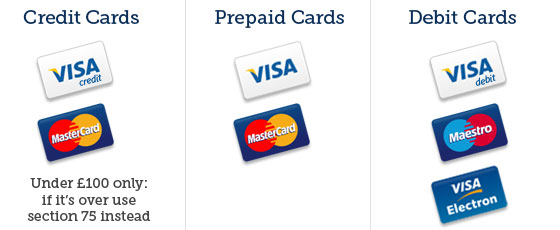

Where Section 75 doesn't apply there is another rule which you can fall back on if you used one of the following cards...

Known as Chargeback, this is part of Visa and Mastercard's internal rules and not a legal requirement. Mastercard only covers amounts over £10 and there is no upper limit, and there's no limit at all for Visa. Here's an example of how useful it can be...

I read about Visa Chargeback on your web site. I'd never heard of it and no one else I know has either. I downloaded a letter to my bank and today received a full refund under the chargeback scheme in relation to the Globespan collapse. Everywhere else I looked I was told to 'forget it as I had lost my money'.

How does Chargeback work?

Complain to your bank not more than 120 days (180 for international purchases through Visa only) after realising there's a problem, and ask to dispute the transaction. Your bank can then put the procedure in motion to claim the money back from the supplier's bank. For some cases you will need to contact the seller first though so it's also good practice to do this.

At this point, the onus is on your bank to get the money back if a transaction hasn't been completed properly and you should get a refund. Importantly, as it's asking for money back from the supplier's bank, not the supplier itself, the money should come even if the supplier itself has gone bust but this isn't guaranteed.

Again, it's worth noting most bank staff don't really know about this procedure, so you may need to explain it to them.

Some possible reasons for claiming a Chargeback are:

- Technical - expired authorisation or a processing error by the bank

- Clerical - being charged multiple times or being billed for the incorrect amount

- Quality - the goods were not as described or were defective

- Delivery - the goods were not received as promised

- Fraud - you have been the victim of fraud and did not authorise the purchase

If you're told to put your request in writing here's a template letter to help:

Chargeback is nowhere near as strong as Section 75. The key difference is that when you complain on a credit card under Section 75, the credit card company itself is legally liable, with Chargeback it's just about the Visa/Mastercard process and that is nowhere near as weighty. It's also the case that you can't take the issue to court if your bank won't pay up.

Spotted out of date info/broken links?

Email brokenlink@moneysavingexpert.com to let us know

Always double check the product details before signing up to them

LINKS THAT HELP THIS SITE (all have a * in above article)

(this has no impact on product or pick - see explanation below)

CashPlus

Explanation (of * links)

How this site is funded. Two types of contacts are listed. The first, which all have a * within the main body of the articles, help MoneySavingExpert.com stay free to use, as they're 'affiliated links' which invisibly take you usually via affiliate linkage or commercial money sites, which then pay this site. It's worth noting this means the third party used may be named on any credit agreements. The second type doesn't help and therefore doesn't have a *.You shouldn't notice any difference, the links don't impact the product at all and the editorial line (the things we write) is NEVER impacted by the revenue - we aim to look at all available products. If it isn't possible to get an affiliate link for the best product, it is still included in exactly the same way. For more details read how this site is financed.

LINKS THAT DON'T HELP THIS SITE

(please only use if necessary)

No * Link Available: Financial Ombudsman

Duplicate links of the * links above for the sake of transparency, but this version doesn't help MoneySavingExpert.com:

CashPlus