Myths, panic and confusion about the 2012 English student finance changes are widespread. All the coverage has focused on Commons' spats and riots in the street – with little info about the practical impact on students' pockets.

This special guide by Martin Lewis aims to change that, with 20 key facts every potential student, parent and grandparent should know.

In this guide

Quick Links

| Tweet | mse.me/student2012 |

For more on the current system see:

Student MoneySaving, Student Accounts, Repay my student loan?

Before we start I'd just like to say...

"For 20 years we've educated our youth into debt when they go to university but never about debt - that must change"

For this reason, even though I'm no fan of the changes, I've agreed to head up the Independent Student Finance Taskforce working with Unis, Colleges & the NUS to try and ensure we bust the myths and misunderstandings that have resulted from so much political spittle flying. For me this is part of our wider campaign to get compulsory financial education in schools.

Some of the following points are still subject to parliamentary approval.

Where possible I've tried to contrast the new system with the current, as many already have experience of that and to help those considering deferring.

Also, as this is the first version of this guide, do please Feedback on whether it helps and what it's missing.

-

The changes ONLY hit new undergraduate September 2012 starters; existing and 2011 students stay on current system

The new system only affects those starting an undergraduate course at university or college in 2012 (included within this are Higher National Diploma/Certificate courses and certain teacher training such as PGCE). Those still on courses started before then stick with the current fees and repayments.

More info if you're changing course, on foundation course, wanting to study medicine or defer from a 2011 courseChanging course

If you start a course before 2012, and then change, provided it's to an equivalent (i.e. full-time to full-time or part-time to part-time) degree even at a different university you should be able to continue on the same fee structure, i.e. not move to the new system. Though always double-check with the institution beforehand.

Foundation course

If you start a higher education course that begins in 2011 and includes a foundation year (which is an integral part of the course, and you enrolled at the outset for the integrated course) then you will continue to remain on the 2011 structure and not move to a new one.

However, if you take a freestanding higher education course like certain 'access' courses in 2011, then start a degree in 2012 you would be treated as a new starter in 2012.

NHS Bursary

Medical students (including graduate entry students studying a four year course) will continue to get the same support from the NHS Bursary scheme, being up to £3,375 a year (depending on the type of course) with means tested extra support for living costs.

Most 2012 students will then be able to apply for a student loan for the remainder of their fees (the situation for those in the final two years of a five or six year course is still being decided). More info on the BMA website.

Deferring a 2011 course

If you're accepted onto a course in Sep 2011 and need to defer once the course has started you'll continue on the 2011/12 financial package. Yet, if you choose to take a year before starting, or stop and start a new course in Sep 2012 you'll be moved to the 2012/13 financial package.

-

Trebling tuition fees doesn’t always mean tripling your costs

Under the current system university tuition fees are £3,290-a-year max, in 2012 all institutions will be allowed to charge up to £6,000 and many will charge up to £9,000 providing they make extra provisions for bursaries for poorer students.

Under the current system university tuition fees are £3,290-a-year max, in 2012 all institutions will be allowed to charge up to £6,000 and many will charge up to £9,000 providing they make extra provisions for bursaries for poorer students. Yet some students won't ever need to repay at all, others will pay far less than the fees and some will pay back much larger amounts (read on to discover which you're likely to be).

It may seem like universities will be cock-a-hoop over this as they're getting more cash, but their direct funding has been radically cut by the government (sometimes by more than the extra fees received).

-

You don't need to have cash to go to university

It ISN'T a case of 'pay up or you can't go'. For first time undergraduates, once your application has been processed, tuition fees are automatically paid by special Student Loan Company loans which full time students only need to start repaying in the April AFTER graduation at the earliest, no matter how long your course (part time students see note 9).

Of course you don't have to take the loan for tuition fees, you could opt to pay it directly. Read more advanced info on is it worth taking the loan?

Some students with savings (or their parents' savings) who may be able to fund some of the tuition fees themselves are asking whether it's worth simply not taking the tuition or maintenance loans, or taking a smaller one?

Certainly it's a bad idea if you're struggling, borrowing elsewhere or pushing your finances to try and avoid it. Yet even if the money is there, for most not taking the loan is a relatively bad strategy from a purely financial perspective (ethically it's your own affair) though there are still some uncertainties.

To explain this, I'm assuming you understand how the system works; if not, do read the rest of the guide first then come back to this. Here are the key issues…

- You may not need to repay it. To use cash in the bank to repay a liability that may never occur is a big risk. If you used savings now to repay the loan but then, as an extreme example, never earned over £21,000 you'd have effectively lost the cash.

A less extreme example would be if you used money from parents to reduce your borrowing, yet while you repaid you don't clear the debt within thirty years anyway. So reducing the borrowing wouldn't reduce your repayments in any way - you'd have been far better to put the cash in the bank.

Therefore a simple strategy is to put the cash aside in a top savings account until after graduation then once you're working you'll have a much better idea of your earning potential (and by then we'll have our full calculator on repayment costs up and running). - The interest cost in the intervening years is not too heavy. You pay RPI inflation + 3% while you're a student. While this is a real cost as it's only for the short term, weighed up against the risk that you end up repaying the debt unnecessarily it's not too large so putting the cash away until you know your earnings strategy does have a cost but not a huge one.

However if you're absolutely sure you'll earn a big salary on graduation, and have the cash now, then it may be worth avoiding this interest cost.

- There may be early repayment penalties. The one spanner in the works is if the government adds penalties for clearing debts, or overpaying – so the 'put money aside and wait and see' strategy would be affected by this.

This decision hasn't yet been made, and is likely to go out for consultation (see my seven deadly sins of early repayment blog).

If these penalties were to be added, it would shift the bias somewhat more to erring on the side of not taking the full loan – though even with the penalties, if you're unlikely to ever repay it you're still better off taking the full loan.

Luckily however we're still a long way off decision time over this, and the early repayment issue should be settled a long time before then.

- You may not need to repay it. To use cash in the bank to repay a liability that may never occur is a big risk. If you used savings now to repay the loan but then, as an extreme example, never earned over £21,000 you'd have effectively lost the cash.

A less extreme example would be if you used money from parents to reduce your borrowing, yet while you repaid you don't clear the debt within thirty years anyway. So reducing the borrowing wouldn't reduce your repayments in any way - you'd have been far better to put the cash in the bank.

Earn under £21,000 and you'll never repay

The loan's repaid through the income tax system. That means once you're working your employer takes it off the payroll, so you never see the money, it simply reduces the amount you receive in your pay packet – meaning no debt collectors will come chasing.

You only repay 9% of everything you earn annually above £21,000 of pre-tax salary. If you've started repaying the loan, but then lose your job or take a pay cut, then your repayments drop accordingly.

The £21,000 threshold is designed to rise in line with average earnings, this will start in April 2017 (the first anniversary of when graduates start repaying) so you'll repay 9% of everything above that threshold.

Read more about...

How the self employed repay

You're self-employed

You repay the student loan just like you repay tax – via the Inland Revenue's Self Assessment scheme (i.e. you calculate your earnings and send cash at the appropriate time to fulfill your obligations). This also applies if you have additional self-employed earnings on top of employment. If you fail to pay you'll be sent a reminder but ignore it and a claim could be made against you in the County Court.

Some further information on this for the current system, which is likely to be similar in 2012 is available on the DirectGov website, though it's a bit sketchy in parts.

How it's treated for tax

The tax effect

While the amount you pay is calculated based on your PRE-TAX income above £21,000, the money is taken after you’ve paid tax. For example...

If you earn £30,000 a year gross (pre-tax) salary you will repay £810 a year (9% of the £9,000 above £21,000)

Yet you still pay tax on the entire £30,000 income – you don’t get any tax breaks on the fact you’re repaying the student loan.What happens if you move abroad

You move overseas

The student loan is effectively a contract. If you leave the UK you're still obliged to repay the student loan based on 9% of all earnings above the equivalent of £21,000 and can face substantial penalties if you avoid it.

Some further information on this for the current system, which is likely to be similar in 2012 is available on the DirectGov website, though it's a bit sketchy in parts.

Whether other income e.g. savings count

You have additional sources of income

If you have additional income of £2,000+ from savings interest, pensions or shares and dividends, then this will also be treated as part of your income for repayment purposes and you'll need to repay 9% of that too via Self Assessment (based on the current rules according to the Student Loan Company website, similar likely for 2012 starters).

How it interacts with paying into a pension scheme

You pay into a pension scheme

Student loan repayments should be based on your income after pension contributions have been deducted. If you are in an employer pension scheme, eg, final salary or career average, your repayments will automatically be calculated on your income after pension contributions.

Yet if you pay into a personal pension, whether monthly via your company payroll or directly as a lump sum, you need to request a self assessment tax return (if you don’t already do one) to have the pension contributions taken into account.

You need to decide if it's worth the hassle but for each £800 you pay into your pension (£1,000 gross) each year, you could pay around £90 extra in student loan repayments.-

After thirty years any remaining debt is wiped

You stop owing when you've cleared the debt or 30 years (from the April after graduation) pass, whichever comes first. If you therefore never get a job earning over the threshold, you'll never repay. More on what happens on death or incapacity

The debt is also wiped if you die, so it won't be passed on to your beneficiaries as part of your estate or if you're permanently disabled in such a way that you'll be permanently unfit to work (in such a case earnings will usually be under the threshold anyway, but this rule's there for rare cases where unearned income is above the threshold to allow the recipient to keep it all).

-

'Above-inflation' interest will be charged Don't understand interest rates? Read the Interest rates beginners' guide

Under the current system, there's no 'real' cost to borrowing money via student loans as the interest rate is set at the rate of inflation (RPI). So borrow a shopping trolley worth of goods and you'll repay enough to buy the same, even though the actual cash amount may increase.

Under the current system, there's no 'real' cost to borrowing money via student loans as the interest rate is set at the rate of inflation (RPI). So borrow a shopping trolley worth of goods and you'll repay enough to buy the same, even though the actual cash amount may increase.Yet that will change. Under the new system, the interest is as follows:

- While studying: Accrue RPI inflation plus 3% on the outstanding balance. This continues until the first April after graduation when it changes to…

- After studying earn under £21,000: Accrue RPI inflation.

- After studying earn £21,000 - £41,000: The interest rate will gradually rise from RPI to RPI plus 3% the more you earn (the interest rises 0.00015% for every extra pound you earn or, put another way, if you earn £1,000 more you accrue 0.15% extra interest). These thresholds are likely to will rise with average earnings from 2017.

- After studying earn over £41,000: Accrue RPI inflation plus 3%.

It's worth noting all the above scenarios assume inflation is positive (prices are rising) it's not yet know what would happen in a period of deflation (prices falling).

Find more about interest rates if you don't complete the course

If you start a course after September 2012, you won't make any repayments until April 2016 (the first April after you'd graduate on a three-year course) even if you do not complete the course.

You'll be charged interest of RPI inflation from the April after you leave until April 2016. After that date interest will be at the same level as everyone else.

This means under the new system, as 'real' interest is charged, for the first time, students won't just pay for the cost of their education, sadly they'll pay for financing it too.

This coupled with the fact people will be repaying less, does extend even further the time it will take many people to repay, though as those on lower incomes are unlikely to ever repay the loan (see key fact 17), for them at least, this won't have an impact.

-

Repayments will be £540 a year lower than now

Many wrongly believe that due to the higher tuition fees, people will have less money in their pockets each month than currently.

At the moment graduates repay 9% of everything above £15,000, yet for 2012 starters that threshold will increases to £21,000 – meaning lower repayments – so those earning above the £21,000 threshold will have £540-a-year more in their pockets than now… a chart should help.

Earnings Current System New 2012 system Annual Repayment Monthly pay packet reduction it's equivalent to Annual Repayment Monthly pay packet reduction it's equivalent to £15,000 Nothing Nothing Nothing Nothing £16,000 £90 £7.50 Nothing Nothing £21,000 £540 £45 Nothing Nothing £22,000 £630 £52.50 £90 £7.50 £30,000 £1,350 £112.50 £810 £67.50 £40,000 £2,250 £187.50 £1,710 £142.50 £50,000 £3,150 £262.50 £2,610 £217.50 Yet it’s worth noting that for simplicity I’ve compared 2012 starters (who’ll start replaying in 2016) with current graduates.

Actually a fairer comparison is with 2011 starters – the last on the old system. While it's likely those repaying under the new system will still have more disposable income in the years following graduation, the gap could be substantially reduced due to the inflation. Read more on why inflation decreases the difference.

Why inflation decreases the difference

Current graduates start repaying their loans when they earn more than £15,000, yet from April 2012 this threshold is set to be uprated (increased) with the RPI measure of inflation until 2016.

The actual figure used will be the rate of RPI in the March from the prior year, so on 6 April 2012 it will rise to £15,795, as this March’s inflation was 5.3%. This means that by 2016 when the main crop of 2012 starters start to repay their loans, the difference between the current and new loans system will be at the most £470 (based on no further inflation).

It is of course impossible to predict the final impact of this, while at the time of writing, June 2011, RPI inflation is still at a very high 5.2% it was only just over two years ago we had a short period of deflation (negative inflation - meaning prices were dropping) so you can’t assume inflation will always be high.

Here’s a chart showing the impact at various rates.

Repayments in 2016 Average annual Inflation Current System New System Increase in disposable income under new system Ignoring Inflation £15,000 £21,000 £540 2.5% (A) £16,550 £21,000 £400 4% £17,550 £21,000 £310 5.5% £18,600 £21,000 £215 7% £19,660 £21,000 £120 (A) This is roughly the Bank of England’s inflation target, though that is actually based on CPI inflation at 2%, this assessment of 2.5% is based on its equivalent from when the target depended on RPI. For the sake of clarity, it would take average annual inflation from 2012 to 2016 of roughly nine per cent for the repayments to be equal (that would be a very substantial rate of inflation, and likely to mean huge national problems).

What about after 2016?

From 2017 the threshold for repayment of under the new system is set to rise with average earnings – there is as yet no decision on what will happen beyond 2016 to the thresholds for those on the current system.

-

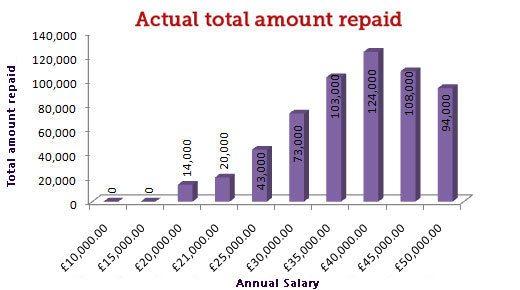

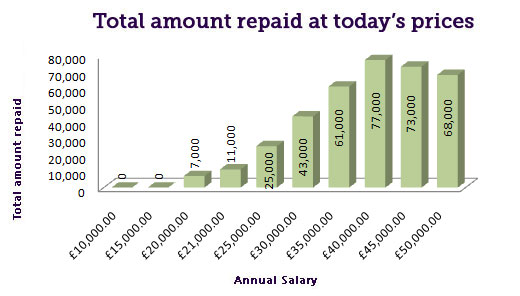

You WILL owe money for longer and MAY pay a LOT more

The flip-side of people repaying less due to the higher £21,000 threshold is that it will take much longer to pay off the loan. And this is compounded by the fact the original debt is bigger and the interest rate higher.

The flip-side of people repaying less due to the higher £21,000 threshold is that it will take much longer to pay off the loan. And this is compounded by the fact the original debt is bigger and the interest rate higher.

The cost is effectively being spread over a much longer period. It means initially graduates will be able to keep more of their income to spend than now, though later on when they would've paid off the loan under the current system, they'll have less as now they'll still be repaying. -

Part time fees rising, but tuition fee loans now available

Part-time students, often forgotten, make up 40% of all undergraduates. Fees for part-timers are likely to rise in 2012 too, with all universities being able to charge up to £4,500 and some £6,750 provided they offer bursaries.

For the first time part-time students (provided it's their first degree and they're studying at least 25% of a full time course) will no longer need to find the cash up front as they'll be eligible for tuition fee Student Loan Company loans on exactly the same basis as full-time students. Though they won't be eligible for maintenance loans or grants.

Also, the current situation states that part time students will begin to repay from Apr 2016, not at the end of their course, which could result in some needing to start paying back tuition fee loans before they graduate (if earning over £21,000). Yet, this is still being decided. -

Monthly repayments are the same whether fees are £6,000 or £9,000

Whether you choose a course that costs £6,000 or £9,000 you'll repay the same amount each month, as that purely depends on what you earn (9% above £21,000).

Of course, the more you borrow the longer you'll be repaying. Yet it is worth noting that, as many people won't finish repaying before the 30 years is up (see key fact 17) unless you're a higher earner, picking a course with higher fees won't actually cost you more. See the min, max and average fees planned to be charged by each university (pages 9 and 10).

Student loans also cover living costs

Full-time students aged under 60 at the start of their course can also take a loan to pay for their living costs, eg food, books, accommodation and travel. They are known as thya re known as These are usually paid in three termly instalments direct to students' bank accounts.

The amount is dictated by two elements:- The Guaranteed bit. Up to 65% of the maximum living cost loan will be available to everyone in 2012 regardless of their parental income (for 2011 starters it's 72%).

- The Income Assessed bit. The amount you can borrow is means-tested, in other words it depends on you or your parents' residual income (i.e. pre-tax income minus pensions, see full

residual income definition.

The idea behind this is if income is higher, then you or your parents are expected to fill this financing gap.

In 2012/13 the maximum annual loan is £4,375 if you live with your parents, £5,500 if you live away from home (£7,675 in London or £6,535 overseas).

-

Under £42,600 income households' students get maintenance grants

Full-time students with

residual income under £25,000 get a grant of £3,250 for living costs – in other words it never needs repaying (unless you leave your course early when you may be asked to pay it back).

Full-time students with

residual income under £25,000 get a grant of £3,250 for living costs – in other words it never needs repaying (unless you leave your course early when you may be asked to pay it back).

If you're entitled to a full grant the maximum loan you'll be entitled to is reduced, though by less than the amount of the grant.

So all in all at £25,000 income or less a student living away from home (outside London) would get a grant of £3,250 and a maximum loan of £3,875 (not the full £4,375).

Those from households with income between £25,000 and £42,600 get a smaller grant the more the income, though the maximum loan amount increases to make up for it.Household income Package of Support Non repayable maintenance grants Maintenance loans Total £25,000 or less £3,250 £3,875 £7,125 £30,000 £2,341 £4,330 £6,671 £35,000 £1,432 £4,784 £6,216 £40,000 £523 £5,239 £5,762 £45,000 £0 £5,288 £5,288 £50,000 £0 £4,788 £4,788 £55,000 £0 £4,288 £4,288 £60,000 £0 £3,788 £3,788 Over £62,500 £0 £3,575 £3,575 For students living away from home and studying outside of London Student loans DO NOT go on credit files

When you borrow from a bank for a credit card, loan or mortgage, to evaluate whether they'll make money from you lenders look at three pieces of information – your application form, any previous dealings they've had with you and crucially the information on your credit reference files (full info: How Credit Ratings Work).

Most normal financial transactions and credit relationships you have are listed on these files - yet student loans are not included (with the exception of students who started university before 1998 under the old loans system and have defaulted).

So the only way loan, credit card or mortgage providers know if you've got one is if they choose to ask on application forms, and they don't always do – though the bigger value the transaction, the longer the application form is likely to be.

The new system is unlikely to impact the ability to get a mortgage

I know many parents worry the new system will hit their child's ability to get a mortgage after studying – unsurprising with the huge deposits needed these days.

I know many parents worry the new system will hit their child's ability to get a mortgage after studying – unsurprising with the huge deposits needed these days.

In fact for most the impact will be limited. The fact you'll only need to repay when earning above £21,000 a year means future graduates will have more income after tax and loan repayments (net income) - which makes saving for a deposit and repaying a mortgage in the years after graduation easier.

Yet this is countered by the fact they'll be in debt much longer, so will have less disposable income later. Overall it's likely to balance out, though this is a provisional view; I do plan to do more work investigating this.

The Council for Mortgage Lenders (the mortgage company trade association) has said "A student loan is very unlikely to impact materially on an individual's ability to get a mortgage but the amount of mortgage available may depend on net income."

The Independent Taskforce on Student Finance Information that Martin heads has commissioned a full report and investigation into the impact on getting a mortgage, it's hoped it'll be published by the end of 2011.

You may not be allowed to repay early

I had initial concern that early repayments may be banned, yet in a government paper on 28 June it was announced they won't, although full details, eg, if there are penalties, are still to come. Read more on the gov paper.

The Higher Education, Students at the Heart of the System, report stated:

"This system of graduate contributions preserves a careful balance between the interests of higher and lower earners, by requiring higher earners to make a fair contribution to the costs of the system as a whole. This enables the Government to offer significant protection to those who do not earn high wages or who have periods out of employment. We recognise that some people may want to pay off their loans early. They will be able to do so."

See the full report

In general, everyone should be encouraged to repay their debts as quickly as possible (unless not doing so tactically to profit as with 0% Credit Card Stoozing). To be penalised for doing so, especially with real interest being charged, is something we've rightly seen regulation against in the private sector.

In general, everyone should be encouraged to repay their debts as quickly as possible (unless not doing so tactically to profit as with 0% Credit Card Stoozing). To be penalised for doing so, especially with real interest being charged, is something we've rightly seen regulation against in the private sector.

This is something I've written on extensively in my seven sins of early repayment penalties briefing where you can find more information about what's happening.

-

Students from, or going to, Welsh, Scottish and Northern Irish unis may have different rules

Scottish, Welsh and Northern Irish students, including those who decide to study in England, receive their financial support from their "home" devolved administration.

It's a matter for the devolved administrations to decide how they wish to support their students and in some cases this is still being decided.

Scotland: Subject to consultation, it's looking likely that Scottish students studying in Scotland will carry on not paying any tuition fees from 2012, while English and Northern Irish students studying there will be charged up to £9,000 per year.

Northern Ireland: A public consultation on the issue has just ended. We'll update this section as soon as we know more but the system is unlikely to change that much.

Wales: Tuition fees at Welsh universities follow the English pattern and will be increased up to £9,000 from 2012. However, the Welsh Assembly will cover the increase for Welsh resident students – i.e. they won't have to pay any more than the current cost plus inflation, likely to be £3,465. English students will need to pay the full amount.

Here's a summary of the current situation for 2012:

Maximum annual tuition charges Location of student Domicile of student England Scotland Wales Northern Ireland England Up to £9k Up to £9k Up to £9k tbc Scotland Up to £9k Likely to be free but tbc Up to £9k tbc Wales £3,465 for the student, Welsh gov will top up to the required level Northern Ireland Up to £9k Up to £9k Up to £9k tbc Source: Ucas

-

Many people will never pay it all back

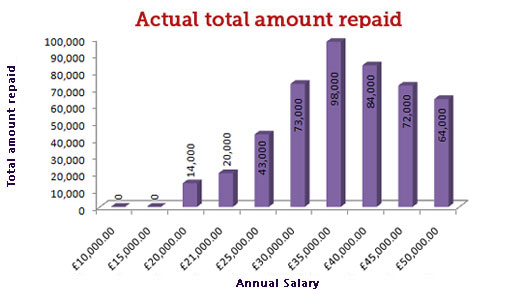

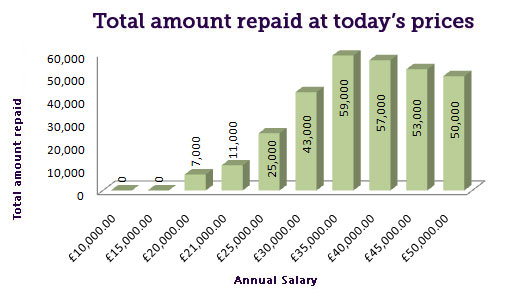

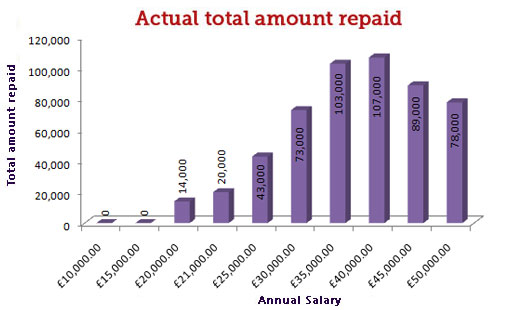

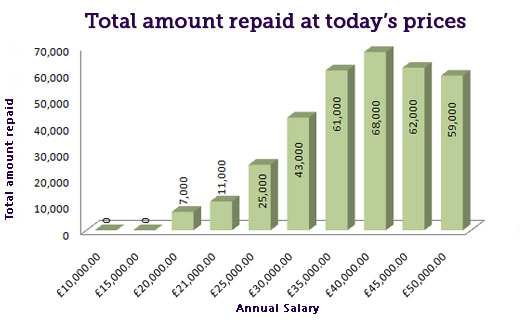

By running the numbers on some typical situations it looks likely only those towards the higher end of the income scale will ever repay what they borrowed.

By running the numbers on some typical situations it looks likely only those towards the higher end of the income scale will ever repay what they borrowed. In one way it's good, as it means the level of the tuition fees is irrelevant to most people - they'll just keep paying the same proportion each month and if they don't earn enough, they won't come close to paying back what was borrowed (never mind the interest). But it's bad in another as it means the loan won't be cleared until it's wiped after thirty years.

Full repayment calculator coming soon

In the meantime... the following table should help you see roughly who's likely to pay the loan off, and what the total cost will be. As inflation and students' future income are both unpredictable we've had to make some assumptions, so this table should be seen as an indication of scale rather than anything more exact.

Before you look at the table

Please be aware it's designed to give a VERY rough indication of who’s likely to pay the loan off – yet we’ve been forced to make many assumptions about inflation, earnings growth, and graduates earning growth small changes to which have a big impact - so please take it with a large pinch of salt.

We are also building a calculator to let you to change the assumptions we have made, in order to see what you'd pay at different inflation and earnings rates.

- Expect to repay more quickly than the chart shows if…

You’re in a career where salary increases rapidly

You live at home or get a maintenance grant

If so scroll down the chart for a better fit. eg, someone starting on £15,000 but with big salary increase progression should probably look at the results for a £20,000 or £25,000 starter. - Expect to repay more slowly than the chart shows if…

You’re in a career where salary remains static

You’re likely to spend periods not working (redundancy, career break, unemployment, parenting)

You're studying in London and not living at home

You're likely to switch to part time work

You're likely to retire during the 30 years

In this case you're likely to pay off your debts more slowly, so look up the chart for a better fit. eg, someone starting on £25,000 should look at the results for a £20,000 or £15,000 starter.

Click the button closest to your tuition costs to get an indication of what you'll pay back...

Of course there is the question will the government change the system?

Parliament is omnicompetent, in other words it is completely free to make and change rules made in the past. This means there is no 100% guarantee the system will remain unchanged for the 30 years until you’re clear and it's worth being aware this is a risk factor.

Yet once the system is finalised and you’ve started university, any negative changes in the future are unlikely as policy makers are generally averse to retrospective change.

Looking at the history of student loans specifically, any major changes to the system have only affected new students. Those who have already started remain on the system in place when they started university (with minor positive changes such as uprating due to inflation).

For example, as explained above, 2011 university starters won’t be shifted to the new 2012 package, their fees and repayments will remain on the old system.

Yet nothing is ever guaranteed, so the only way forward is once the system is finalised, is to be aware at the extreme it could change, but to work based on the fact it won’t.

- Expect to repay more quickly than the chart shows if…

-

Think of it like a graduate tax not a loan

The maximum possible loan combining tuition fees and maintenance is £16,675 a year, £50,000 over a three-year course.

The maximum possible loan combining tuition fees and maintenance is £16,675 a year, £50,000 over a three-year course.This is a frightening amount, and indeed many are frightened of it. Yet it's important to not just jump at this figure but look at it in regards to how much of that loan you'll actually have to repay.

In fact when you examine this debt, it's far more like an additional tax than a loan for the following reasons:- It's repaid through the income tax system

- You only repay it if you earn over a certain amount

- The amount repaid increases with earnings

- It does not go on credit files

- Debt collectors will not chase for it

- Bigger borrowing doesn't increase repayments

- Many people will continue to repay for the majority of their working life.

In summary, it's basically a graduate tax but one that simply ends once you've repaid what you borrowed plus interest (this isn't the first time I've argued this, see we already have a graduate tax blog).

This means on current thresholds, a typical graduate will face the following deductions from their payroll, while they still have an outstanding student loan.

Equivalent 'marginal' (1) tax rates for graduates under 2012 system

Assumes current tax thresholds remainAnnual earnings up to £7,475 No tax – as this is the typical 'personal allowance' the amount earnable before income tax starts. Earnings over £7,475 up to £21,000 32% tax and national insurance Earnings above £21,000 41% due to addition of student loan repayments Earnings above £42,475 51% due to addition of higher rate tax, but drop in national insurance (2) Earnings above £150,000 61% due to higher rate tax (2) (1) 'Marginal' means you only pay the specified tax rate on that portion of salary. For more see the Tax Rates guide. (2) Earn above £100,000 and your personal allowance will also be affected. The reason I stress the tax concept is because many parents wrestle with 'how will I pay for my child to go to university?' and then risk their own financial solvency and security to do so.

Let me be clinical for a moment: it could sound callous but you need to decide whether paying for it really is your responsibility.

The system is set up that the cost is met by the beneficiary of the education - your child. When this is referred to as a 'loan' many parents feel guilty and become desperate to avoid their child getting into this debt, even though they may not need to repay it.

Yet if we'd called this system a graduate tax, would you still feel compelled to prevent your child paying a higher tax rate? Of course there is a balance to be had but it's worth thinking this through to judge your own reaction.

-

Student loans should be counted as part of students' income

Many school-leavers go straight to university with their parents or grandparents yelling "STICK TO A BUDGET!" Yet that simply isn't enough info; think about this for a moment.

A working person shouldn't spend more than they EARN.

What shouldn't a full time student spend more than? It's this piece of the budgeting jigsaw many people miss, but it's crucial - without knowing your income you can't budget.

It's this piece of the budgeting jigsaw many people miss, but it's crucial - without knowing your income you can't budget. I'd define a student's income as – the student loan, any grant, any income from working and any money given by parents or relatives. Total that up and this is what you should budget not to spend more than.

It's important to note while this does include the student loan, it doesn't include 0% overdrafts, which at best should be seen as aids to cashflow but not income (see Best Student Accounts guide) or any other commercial debt.

Also if you're 17 and reading this guide, that's brilliant news - nothing is more important than understanding the cost of your education. Can I also suggest you read the Teen Cash Class guide to get more ideas on how to be successful with your money.

If offered a fee waiver or a bursary - go for the bursary

Part of the changes to student finance in England from 2012 onwards involves what's called the National Scholarship Programme. In 2012/13 there will be roughly £100 million to give out to students with a household income under £25,000.

Yet the name is frankly less accurate than calling a rabbit a cabbage. It is neither national (there's no uniform system and each university provides its own) nor is it about scholarships (which are based on academic merit). Rather it's about bursaries and fee waivers.

Yet the complete misnomer doesn’t mean it isn’t important. The exact structure and money is likely to be given in one of two ways but should be worth around £3,000:

- Fee Waiver. Here you are given a reduction each year on your tuition fees meaning the loan you need is less.

- Bursary. This is some form of cash, or gift in kind. It could range from a £1,000 grant or help with living arrangements depending on your situation.

Find out what each uni is offering on Direct.gov (remember, you need to apply directly to the uni once you’ve an offer of a place but you should find out in advance what they offer and if you qualify).

Why a bursary beats a fee waiver

It is interesting to note, that fee waivers are of great benefit to the Treasury. As the university is giving a reduction, it decreases the government loan book. However, it is far better for you, so if there is a choice and the amounts are equal to go for a bursary.

The reason for this is quite simple. As you’ll have seen in note 17 many people will never repay in full even at the £6,000 level.

Therefore in real terms, unless you earn a higher salary on graduating the fee wavier won’t actually reduce the amount you repay at all. Whereas a bursary will provide definitive cash now, which is a boon and could reduce the need for any commercial borrowing.

So as one is a certain gain, and the other a ‘you may benefit in the future but might not’ the choice is a no brainer.

Other forms of funding

On top of the official financial support, other funding sources are also available from scholarship sites such as Scholarship-search, Family-action, Turn2us, StudentCashPoint and UniGrants (though do check the details directly with the university, find contact details on the nasma website, or grant provider too).

What’s all this about access agreements?

Institutions that charge fees above £6,000 are also obliged to put some of the excess charge (works out at an average of around 26%) into access agreement schemes to widen participation for students from under-represented groups. In 2012 this will be around £500 million which will be spent on waivers, bursaries and scholaships as well as increasing access to and retention on courses.

See further definitions on learner support funding.

Definitions of discretionary funding

Many organisations, including universities and colleges, offer additional funding to help students in particular circumstances. Sometimes this is to support non-traditional entrants to Higher Education and sometimes to encourage applications from high achieving students.

As each organisation will have its own priorities for the students it wants to assist, the following categories will vary depending on where and what is being studied. Students need to research what support is on offer both in their local area, subject area, and at the universities they are applying to.

Bursaries

A bursary is a non-repayable grant. Bursaries are usually paid by universities to help with costs associated with study: books and equipment, childcare, and travel are typical examples. Eligibility is usually determined by household income, or other personal circumstances, eg, those with children or care leavers. Availability and how much you receive will vary at different universities.

Scholarships

A scholarship is a non-repayable grant. Scholarships are usually paid in recognition of educational achievement and can help towards the costs of fees, other course costs, and may also provide living cost support. Availability and how much you receive will vary at different universities.

Fee Waiver/Fee Discount

This is a form of non-repayable grant which is paid to cover some (via a discount), or all (via a waiver) of your tuition fees. You will not usually receive a payment directly when you are awarded a fee waiver/discount. It reduces the amount of tuition fees you are required to pay.

Info provided by nasma.

As our first version of this guide, please feedback on whether it helps and what's missing.

Spotted out of date info/broken links?

Email brokenlink@moneysavingexpert.com to let us know

Always double check the product details before signing up to them

LINKS THAT HELP THIS SITE (all have a * in above article)

(this has no impact on product or pick - see explanation below)

N/a

Explanation (of * links)

How this site is funded. Two types of contacts are listed. The first, which all have a * within the main body of the articles, help MoneySavingExpert.com stay free to use, as they're 'affiliated links' which invisibly take you usually via affiliate linkage or commercial money sites, which then pay this site. It's worth noting this means the third party used may be named on any credit agreements. The second type doesn't help and therefore doesn't have a *.You shouldn't notice any difference, the links don't impact the product at all and the editorial line (the things we write) is NEVER impacted by the revenue - we aim to look at all available products. If it isn't possible to get an affiliate link for the best product, it is still included in exactly the same way. For more details read how this site is financed.

LINKS THAT DON'T HELP THIS SITE

(please only use if necessary)

No * Link Available: Family Action , Scholarship Search , Studentcashpoint , Turn2us , Unigrants

Duplicate links of the * links above for the sake of transparency, but this version doesn't help MoneySavingExpert.com:

N/a