Do you have credit or store card debts? Shifting them to a new 'balance transfer' card can save you �100s or �1,000s.

This daily updated step-by-step guide compares the best buy 0% and long term offers, takes you through choosing a deal and shows how to avoid nasty tricks.

In this guide

Best Buys:

| Tweet | http://mse.me/btcards |

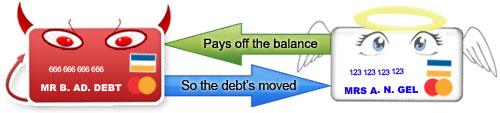

What is a balance transfer?

It's when one credit card repays debts on other credit or store cards; so you now owe it the money instead, hopefully at a special cheap rate.

For example:

- Current debts: Louiscard �3,000 at 18%, Cherylcard �1,000 at 16%.

- New credit: The Danniicard's 0% for 12 months on balance transfers.

- What happens: Ask the Danniicard to balance transfer the debts. It then pays �3,000 to the Louiscard and �1,000 to the Cherylcard.

- New situation: The Louis and Cherylcards are debt-free, as the debt has been transferred to the Danniicard; to which you now owe �4,000 at 0%.

Most top balance transfer deals are for new cardholders, and require the debt to be shifted within a couple of months of opening the card account for a fee of around 3%. Yet there are a few existing customer balance transfer deals which are very useful for more efficiently using credit you already have; full details on those are in the Credit Card Shuffle article.

It's important you don't confuse cutting the interest with paying less each month, as that's determined by the minimum repayments. See the balance transfer Q&As; for an explanation.

Choosing the right balance transfer deal

The right type of card depends on a number of factors: how much debt you've got, how quickly you can repay it, your credit score, and how on-the-ball you are financially. This guide takes you through the pitfalls, and the 'Which is cheapest?' calculator finds which one will charge you least.

BEST BUYS: Top 0% balance transfers

If you can repay your debts within about two years, or are prepared to be a card tart and continually shift debts (see the full tarting explanation) then you want a 0% deal.

However, many cards charge balance transfer fees of around 3% of the debt shifted. Thus, it's a question of balancing the 0% deal and the fee, depending on your needs.

0% deals are currently at their longest ever, and are often cheaper than the best low-rate long term cards, even if your debt takes several years to repay (though you should always try to switch at the end of the 0%). To help pick the right one, we've built the Which card is cheapest? calculator.

The LONGEST 0% deals

All these deals require you to pay a one-off fee when you do the transfer. The trade-off is you get it interest-free for a long time. Remember you must make at least the minimum repayments each month.

If you can repay quicker - 22 months 0%Barclaycard Platinum: One-off 2.9% fee

- Balance transfer length & fee: 22 mths 0%, 2.9% fee

- Rep variable APR: 17.9% (Official APR Example)

- Card issuer: Visa

- Min repayment: Greater of 1% of balance plus interest, 2.25% of balance or �5

- Any restrictions? Must transfer within 60 days

- Min income: �20,000

The longest 0% deal is Barclaycard* Platinum's 0% for 22 months with a 2.9% fee of the amount transferred.

While this is the longest deal currently available, you can't transfer from other Barclaycards to this one, so have a look at the alternatives below.

After the 0% period the rate jumps to 17.9% representative APR. See the Which card is cheapest? tool for how the top options compare.

Alternatives to BarclaycardHalifax 22 mths & NatWest/RBS 20 mths 0% deals

You can't balance transfer between two Barclaycards, so if you need a different provider see below for the next best options.

Halifax - longer 0%, but higher fee

- Balance transfer length & fee: 22 months 0%, 3.5% fee

- Rep variable APR: 17.9% (Official APR Example)

- Card issuer: Mastercard

- Min repayment : Greater of 1% of balance plus interest, or �5

- Any restrictions? N/A

- Min income: �20,000

If you already have the cards above, Halifax* is giving new customers 0% for 22 months on debts transferred but with a large 3.5% fee.

After the 0% ends the rate jumps to 17.9% representative APR, so try to ensure you've repaid in full by then or are ready to transfer to another cheap deal.

NatWest/RBS - slightly shorter 0%, but lower fee

- Balance transfer length & fee: 20 months 0%, 2.9%

- Rep variable APR: 17.9% (Official rate Example)

- Card issuer: Mastercard

- Min repayment : Greater of 1% of balance plus interest, or �5

- Any restrictions? N/A

- Min income: �10,000

The NatWest*/RBS*card gives 0% for 20 months with a 2.9% fee on debts shifted within 3 months. After the 0% period the rate after jumps to 17.9% representative APR.

| Tweet | http://mse.me/btcards |

Card |

0% Length |

BT fee |

Representative Variable APR after |

Notes |

|---|---|---|---|---|

| HSBC* |

23 mths

|

3.3%

|

17.9%

|

Existing current account holders only |

| Virgin* |

20 mths

|

2.99%

|

18.9%

|

- |

| Bank of Scotland* |

18 mths

|

3% |

16.9%

|

- |

| Nationwide* |

17 mths

|

2.95% |

15.9%

|

Make sure you choose BT option when applying |

| Santander |

17 mths

|

3%

|

17.9%

|

Apply online only. Min income �7.5k |

| See all Official APR Examples | ||||

Low-fee 0% balance transfers

If you can clear your debts more quickly than the 0% periods above, it's possible to slash the fee you pay, cutting the overall cost of paying off your debts.

Cheap card if you can repay more quicklyNatWest/RBS Platinum, with low 1% fee

- Balance transfer length & fee: 13 months 0%, 1% fee

- Rep variable APR: 17.9% (Official rate Example)

- Card issuer: Mastercard

- Min repayment : Greater of 1% of balance plus interest or �5

- Any restrictions? Must transfer within 3 months

- Min income: �10,000

The NatWest* and RBS* Platinum are 0% 13 months on balance transfers, with a one-off fee of 1%. You must make the transfer within three months.

This deal's a fair bit shorter than the top picks above, but the fee is the lowest we've seen in a long time, so if you can repay within 13 months it's much cheaper. Even if you don't fully repay within the time it could still win, see the Which card is cheapest? tool to see how it works out for you.

After the 0% deal ends the rate jumps to 17.9% representative APR.

Slightly longer deal with low feeBarclaycard Platinum, with lower 1.6% fee

- Balance transfer length & fee: 16 months 0%, 1.6% fee

- Rep variable APR: 18.9% (Official rate Example)

- Card issuer: Visa

- Min repayment : Greater of 1% of balance plus interest, 2.25% of balance or �5

- Any restrictions? Must transfer within 60 days

- Min income: �20,000

The Barclaycard* Platinum is 0% 16 months on transferred balances, usually the fee is 2.1%, however a refund currently reduces it to 1.6% if you transfer within 60 days.

The way the fee is charged is a bit clunky; a 2.1% fee will come out of your account and then the difference between that and 1.6% will be refunded back to you within 28 days of your transfer.

You can't transfer from other Barclaycards to this one. So if that's what you need, try one of the other options. The rate after jumps to 18.9% representative APR.

If you need a different cardVirgin with higher 1.99% fee

- Balance transfer length & fee: 16 months 0%, 1.99% fee

- Rep variable APR: 16.6% (Official rate Example)

- Card issuer: Mastercard

- Min repayment: Greater of 1% of balance plus interest, or �25

- Any restrictions? N/A

- Min income: N/A

Another low fee card is the Virgin* with 0% 16 months on transferred balances with a 1.99% fee (it's an exclusive via MoneySupermarket, the link above takes you there).

The rate after jumps to 16.6% representative APR but if you need longer to repay, check the top picks above.

No fee, for Northern Irish residents onlyNorthern Bank

- Balance transfer length & fee: 5 months 0%, NO FEE

- Rep variable APR: 22.9% (Official APR Example)

- Card issuer: Mastercard

- Min repayment: Greater of 1% of balance plus interest, 3% or �5

- Any restrictions? Available in NI branches only

- Min income: N/A

The only totally fee-free card available is restricted to Northern Irish customers, in branches of Northern Bank. You get five months at 0%, and won't pay a fee.

Make sure you repay the debt or shift it before the 0% period ends though, or you'll pay the big 22.9% representative APR.

Top card for balance transfers & purchases

Most credit cards offer either a good deal on balance transfers OR purchases, but some do a bit of both. This means you can get a strong deal while only applying for one card, which saves damaging your credit score with unnecessary applications.

Below are the top cards. For more best buys, further information and a top deal for Nationwide FlexAccount customers see the 0% Balance Transfer & Spend guide.

Longest open to all 0%, for top credit scorers Halifax: 15 mths 0% with 3% fee. For 51% of applicants

- BT and spending length & fee: 15 months 0% (with 3% BT fee)

- Representative variable APR: 17.9% (Official APR Example)

- Card issuer: Mastercard

- Min. Income: N/A

- Min. Repay : Greater of 1% of balance plus interest or �5

The Halifax* All in One card has 0% on purchases and balance transfers for 15 months, with a fee of 3% of the amount transferred. While this is the longest open-to-everyone all-rounder card we've seen, only a minimum of 51% of applicants will get the deal.

Under EU rules, card providers must "reasonably expect" 51% of those accepted to get the advertised rate, but when it's a promo deal, card firms often give it to all those accepted. But Halifax has taken this a step further. The promotional 15 months 0% will be given to "at least" 51% of those accepted. The rest will either get 13 or 11 months 0%. So only apply if you have a top Credit Rating, otherwise look at the options below.

The rate after is 17.9% representative APR for both purchases and BTs, if you don't get the 15 month deal it'll be 21.9% or 23.9%. So make sure you've paid it off, or you're ready to shift the debt to a new card. If you're a Nationwide FlexAccount holder this account is beatable, see the 0% Balance Transfer & Spend guide for more info.

Next longest for transfers & spending Barclaycard Platinum: 14 months 0% with 2.9% fee

- BT and spending length and fee: 14 mths 0%, 2.9% fee

- Representative variable APR: 18.9% (Official APR Example)

- Card issuer: Visa

- Min. Income: �20,000

- Min. Repay : Greater of 1% of balance plus interest, 2.25% or �5

The next longest all-rounder card is Barclaycard* Platinum, with 0% on purchases and shifted debts for 14 months, for a 2.9% balance transfer fee.

The other bonus with this card is the 'Freedom' reward points. However, you only earn these in a small set of shops, so it's not as good as some other Reward or Cashback cards.

When the 0% deals end the rates goes to 18.9% representative APR for both purchases and BTs, so make sure you've paid it off, or you're ready to shift the debt to a new balance transfer card.

You won't be able to shift balances from other Barclaycards to this one. If that's what you need then try one of the other cards in the 0% Balance Transfer & Spend guide.

Watch out for good junk mail

This is one of the few areas where junk mail can be positive. Very occasionally direct mail offers, targeted website offers or sign-up stalls in shopping centres offer better deals so keep your eyes open, but ensure you ask about any fees.

BEST BUYS: Cheapest long term deals

This route can be simpler - get a card, shift your debts, then put the card away and pay it off, knowing it's cheap. Some people could be better off going for a 'stable relationship' like this rather than trying to be a credit card tart, as only a few mistakes make tarting costly.

However, with the huge length of the 0% deals we are seeing, and decreasing personal loan rates, you should consider whether you can cut the cost further and retain the simplicity.

-

0% cards can be cheaper. The current top 0% deals are huge. Switch debt to the top 0% card and even if you end up on the APR, if you can't repay in full or switch again (though you should always aim to), it can still beat the best long term deals, if you don't do any extra spending on it. To help find the cheapest route, use the Which card is cheapest? calculator.

The exception is if you get a higher APR - which 51% of people will, particularly if your credit rating's a bit shabby. If so, 'life of balance' deals - where the rate advertised is the rate all accepted customers get - become better much sooner. - Prefer fixed repayments? Long-term, low rate plastic can beat personal loans, as they allow the flexibility of paying off more when you can afford it. However, you must be disciplined for this to work - if you're less organised, look at the top cheap loans.

If you're still after a long-term low rate card, the gold standard is a 'life-of-balance' transfer deal; here the cheap rate is guaranteed to last until the debt you've shifted is repaid in full. Sadly none of these currently exist - the rates below are all variable.

Low long-term rate, no feeSainsbury's (need a Nectar card)

- Promo Rate & Fee: 6.9% APR variable, NO FEE (see official rate example)

- Min Income: N/A

- Card issuer: Mastercard

- Min repayment : Greater of 1% of balance plus interest, 2.25% of balance or �5

The lowest long-term rate is from Sainsbury's* with 6.9% representative APR on debt shifted to it, with no fee. You'll need a Nectar card to apply (must have been used in past six months), but you won't earn points as you spend.

Unfortunately, like all credit cards, this is a representative rate. While 51% of accepted applicants will get 6.9%, some slightly poorer credit scorers will be given higher rates of either 9.9% or 12.9% APR - and that can hit the cost severely.

Is the rate fixed? No. While the card is variable rate, credit card regulations mean it's not allowed to increase within the first year. After that, as long as you agree not to borrow more (which you shouldn't be doing on this card anyway), you have a right to reject any rise. See Rate Jacking guide for full rules.

Alternative long-term card, fee-freeBarclaycard Simplicity

- Promo Rate & Fee: 7.9% APR, NO FEE (see official rate example)

- Min Income: �20,000

- Card issuer: Visa

- Min repayment : Greater of 1% of balance plus interest, 2.25% or �5

Many credit card providers won't let you shift debts between their own cards - so if you need an alternative, Barclaycard* Simplicity offers the 7.9% representative APR on balance transfers to the card, with no fee.

Is the rate fixed? While the card is variable rate, credit card regulations mean it's not allowed to increase within the first year. After that, as long as you agree not to borrow more you have a right to reject any rise (see Rate Jacking guide for full rules).

Like all credit cards, to get it you'll be credit scored - while 51% of accepted applicants will get 7.9%, some slightly poorer credit scorers may be given a higher rate.

Calculator: Which card is cheapest?

Choosing your balance transfer weapon's more complicated than it used to be. Grabbing a super-long 0% deal and letting it lapse to the APR can now beat the long-term cheap rates for repayment lengths of around three years or more.

The aim should still always be to repay within the interest-free time, or switch after that to another 0% deal if you haven't repaid. However, if you can't, don't automatically jump for a long-term deal, as it may not be cheapest.

This calculator reveals the cheapest of our top picks, based on your debt and repayment amount.

What's the cheapest card?

- Repayments are fixed: If they'll be inconsistent play safe and pick the minimum you'll repay in any month

- No spending: As this isn't usually at the 0% rate (so avoid)

- Representative APRs: After the 0% ends we use the rep APR, yet only 51% of people get it

- Sainsbury's card: Only 51% of applicants will get 6.9% APR & the rate is variable

- Not all cards are included

It's important to note all the APRs used in the calculator (except 0% and long-term special offers) are representative, so only 51% of accepted applicants must get them - the other 49% are likely to pay more. If you're in that bunch, you should seriously look at switching again once the deal ends.

BEST BUYS: For poorer credit scorers

The advent of the credit crunch means it's more and more difficult for anyone with a less than perfect credit history to get good credit limits or decent deals. Assuming you've already checked your credit score and followed the tips there for improving it, there are still a number of ways to cut your costs.

- Only got limited/minor issues?

If you haven't tried in the last year or so, it's still worth trying an application for the top cards, as listed above. There's still a chance you'll be accepted; if you are rejected, then follow the system below. - Use a 'credit worthiness' comparison.

Comparison site MoneySupermarket* does personalised credit card searches. It asks a few quick questions to assess your credit worthiness, then tries to match you up with the best card. This uses 'soft searches' of your credit file, which importantly don't leave a mark (hence won't hit future applications).

A similar but far less wide ranging service is offered by Check My File, plus it's worth taking a look at our quick Credit Checker. These are a bit rough and ready, so shouldn't be relied upon fully, but can give a decent indication of the cards you may get without doing a proper credit search.

These services are useful, but don't cover all cards, so they should only be used if you think you may have credit issues. It's also worth noting the comparisons are basic and exclude many issues; so always double-check it's the correct product for you, following the logic in this article before applying for a card. - Get cheaper debts without new credit.

You don't need a new card to get new credit. It's possible to play the system and get much cheaper debt by utilising existing customer balance transfer deals to more efficiently use your existing credit. For full details on how to do this, read the Credit Card Shuffle article.

Think before adding the 'insurance'

Payment protection insurance is commonly sold with credit cards - the idea is it'll make some payments for you, usually for a year, if you are unable to (eg, if you lose your job).

There have been a myriad of cases where it has been mis-sold, eg, borrowers didn't realise they were signing up for it, or it was totally unsuitable for them. Some big lenders have been fined.

The protection isn't always bad, though policies sold with cards are often overpriced (you pay a monthly amount depending on the size of your balance). If you want it, compare the lender's cover with standalone providers such as Paymentcare or Best Insurance.

Always be vigilant to check you aren't getting more than you bargained for when you fill in the application, then check your statement each month to check you aren't inadvertently paying for extras if you didn't ask for them.

Avoid spending on balance transfer cards

Credit cards allow us to do a number of different things such as spend, shift balances or withdraw cash. From the start of 2011, the rules on where your credit card repayments are allocated changed.

Banks now must put any repayments towards the most expensive debts first. This means that spending on a balance transfer card isn't as bad as it used to be, but can still cost you if you're not careful.

Spend on a 0% balance transfer card and any repayments will go towards the spending first. To avoid interest you'll have to repay the full amount spent each month. This could get complicated, so if you need to make new purchases it'd be best to get a separate 0% Spending Card.

Balance Transfers: Q&A; with Martin Lewis

Filmed on 26 May 2011

Balance transfer Q&As;

There are a range of variables to take into account when choosing a balance transfer card:

How do I go about doing a balance transfer?

When you apply for the new card, it will usually include a 'do you want to transfer debts from other cards?' section. In this you just put in the details of the other cards; and if you're successful getting the new card, it will pay them off.

Even if you don't do it at initial application, most cards normally allow you to do a transfer within a set period of getting the card (usually 30 - 90 days). All you need to do is call up and send them the details of your other cards.

Does a lower interest rate mean I pay less each month?

No. These are totally separate things. Unlike loans, with credit cards you choose how much you repay each month, though every card has a set 'minimum monthly repayment'. The interest rate is the cost of the debt. For example, a rate of 20% on �1,000 means it costs you �200 per year (see the how Interest Rates work article for more).

This does mean in some circumstances you may shift debt to a new cheaper card, but if it has a higher minimum, you'll need to pay more each month. If that may be unaffordable, ensure you check the minimum repayments before switching.

How much should I pay off each month?

As much as you can - even 0% debt is still debt. The more you repay, the faster the debt disappears. Especially important is that you try to pay more than the set minimum. For more on that and tips on how to do it, read the Minimum Repayments: Danger! article.

If a lower interest rate doesn't mean I pay less, why bother?

The cheaper the interest rate, the more of your repayment goes towards clearing what you owe rather than servicing the interest. This means you'll be debt-free more quickly and will have to pay less in total to do it.

What if the credit limit I get isn't high enough?

Move what you can, then if needed simply apply for another provider's card and move the rest there. Don't leave it unused out of exasperation, it's already on your credit file so you may as well use it (read the Credit Card Limit: Didn't get what you wanted? article).

Should I cancel old cards?

If you've regularly used cards to balance transfer in the past, it's likely you'll have held cards from many of the top pick providers below. Each has its own rules, but many card providers will automatically reject you if you already have one of its products, or had one in the past 12 to 18 months.

To help, where possible we've listed alternative cards, in case you aren't eligible for the top picks. To improve your chances of getting the best deal, cancel any cards that you have open but don't need. Read more in the Should I cancel old cards? guide.

How will the credit crunch impact balance transfers?

The credit crunch means it's more difficult to get good balance transfers. One of the great worries is that as credit limits are getting lower, people will need two new cards to cover all the debts on one old card.

This in turn means more applications, which will hit credit scores. If this is something that's happening to you, the sensible strategy is to turn to long term deals to ensure you have permanent access to a cheap rate.

How many times can I do balance transfers?

As many times as you like. You can balance transfer from card, to card, to card. The only limiting factor is whether your credit score is high enough to be accepted for new cards.

At what point during tarting should I apply for a new card?

The best time to apply is roughly six weeks before your current 0% deal ends. This gives you enough time to apply, find out if you've got the card, and shift the debt, while your other card is still at 0%. Use the Tart Alert to remind you when.

Will card tarting hurt my credit score?

Multiple applications, especially close together, and high outstanding debts, even at 0%, diminish your ability to get competitive credit. The most important preventative measure is to spread card applications out.

Do this and most people with reasonable income and no missed payments should be able to tart without worry, though occasionally some get scored out (read Credit Ratings: How they work and how to improve them article).

What if my card's got a cheap spending deal?

The basic answer is always err on the side of caution. However, if a card has a 0% deal for purchases and balance transfers that lasts exactly the same length of time, then it's fine to spend on. However if they're not identical eg, 0% for purchases for 3 months and 0% on balance transfers for a year, it's best not to do it.

Is the balance transfer fee interest free as well?

This depends on the specific card, and it does vary. Usually you do pay interest on the fee, yet it's arranged so your first monthly repayment pays all of it off, so the interest is negligible.

Which cards give the best limits?

This is almost impossible to answer, you're credit scored depending on that lender's wish list for a profitable customer. So it all depends on how well you fit what it wants. In general though Barclaycard has a reputation for lower credit limits and the MBNA range of cards higher limits.

Why did it reject me, I've got a great credit score?

Remember lenders choose on their wish list for profitable customers, its not all about risk - read the credit scoring article for a full explanation. Of course you should check for errors on your credit file, but hard and fast reasons are difficult to come by. It may be as bizarre as a lender choosing to give credit cards to customers it's more likely to be able to flog a mortgage too.

Why did it give me a different card to the one I applied for?

Some cards operate a rate for risk policy.

Any other things I should look for when picking a 0% card?

If you want to get a little advanced, it is worth considering whether the card offers existing customer balance transfer deals (as explained in the credit card shuffle article). This is a useful option for long term tarts as it offsets the risk of being rejected due to a poor credit score.

The best picks for this are as follows:

- MBNA card range: While most of these cards do have a balance transfer fee, MBNA tends to repeatedly offer good deals to existing customers, often at 0%, though you need to call it and ask. If you're adopting this strategy it may be worth taking the hit of a fee to keep this facility open. The main cards are MBNA and Virgin*.

- Barclaycard. Barclaycard allows existing customers to shift debts to it at 7.9% life of balance (i.e. until all the debt is repaid) for a one-off 2.5% fee, thus giving you a back-up option of long-term cheap debt if necessary. For more info see Barclaycard Loophole article.

My question hasn't been answered yet, what should I do?

If it's a general question about how balance transfers work, then please ask it here and we will endeavour to include it in the article. If it's a specific question about your situation or a product, then please use the question/discussion link which will take you to the Forum where you can chat about it with other MoneySavers.

| Tweet | http://mse.me/btcards |