This powerhouse system severs car insurance costs - so  powerfully the record result is 96p a year for fully comp. First, combine comparison site results to massively increase the number of quotes, then grab hidden cashback.

powerfully the record result is 96p a year for fully comp. First, combine comparison site results to massively increase the number of quotes, then grab hidden cashback.

You needn’t be at renewal either, provided you haven't claimed, most policies can be cancelled with a refund; a few do charge penalties, but you’re still likely to save.

In this guide

Best Buys

| Tweet | http://mse.me/carins |

Step 1: Follow the DOs & DON'Ts

Insurance premiums (the payments you make to insurers) depend on three things:

By reducing an insurer's perception of your risk, you can reduce the price you'll pay.

Car insurance rates are set by actuaries, whose job is to calculate risk. Each insurer's price depends on two things; their underwriters' assessment of your particular risk focus, and then their own pricing model that dictates what customers they want to attract. See the following for ways to reduce your risk:

DON'T forget to check your photocard's expiry

Photocard driving licences replaced paper ones in 1998, but under the new system you must renew your photo every 10 years. Yet as at July 2011, 1.7 million photocard driving licences are out of date, according to the DVLA. For full info and how to renew, see the Is your driving licence valid? guide.

DO fit security and park or drive carefully

Any extra security will help; fitting an alarm or immobilizer (especially one approved by Thatcham) will reduce the bill substantially.

Plus, as theft and accidental damage add a wedge to insurance costs, if you leave your car in a garage or driveway it's a big deterrent to theft and means accidental damage is less likely, resulting in a 3% - 7% drop in insurance costs.

Plus the more points on your licence, the higher the cost. While speeding points remain on your licence for four years, insurers usually check for convictions during the last five before they are removed from your record.

One speeding conviction may only affect the price of cover by around 5% - but any more'll bump up the price, with two offences costing around 20% more.

Being caught with a mobile phone is more serious, and can double your quote. It can also give you three instant points on your licence, which stay on for four years. Approved hands-free kits are fine if used properly.

DON'T assume third party's cheapest

Before we begin, it's important to understand that there are three different types of car insurance: third party, third party fire and theft, and fully comprehensive (full definitions below).

Logically, third party insurance should be cheapest as it offers a lesser level of cover than fully comp - yet this isn't always the case. So get quotes for third party and fully comp just in case it's cheaper. Plus always make sure you check your policy so you know exactly what you are and aren't covered for in the event of a claim.

While it's likely third-party buyers are on average a higher-risk group, perhaps as overall they care less about their cars, and so prices are pushed up. To illustrate this, in one low-risk driver quote we found £290 for fully-comprehensive, compared to £406 for third-party. This isn't a hard rule, but always check both.

Third Party

The minimum level of cover you need to legally be able to drive on the road is called 'Third Party'. It used to be the cheapest type of insurance, but bizarrely fully comprehensive policies can now sometimes be cheaper.

Third Party covers you for any damage you cause to another person's vehicle, and gives protection for any passengers in your car.

Therefore, if you're in an accident and it's your fault, you'll have to pay for any repairs to your own car yourself, as your insurance won't cover it. It may be more expensive because it's assumed you care less about your car and are therefore more likely to have an accident.

It's generally the most suitable for those:

- With cars worth less than £1,000

- Aged under 25 (though also read Car Insurance for Young Drivers guide.

- Without a no-claims bonus

- Living in a high risk area

Third Party Fire and Theft

Third party fire and theft has the same level of cover as third party insurance. However, self evidently, it also has the additional cover of assistance if your car is stolen or set on fire.

Fully Comprehensive

This is the widest level of cover, but can sometimes be the cheapest. The big advantage is that if you have an accident and it was your fault ...

you'll be able to claim the cost of repairing your car, and cover personal injury costs, as well as those of other drivers.

The cover also includes accidental damage and vandalism, for example if somebody causes damage to your car when it is parked in the street and drives off.

Plus you'll usually (though not always, so do check your policy details carefully) be able to drive other people's cars if you have their permission, although this is likely to only be Third Party. Sometimes you'll be covered for driving hire cars too.

Fully Comp is a good idea if your car is worth more than £1,500, and gets more important the more valuable you car is. Many insurers will only offer fully comprehensive cover for higher value cars anyway.

There are a few ways of cutting the cost of fully-comprehensive cover. For example, Tesco Value insurance offers a comprehensive policy but has a higher compulsory excess, which lowers the cost. However, this doesn't automatically make it cheapest; ensure you first use the comparison sites above to check.

DO try adding a second responsible driver

If you're considered high risk adding a second driver to the insurance, even if they won't use the car often, can smooth out the average risk and sometimes reduce the premium. Those with an additional record for driving well are likely to help make bigger savings, but anyone that's in a lower risk category than you can help.

It won't always work, but it's worth playing with quotes to check. Yet don't confuse this with 'fronting', which is illegal - more below.

At no point should you add your name as the main driver on someone else's car, such as one of your children, instead of them. This is known in the industry as fronting and is fraud. When you come to claim, this will often be checked out and your insurance will be invalidated and can lead to prosecution, so don't do it.

DON'T over estimate your mileage

The less you drive, the cheaper your insurance will be. Where possible, try and reduce your mileage. This may sound trite, but actually the real key is incorporating the extra insurance cost when you make long journeys, not just the cost of petrol compared to taking the bus or train (also read Cheap Trains article).

Anecdotally, though many simply get a quote for 10,000 miles per year, MoneySavers have reported that 5,000 is the cheapest quote - though we haven't tested this. If you drive your vehicle on business, always declare this rather than just include the business miles as personal, or the policy may be void.

DO tell insurers about changes and special circumstances

If you haven't got 'normal' circumstances, eg, you've made a claim in the past few years, have a modified car or expect to drive 100,000s of miles a year, tell the insurer. If you don't and then try to claim, even for an unrelated issue, your whole policy may be invalid.

Plus you should also tell your insurer about any changes. This is crucial as it reduces potential problems in the event of a claim, even if it's just your address. Trying to get insurance after you've had a policy cancelled due to a fraudulent claim is very difficult, very expensive and will follow you for the rest of your life.

A change in circumstances includes moving jobs, as insurers believe this can affect your risk. Scandalously, the unemployed often (though not always) pay higher rates for their car insurance, so do inform your provider if you're out of work but also do the full checks below to see where you can get the cheapest cover.

You may also save on insurance if you're in a more stable relationship, ie, if you're living with a partner rather than listed as single.

DON'T modify your car

Sexy it might be, MoneySaving it ain't. The more changes you make to your car, barring security ones, the more you'll be charged.

Always make sure you inform your insurer of any modifications to your car, whether you made them or not, or it may invalidate your policy. A modification is anything that isn't part of the standard vehicle specification, including factory fitted optional extras such as alloy wheels.

DO work out how much you'd really claim for

It's worth considering going for a policy with a higher excess (the amount of any claim you need to pay yourself). Many people will find that claiming for less than £500 worth of damage both increases the future cost of insurance and can invalidate no-claims bonuses, meaning it's not always worth making a claim.

So why pay extra for a lower excess? A few policies will substantially reduce premiums for a £1,000 excess, so try this when getting quotes. The downside of this is if you have a bigger claim you'll have to shell out more, so do take this into account.

DON'T be tempted to lie

With insurance, remember - the golden rule is:

If you've read these tips and thought, 'it's easy to lie about this', then of course you're right. Yet lying on your insurance form is fraud. It can lead to your insurance being invalidated and, in the worst case, a criminal prosecution for driving without insurance. Don't do it.

DO try tweaking your job description or quote date

There's another quick tip to lower your costs: tweaking your job description could save you cash. Insurers decide prices depending on historic risk assessments, and your occupation plays an important part in this. To help we've built a fun Car Insurance Job Picker tool to show the riskiest jobs and see if small tweaks to your job description could save you cash.

Prices change at different times of the month

Plus, there's a technique to see if you can get cheaper cover at different times of the month; but it's a little time consuming...

Run your quotes a month before renewal and click through to the cheapest three insurers' sites making sure you save the quotes. Some, although not all, hold their prices for up to 28 days. Then, nearer your renewal date go back to check the price and buy if it's cheaper, or revert back to the saved quote if it's not.

DON'T forget car type impacts insurance cost

The combination of popularity, engine size and value all impact car insurance cost. It's worth considering this when you buy; insuring a super-powerful beast of an SUV for a 17 year-old would cost enough to make Bill Gates weep.

DO try and protect your no claims bonus

For every year you don't claim on the insurance policy you get a discount. This makes a substantial difference to the overall cost. If you do claim it's usually two years off this discount. This is deliberate to encourage people not to claim. You can also get a protected no-claims discount so that claims don't impact it.

Remember though, if you do have an accident, even if you don't claim to keep your no claims discount, the price of the policy can rise simply because you may be assessed as a higher risk in the future.

Some schemes also offer an accelerated no-claims bonus, ie, giving you a year's no-claims bonus after ten months, such as Admiral's* Bonus Accelerator.

Switching from a company car to a private car

If you have a no-claims bonus from driving a company car and try to find private insurance online, you'll find neither insurer nor broker will allow your previous no-claims bonus to count.

Yet if you phone up, most companies will give some form of ‘introductory or special bonus' to those switching to a private car. This is because these discounts are often applied manually as the online systems don't automatically allow a discount.

The overall tactic is to first use the usual process below then call the top three (or possibly five) providers listed and discuss this no-claims company issue.

Watch the video guide

Courtesy of five tv. Originally from It Pays To Watch (Jan 2009)

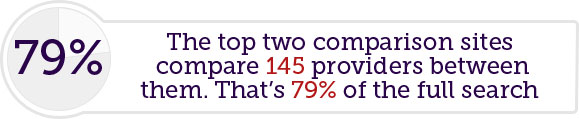

Step 2. Correctly combine comparison sites

Comparison sites zip your details to hosts of insurers' and brokers' websites, scraping their data off the screens to report back the cheapest. Yet as they don't all compare the same sites, to maximise the spread of quotes, you need to combine them, so we've analysed the order that gets you the max. quotes in the min. time (see how the order's picked).

GoCompare*

Pros:

- Covers 61% of full search in 5 mins

- Ability to customise searches, eg, add breakdown cover or coutesy car

Cons

- You must go to the 'more information' link on the last page and tick the 'do not contact' box or it'll to spam you.

- Can misquote excesses - doublecheck!

Add feedback: GoCompare Car Ins

Moneysupermarket*

Pros

- Covers 50% of full search in 5 mins

- Nice features inc. mileage calculator, predictive occupation search.

- Results instant-update when tweaking

Cons:

- Will also follow up unless you untick the boxes in 'getting back your quotes' at the end of page 2

Add feedback: MoneySup Car Ins

Avg. time taken: 5 mins

Direct Insurers searched: 35

Brokers searched: 95

Avg. time taken: 5 mins

Direct Insurers searched: 25

Brokers searched: 76

Two competitive insurers refuse to be included by any comparison site, and sometimes have special offers so are worth checking separately.

Aviva*: Currently 20% off for new customers with at least four years' no claims.

Aviva*: Currently 20% off for new customers with at least four years' no claims.

Direct Line*: Currently '12 months for the price of 10'.

Direct Line*: Currently '12 months for the price of 10'.

Two comparison sites have attempted to tackle the market by offering 'quick cashback' if you compare then get a policy through them. While it doesn't pay nearly as well as some hidden cashback deals (see step 4), it could still be enough to make a difference.

Beatthatquote:

Beatthatquote:

You'll get £25 cashback if you go via special links like this one - BeatThatQuote* - not if you go to it direct.

Important: How to get the cashback

You must claim it 60 days after buying the policy, it'll then be paid after another 60 days so it's not quick. To claim it you must use the password and reference number that Beatthatquote gives you to retrieve your quote on the insurer's site, and ensure you buy exactly the same policy.

Then use this cashback claim form after 60 days. Details will be emailed to you, so always check your junk folder, and diarise the dates to chase it up.

Important: read this before going for it.

As well as the slightly complex claim procedures, you should never see this as a done deal, only as an added bonus. Another thing in common with normal cashback sites, never count the cash until it's in your bank account - your primary aim should always be getting the cheapest policy.

It's important to be aware that the cashback is coming from the comparison site, not the insurer, so getting the cashback does rely on their ability to pay.

These sites include far fewer insurers than the main comparison sites above (though they do add over 20 new providers, so are worth checking on top) but they argue the cashback they give makes up for that provided you jump through the hoops to get it.

MoneyExpert:

MoneyExpert:

This smaller site also pays £25 cashback, but currently its sister, SimplySwitch*, is topping the offer up to £40 if you go via its site and enter the code SIMPLYCAR.

MoneyExpert has set its default excess to £400 and includes some assumptions, so be careful to check the quotes are right for you. Important: How to get the cashback

The cashback must be claimed between 14 and 30 days after the policy starts (ie, not when it was purchased). If you leave it more than 30 days, you won't get the cash, so diarise this carefully.

It must be claimed from MoneyExpert (not MoneySavingExpert) specifically by the car insurance policyholder using the cashback claim form, plus it's not available if you're in Northern Ireland or the Channel Isles - read the full T&Cs;.

With both the process isn't that straightforward, nor without potential pitfalls, also be aware neither site lets you "opt out" of further marketing, so you are likely to get follow up phone calls and emails.

Important: read this before going for it.

As well as the slightly complex claim procedures, you should never see this as a done deal, only as an added bonus. Another thing in common with normal cashback sites, never count the cash until it's in your bank account - your primary aim should always be getting the cheapest policy.

It's important to be aware that the cashback is coming from the comparison sites, not the insurer, so getting the cashback does rely on their ability to pay.

These sites include far fewer insurers than the main comparison sites above (though they do add over 20 new providers, so are worth checking on top) but they argue the cashback they give makes up for that '“ provided you jump through the hoops to get it.

If you still

haven't found a deal you're happy with or want to push the envelope there are many more options to try.

These other comparison sites between them will add more than thirty providers; QuoteZone*, Confused*, CompareTM*, TescoComp*, Uswitch*. Though there are more standalone

insurers.

Order based on a full survey carried out roughly every three months, last done in Dec 2010

Always double check the policy terms...

Once you've found the cheapest from the screenscrapers, make two important checks:

-

Double check the quotes

Click through to the insurance provider's own website to double check the quotes, as to speed up searches some comparison sites make a few assumptions (see what to check). - Examine the policy's coverage

Check whether it's suitable. So if you want "free car hire" if your car is being fixed, is it included?

Plus while you're there it's worth playing with the policy details to see if you can finesse the price down; look at the excess, and whether adding drivers cuts the cost.

This tool by Find* allows you to check the coverage of two different polices side by side.

What happens if my insurer goes bust?

Insurance providers regulated in the UK are covered by the same government-backed Financial Services Compensation Scheme (FSCS) as banks, meaning if they go into default, you're protected.

Comparison sites include many providers, the vast majority of which are regulated. A small number aren't, for example Markerstudy which is regulated in Gibraltar (meaning you'll need to claim from there if it's your insurer and it goes bust), so it's always worth checking yourself if you're concerned.

In the unlikely event a regulated insurer does goes bust, the FSCS will try and find another provider to take over or issue a substitute policy. However, if you've ongoing claims, or need to claim before a new insurer is found, the FSCS should ensure you're covered. For more see the Insurance section of the Savings Safety guide.

Step 3: Check Special Policies

Once you’ve tried the comparison sites it's worth trying these extra ways to see if they undercut your best price.

Pay when you drive

A tracking device is fitted to your car to monitor when you drive - so the more you drive, the more you pay (though of course, it's also likely to depend on your personal risk profile).

A tracking device is fitted to your car to monitor when you drive - so the more you drive, the more you pay (though of course, it's also likely to depend on your personal risk profile).

Coverbox. A 'pay as you drive' scheme from Coverbox* has per mile charges that vary according to the time of the day or night when you drive.

For low mileage drivers these can cut costs, especially if you don’t drive at night time (11pm - 5am) when the costs per mile jump.

Young, low use drivers or provisional licence holders

As a first port of call young drivers should always follow the same system, using the comparison services and trying to get cashback. However, if that hasn't cut costs there are further options which may help. See the full Young Person Car Insurance guide for more detail.

Try a local broker

Some groups, eg, those in areas of high crime or with lots of penalty points, can find it incredibly difficult to find cheap insurance cover as they are considered too high a risk. Try speaking one-on-one to a local insurance broker about your individual circumstances to see if they can find you a decent policy (search on the British Insurance Brokers' Association website).

Multi car discounts

If you've two or more vehicles between friends or family members in your household (Vans can be included in this but Bikes usually aren't), some providers offer discounts if you insure them all together. Comparison sites don't have the technology to do these searches, so you need to compare manually.

If you've two or more vehicles between friends or family members in your household (Vans can be included in this but Bikes usually aren't), some providers offer discounts if you insure them all together. Comparison sites don't have the technology to do these searches, so you need to compare manually.

First, use comparisons for each car separately. The discounts are usually around 10%, so often it's likely just finding the cheapest standalone insurer will win anyway. So always do a comparison first then try the deals below to compare.

Get all cars on one policy. Cover two cars and Admiral* will give up to 12% discount, cover four or five and you could get up to 24% discount. All cars will then be covered on one policy so the renewal date will be aligned to end at the same time.

Separate policies but still get the discount. Other insurers allow cars to have separate policies but give a discount as long as the vehicles are in the same household. Privilege* gives up to 10% off, Direct Line* 10% off (first year – second year is 5%), Churchill* (who also cover named drivers on another Churchill policy) up to 10% off and Aviva* up to 15% off.

Plus while it says it gives reductions, Tesco doesn't say how much the discount will be, so check before you buy.

Temporary Car Insurance

It's possible to get temporary insurance for 1 to 28 days, such as to to drive a friends car protecting their policy and no claims Budget's Temporary Insurance, Insure Daily, TempCover.com* and RAC are amongst some of the available policies.

Step 4: Grab hidden cashback & discounts

By now you'll know the cheapest available provider, yet you may be able to cut the cost even further.

The top cashback deals

Once you know who your cheapest provider is, you need to check there aren't any hidden cashback deals, these can be as high as £100. If your second or third cheapest quotes weren't too much more expensive see if cashback's available for them too and find the overall winner.

The step-by-step list below takes you through a variety of options to improve your deal.

Check 1: Cashback websites

These sites carry paid links from some retailers and financial services providers; in other words if you click through them and get a product they get paid. They then give you some of this cash which means you get the same product, but a cut of its revenue.

Don't choose based only on cashback, see it as a bonus once you've picked the right cover...

Those new to cashback sites should ensure they read the Top Cashback Sites guide for pros and cons before using them.  Otherwise use the Cashback Sites Maximiser tool to find the highest payer for each insurer.

Otherwise use the Cashback Sites Maximiser tool to find the highest payer for each insurer.

Things you need to know before doing this...

- Never count the cash as yours until it's in your bank account. This cashback is never 100% guaranteed, there can be issues with tracking and allocating the payment, plus many cashback sites are small companies with limited backing, and you've no protection if anything happens to them.

- Withdraw the cashback as soon as you're allowed. Money held in your cashback site account has no protection at all if that company went bust, so always withdraw it as soon as you're eligible.

- Clear your cookies. While it shouldn't be a problem, if you've used comparison sites beforehand, there is a minor risk that the cashback may not track due to cookies - so it's good practice to clear those first (read AboutCookies).

Check 2: Get cashback via comparison sites

If cashback sites don't list your insurer then a couple of comparison sites pay cashback if you compare then get a policy via their sites.

Beatthatquote* (only via special links like this, not direct) pays £25 and MoneyExpert £25 (although currently its sister, SimplySwitch*, is topping the offer up to £40 if you go via its site and enter the code SIMPLYCAR).

Again though, it's more important to get the right policy than a bit of cashback, so ensure that first. However, you must make sure you tick all the right boxes to claim this cashback, and understand that the comparison sites pay this bonus directly - not the insurers - so you are reliant on their ability to pay. Please read the quick cashback section above for full pros and cons.

Check 3: Special deals

If you can't get cashback it's worth noting a few companies have special deals not always mentioned by comparison services. These currently include (listed alphabetically):

Aviva* gives 20% off for new customers with at least four years' no claims. |

Argos (which uses the Beatthatquote comparison) is giving a £30 giftcard for buying insurance via its site. |

Insurance broker Be Wiser* is giving free RAC membership for policies bought via its website. |

Buy via the Confused partner site on Nectar and you'll get 1,000 points (worth £5). |

Buy from Direct Line* before 29 Sep and get '12 months for the price of 10'. Minimum premiums reply. |

New customers buying car insurance from Santander* will get £50 cashback. Quotes are valid for 30 days. |

Buy your car insurance via TescoCompare* and you'll get 500 Clubcard points (worth around £15 if used on certain clubcard deals). |

Buy your car insurance via Tesco and you get up to a 10% online discount. Clubcard holders get an extra discount although Tesco don't reveal what this might be. |

Haggle on your car insurance!

The car insurance market is very competitive and companies are desperate to retain business. Therefore once you've got your overall cheapest price get on the phone and try to haggle. There's often massive price flexibility, but be fully armed with the screenscraper's cheapest quotes and any available cashback first.

The first port of call should be your existing insurer, after all if it can beat or even match the best quote it saves the hassle of switching policy. If that doesn't work and you're still in the mood, take it to a broker. For more haggling tips read the full Haggle On The High Street guide.

Step 5: Remember next year

Fortunately, providing you drive well and don't have any accidents, your insurance premium should get cheaper after the first year. However, don't automatically stick with the same provider - it may not still be cheapest.

Apply for cover from your existing insurer as a new customer and it's likely you'll be given a cheaper price. This is because car insurers, like any company, will happily profit from apathy if they can.

Insurers must send out renewal notifications at least 28 days before renewal, though this doesn't leave much time, and you can end up rushing to try and find a cheaper price.

To avoid being forced to decide quickly, diarise a warning six weeks before your renewal date, so there's plenty of time to sort out a new provider. Alternatively use the free Tart Alert which sends a reminder text or email.

Warning! Women's car insurance to rise

The EU court ruling - that from Dec 2012 gender can't be a factored into insurance prices - means that as women under 40 pay much less than men under 40, they need to expect gradual rises until then. See the MSE news story Insurance costs to soar for full info.

Get paid to be a mystery shopper

You could also sign up to Consumer Intelligence, a consumer research company, who pays several hundred people a month near renewal, up to £50 to carry out comparisons. Importantly, you don't need to buy insurance from any of the companies you've contacted. See the It's a Mystery forum thread for full details.

The current record result

This technique often produces huge savings. Those who normally just accept their insurers renewal regularly see £100s shaved off the cost. And significant numbers of MoneySavers report getting deals for under £100.

The Record... 96p for a year’s fully comprehensive cover

Policy Price: For Barbara the cheapest was £120.96 from Swinton Insurance for a fully comprehensive policy, with protected no claims bonus, and including a courtesy car.

Insurer cashback: The company had its own £70 cashback promo on.

Cashback site: She then got a further £50 via using a cashback site.

All added together that means the total cost of the insurance was just 96p. Her comment, "I'm always looking for a bargain so when I found my car insurance for £120.96 I thought I was doing well. But when I also got £120 cashback I realised I had done really, really well. Can anyone beat that?"

Have you used this guide's techniques to save on car insurance? If so, pls feedback in the Car Ins Super Deals forum discussion.

Car insurance Q&A;

Should I take a monthly payment plan?

Beware 'pay monthly' options - usually the insurer actually just loans you the annual cost and then charges interest at hideous rates on top. So either pay in full, or if you can't afford it, use a credit card with a lower APR rate (or better still, a 0% credit card for spending ensuring your repayments are big enough to clear it within a year.)

I'm not driving my car for a bit, does it need to be insured?

Yes - legally cars must be insured unless declared off road - unless they have been untaxed since Jan 1998. The Continuous Insurance Enforcement scheme, whcih came into force on 20 June 2011, means all cars must be insured - even if no one drives them. The aim's to crack down on two million uninsured drivers by matching up the database of cars and insured drivers.

The only way out is to apply for a SORN (Statutory Off Road Notification) declaring that your car will never be driven. Ensure you search for the new cheapest in advance of renewal, or you'll end up just auto-renewing to stop the fine.

Am I covered to drive others' cars on my insurance?

If your insurance allows it, driving someone else's car instead of yours can be a way to cut mileage. Check your policy details carefully to find out if you can.

If you have fully comprehensive insurance then often, although not always, it includes what’s called ‘driving other cars’ cover. This provides you with Third Party cover whilst reducing your mileage and therefore the cost of your own policy.

Would it be cheaper for me to just get a motorbike instead?

Generally, insurance is a lot cheaper for a moped or motorbike than for a car. Plus, some insurers may put any no claims bonus from bike insurance on your car insurance too if you later get your car insured with them. Yet do take safety into account - if you're in an accident you're much more protected if you're in a car. See the bike insurance guide for more.

What's the difference between a screenscraper and a broker?

Brokers and screenscrapers may seem like they're doing a similar job, as each search a number of different insurers; yet they're radically different beasts. A good analogy for this is to compare it to searching for the cheapest loaf of bread.

Individual insurers are like bakers, your choice is simply to buy its cheapest loaf that suits.

Brokers are like supermarkets; they stock a range of bakers' loaves and the price charged depends on their relationships with suppliers.

Screenscrapers are like sending someone round supermarkets and bakers to note all their prices.

Must I inform my insurer if I have an accident but don't claim?

If you have an accident, and damage someone else's car, but decide to cover the costs yourself, strictly speaking you should still tell your insurer about it.

Many don't, thinking it will increase premiums, yet a problem may arise if you have a second accident and it is found to be related to work undertaken for the first. If this does happen it would most likely result in non payment of the claim, rather than cancelling the insurance or being reported for fraud, but could still end up costing you £1000s.

Glossary

Ask A Question / Forum Discussion

Car Insurance

Spotted out of date info/broken links?

Email brokenlink@moneysavingexpert.com to let us know

Always double check the product details before signing up to them

LINKS THAT HELP THIS SITE (all have a * in above article)

(this has no impact on product or pick - see explanation below)

Admiral , Aviva , Be Wiser , Beatthatquote , Compare the market , Confused.com , Direct Line , Find , GoCompare , HSBC , MoneyExpert , Moneysupermarket , Privilege , Quotezone , TempCover , TescoCompare , Uswitch

Explanation (of * links)

Important FSA Note. Referring people to insurers or insurance intermediaries can in some circumstances require FSA authorisation. For this reason, Martin Lewis of Shepherd's Studios, Rockley Road, Shepherd's Bush, London W14 0DA is authorised and regulated by the Financial Services Authority.How this site is funded. Two types of contacts are listed. The first help MoneySavingExpert.com stay free to use, as they're ’affiliated links' which invisibly take you via commercial price comparison services like Moneysupermarket or Find, which then pay this site per click. This is up to £15 if after doing a comparison you choose to apply for a mortgage or 0.1% of the mortgage, if you complete through Charcol. This in no way impacts any editorial decisions (what we write). Nor does it cost you anything or change the product. The second type don't help, but are listed so you can choose.

You shouldn't notice any difference, the links don't impact the product at all and the editorial line (the things I write) is NEVER impacted by the revenue. If it isn't possible to get an affiliate link for the best product, it is still included in exactly the same way. For more details read how this site is financed.

LINKS THAT DON'T HELP THIS SITE

(please only use if necessary)

No * Link Available: AboutCookies , Be Wiser , Beatthatquote (via Argos) , Budget , First Direct , Insure Daily , Nectar , Tesco

Duplicate links of the * links above for the sake of transparency, but this version doesn't help MoneySavingExpert.com:

Admiral , Aviva , Be Wiser , Beatthatquote , Compare the market , Confused.com , Direct Line , Find , GoCompare , HSBC , MoneyExpert , Moneysupermarket , Privilege , Quotezone , TempCover , TescoCompare , Uswitch