No debt problems are unsolvable. It mightn't be easy or quick, but there's always a route. Debts are urgent, they grow rapidly over time, and speedily spiral into trouble. The earlier you deal with ‘em, the easier they are to deal with.

No debt problems are unsolvable. It mightn't be easy or quick, but there's always a route. Debts are urgent, they grow rapidly over time, and speedily spiral into trouble. The earlier you deal with ‘em, the easier they are to deal with.

As debt isn't just a finance issue, but feeds into all elements of your life, solutions are wide and varied; from cutting interest costs, budgeting, or simply where to find free, non-profit one-on-one help.

In This Guide

Are you in debt crisis?

There are two ways to deal with problem debt, and which one is right for you depends on whether you're in what's technically defined as debt-crisis or you just have worrying or large debts.

What counts as debt crisis depends on who you ask, but there's a strong indication if you answer yes to either of these ...

Are you struggling to pay all basic outgoings eg mortgage, rent, energy bills and credit-card minimums?

or

Are your debts (excluding mortgage) bigger than a year’s after-tax income?

Therefore even if your debts are big, if you can service them, even at the minimum level, you're not in debt crisis and a different solution applies.

Watch The Video Guide

Watch the full video (21 mins) or click one of the links below Mar 2010

Budgeting and Benefits (4 mins) | Where to get further help (5 mins).

If you're in debt crisis...

First of all, don't panic at the name. I've never yet heard of someone with debts so bad there isn’t a path through them; starting to deal with them will make you feel better and speed up the process.

While even for those in crisis the nuclear option, bankruptcy, is rare. Even then, as this email shows there's always hope:

"I'd always been brought up to believe being a bankrupt was just one step away from being a burglar; so when it became apparent that my daughter was reeling from the pressure of unpaid debts, bankruptcy wasn't a consideration.

"Her debt was that bad, that even living as a pauper she couldn’t afford the interest charges. Yet still the credit card companies offered to increase her credit limit and her bank offered to consolidate her loans.

"After taking the time to research the matter thoroughly and getting loads of advice we decided bankruptcy was the best option and although it’s not a step that should be taken lightly my daughter is alive again.

"She has a genuine fresh start after seven years of increasing money pressure, and it has made the world of difference to her. Of course, she has to be careful with her limited resources but is now able to manage and live a reasonable life…and not lie awake at night worrying about money!”

The fact you're here is a great start

If you're in crisis, the fact you're here and reading about it is a great start. Many people simply close their eyes to reality and there is nothing worse. Now you know there's a problem, it may feel worse than before, but the fact you're about to sort it out, means in reality you're better off.

First read the debt help checklist

The debt help checklist below is designed primarily to prevent people from getting into debt crisis, rather than for those already there. Much of the information won't be applicable, yet it's worth scanning through for five minutes to see if anything is relevant, as it may allow you to meet your minimum outgoings and thus avoid your crisis snowballing out of control.

There's free one-on-one help available

The reason this guide doesn't cover crisis solutions in detail is simple... there are a range of great free, non-profit debt counselling agencies who will give you one-on-one help if you're in crisis; and no web guide can come close to that personal service. Therefore my preferred solution is to direct you to them. See the free debt counselling section.

If you've debt problems but not debt crisis...

Don't visit a debt counselling agency; not just because they're heavily oversubscribed and should be left to those in urgent need; but more importantly the solution they use isn’t for you.

Debt counselling involves negotiating with creditors and even bankruptcy, IVAs or Debt Relief Orders. These are serious measures, designed for those with limited alternatives, in effect drawing a line and saying "this person is no longer within the system". The result is the debilitation of your credit score and less access to financial and some consumer products.

Instead there are three sources of help:

Take time to go through the checklist

The debt help checklist below is designed to take you through every single way to take on your debts, cut the costs, and pay them back speedily. So take some time and go through each to check whether it applies to you.

Help and support from those in the same boat

If you want help or want to talk about it, there are many people in the Debt-Free Wannabe Forum in a similar boat, all supporting and helping each other reach what they call their "debt-free day", after going through the checklist, this is an amazing resource.

Some help for those on low incomes.

If you’re really stuck and want to talk to someone, then don’t go to your bank, it will just try and flog you its own products. Those on low incomes, such as claiming any benefits, can access the free Government helpline, Now Lets Talk Money on 0800 0121656, though the information it gives is no where near as specific or sophisticated as the information below.

Are you hiding your debts?

Many people hide their debts from friends and family or sometimes even themselves (by not opening statements or not totalling their liabilities). If that’s you, then it's time to come out of the closet. You can only sort your debts out if you know the scale of them. It may feel better not to know, but in the real world it makes things worse.

For those hiding debts from a partner, spouse, family or loved ones...

Seek help, or work out an action plan first, so you're telling them about solutions, not just problems. It's easier to break the news if you and show you're determined to improve.

It’s much easier that way and remember; if you're prepared to take action the question isn't "will I ever get through this?", but "when will I be through this?"

DO YOU HAVE MENTAL HEALTH/relationship problems?

Debt isn't purely a financial issue. It can break up families, take the roof from over your children's heads, kill confidence, pile on stress, cause depression and even lead some to take their own lives.

If you're feeling depressed then Samaritans is always there to help, either through its website or on the phone number 08457 90 90 90 or have a look at the website depressioncanbefun.com. If you're worried about your relationship Relate has lots of useful info too.

For a full guide to handle debts when stressed, work with banks, get free one-to-one debt counselling and specific tips for bipolar and depression sufferers, read our free Mental Health & Debt Help PDF booklet.

Being chased for debt that's not yours?

There are a number of Debt Collection Agencies, whose job it is to chase down unpaid debts for other companies, and disgustingly one time-saving tactic used is to fish for the right person by sending demands to all those with the same surname, in the hope someone will pay up.

If you're called or receive a letter asking for money, the onus is on THEM to prove that you DO owe the money and that it is genuine debt. So if the debts aren't yours, don't panic; send a letter to say you're not responsible. National Debtline has a template letter you can use.

Before you start

No one ever wants to get into debt. It comes from spending money you don't have. This could be for frivolous reasons, or you may've had a horrible change in circumstance, like a partner dying, personal illness, divorce, mental health problems or losing your job (see the full Redundancy Guide for hints and tips if you have lost your job).

Yet however good or bad your reason from now on it's irrelevant, the most important thing you can do is get a disciplined handle on your spending...

Debt's a symptom not the problem. Before tackling it you must reduce your spending, not only to stop you borrowing more, but to maximise repayments.

The prime aim of this guide is to cut the cost of your debts, yet if you do that without examining the bigger picture of all your spending it'll be wasted (there are some top tips later on to help). That's why, in this guide, my prime focus is on cutting the cost of your debts themselves, rather than looking at the bigger picture of all spending.

How bad are your debts?

If you're wondering how bad your debts are, as the old adage says, size isn't everything. What counts is your debt in proportion to your ability to repay.

Are your non-mortgage debts bigger than a year's after tax salary?

If your non-mortgage debts (usually credit cards and loans) are more than a year's salary after tax, then they're quite severe; after all, that means you'd need to work more than a year to repay them, even if you had no outgoings.

Yet even if your debt is manageable, if you don't know where it came from, that's a big danger signal, compare these two answers:

Q: "So how did you build up debts of this size?"

A: "Well I planned for and budgeted, shopped around to get the cheapest borrowing in order to buy a car/conservatory/caravan and now we're repaying it."

and compare that with

Q: "So how did you build up debts of this size?"

A: "Well I'm not sure really, I just used my credit card and the cost built up."

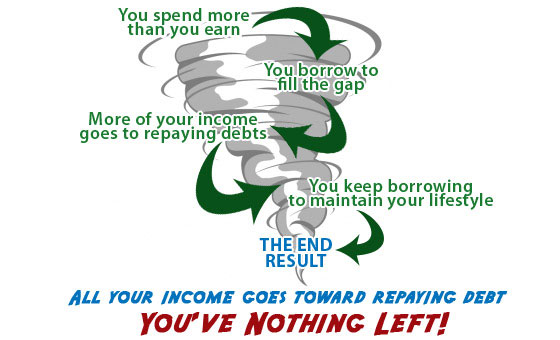

The latter is of course the most worrying. It means you are spending more than you earn and using borrowing as a means to fill the gap. If you continue to do that, you'll get in a debt spiral.

Never borrow more to get out of debt

Traditional debt help says 'never borrow your way out of a debt problem'. Yet this ignores the varying cost of different debts. The MoneySaving approach is "never borrow more to get out of a debt problem."

If it’s possible to borrow more cheaply elsewhere to replace existing borrowing, then this can provide a huge boost, as lower interest rates mean more of your cash goes towards repaying the actual debt rather than just servicing the interest. Those with big debts may save thousands a year in interest by being more savvy with their borrowing.

The Debt Problems Checklist

The idea of the checklist is simple: to explore every option and use each one that works for you. Most link to more detailed guides focusing specifically on those subjects. Once you've found something that works, don't stop, continue down the list to see if there's anything else that will help.

Some of the suggestions only work for those with a decent credit history and not too severe debts, but it's still worth checking.

The first steps... sort your spending

The following are a few ways to manage your cash and reduce your outgoings that are specifically useful for those with debt problems. If you've time, it's far better to go through the full Money Makeover guide.

Budget and reduce outgoings

If you have debt problems then doing a budget is central, you have to get a handle on what you spend to future proof your finances. The big problem with most budgets though, is... they don't work. To help there's a special free budget planner which counters all the traditional budgeting problems.

Full info: Free Budget Planner and the Stop Spending guide.

Earn under £66,000? Check your benefits

Any family with income under £66,000 may be entitled to some form of benefit. You can do a quick check up for free in just five minutes.

Full info: Benefit Checkup

Can you get help paying the mortgage? Use our eligibility checker

There are three government schemes specifically to help mortgage holders who are struggling to make monthly repayments. They range from an extra benefit to pay the interest for you, to a full rescue scheme where the local council buys some or all of your home then rents it back. Read the full Mortgage Arrears guide, including the quick eligibility checker.

There is also a useful five minute video explaining what to do and what happens at court (if things get that far) on the Direct.gov website for both home owners and renters.

Full info: Mortgage Arrears.

Reclaim, Reclaim, Reclaim

For those in debt it's very likely some of it has been made up of charges which have unlawfully been taken from you. If you've incurred bank charges or credit card charges for going beyond your limits in the last 6 years you may be able to get the cash back and the same is true of mortgage exit fees.

It's also possible you may be in one of 400,000 homes in the UK paying too much for your council tax, or if you have a loan then it's crucial to check whether you were missold the insurance which could've cost £1,000s to see if you can get the cash back.

Cut the costs of all your debt

Now the aim is simple, repay the debt as quickly as possible, while being charged the lowest possible interest rate.

Check Credit Reference Files (for free)

Before you start it's worth ensuring your ability to get new cheap credit isn't being hampered by erroneous data on your credit files. This can cause rejections, but worse still, if you keep applying before it's corrected, even once the problem is fixed you can then be rejected because of all the applications. It's possible to check your files for free though.

Full guide: Your Credit Rating

Shift debts to a cheaper credit card.

Suitable for: Mid to high credit scorers

Used correctly and with discipline credit cards are the cheapest borrowing possible, especially when shifting debt to new ‘balance transfer' offers. It's possible to get long term borrowing on a credit card at under 5%. Even if you don't have a great credit score there are still attainable deals.

Full guide: Best Balance Transfers

Cut credit card costs without new credit.

Suitable for: Low-mid to high credit scorers

New credit isn't always necessary to cut credit card costs. Many credit cards allow existing customers to move other debts to them at special rates. Do this in the correct order, following the Credit Card Shuffle technique, can create substantial savings (e.g. using this technique in a TV money makeover I cut one mans interest from £1,400 to £400 a year).

Full guide: Credit Card Shuffle Related Articles: Other Credit Card Articles

Check for grants and support.

Some utility companies offer help if you have large arrears on your gas, electricity or water bills. You'll need to be a customer of the company so if yours is not listed contact it to see if it has a similar scheme.

Gas & Electricity: Schemes are offered by British Gas Energy Trust, EDF Energy Trust, Npower First Step

Water: The Water UK website has info on all the water company schemes.

Related Guide: Details of other grants available in the Grant Grabbing Guide.

Get a cheap personal loan.

Standard personal loans can give you a consistent cheap debt, though not usually as cheap as the cheapest credit cards. Though as you must make fixed repayments each month, it has the benefit of providing structure.

Unfortunately, those with poor credit scores won't usually get decent rates yet an alternative is to look at joining a Credit Union. For many they’re a welcome alternative to payday loans or doorstep lending.

Credit Unions are independently-run local co-operative organisations that aim to assist people who may not have access to financial products and services elsewhere. There are 500 in the UK providing loans, savings and current accounts, each deciding its own services and rules on who can join.

Full guides: Cheap Loans, Credit Unions

Related guide: Cut The Cost Of Existing Loans

Always use savings to repay debt

The interest paid on savings is usually far less than interest charged on borrowing, so paying off debts with any savings is a serious boon.

The reason I've put this after the main debt switching steps is that you should first try and cut the cost of your debts where you can, then use what savings you have to pay off as much as you can - but focusing on the remaining high interest rate debts.

You may be thinking, "but surely I need my emergency cash fund", actually that's old fashioned logic, read the guide linked below for a full explanation of why.

Full guide: Repay Debts with Savings?

Danger Credit Card Minimum Repayments

The amount you repay on cards is also crucial. Minimum repayments are designed to keep you hocked in for years. Make only the minimum on a standard high street card with £3,000 on it, and it'll take you 41 years to repay. Yet it's easy to turn this around even if you can't afford to pay more.

Full guide: Minimum Repayments includes a special calculator

Remortgage: shift debts to a cheap deal.

Suitable for: Low-mid to high credit scorers

It's worth stating that a mortgage is just a loan secured on your home, meaning if you can't pay it back the lender can take your house. It's due to this additional security that it can offer a cheap rate over the long term.

With the credit crunch, it's not as easy to get a cheap deal as it used to be. Yet it's worth working HARD to find one. For every 1% you can drop the rate per £100,000 of mortgage debt you save £80 a month. So it's important to squeeze every last fraction lower.

An obvious idea is to shift credit card and other loan debts onto your mortgage if it's cheaper. On the surface this looks like a no-brainer; the debt is cheap and as it's over a long time the amount you pay each month will be lower.

Yet it's not quite that simple. Technically you are shifting unsecured debt to secured debt so there's an increased risk of losing your home if you can't repay. Plus it may increase your life assurance and other associated mortgage costs. And it may not actually be cheaper, paying off over a longer period means you end up paying more interest; e.g. 5% over 20 years is actually much more expensive than 10% over five years.

Don't be totally put off though, if the other routes above haven't worked, it's still worth considering and doing the numbers, especially if you've a flexible mortgage so you can pay the debts off more quickly.

Full guides: Remortgage Guide, Free Mortgage Guide

Dealing with problem debts

If you can't cut the cost of the debts, or if after doing that you're still struggling, it's time to consider some more severe measures.

Communicate with your lender

It's very important to get on top of debts as soon as possible. Don't default or miss payments. Let your lender know if you’re going to be unable to pay; it's always better to talk to them, though of course preventative measures such as reducing interest, expenditure, and being a smart consumer are the best form of action.

Can you get an interest free social security 'Social Fund' loan?

There are two main types of loan available from the Government's Social Fund which may be able to provide you with interest-free borrowing rather than getting any commercial debt.

Crisis loans are for emergencies or disasters, and to help stop serious damage or risk to you or your family's health and safety (e.g. repairs after burglary or while awaiting benefit payments) and you needn’t be in receipt of benefits to get them.

Budgeting loans are only for benefit-recipients, but allow a wider range of borrowing; for instance to pay for clothes and furnishings.

Both of these are applied for via the Job Centre. Though if you have means to get money any other way (using savings, for example), you won't qualify. Up to £1,500 can be borrowed at one time for each loan, or in total if you apply for both, and repayments are dependent on what you can afford to pay.

Sadly demand is extremely high at the moment and there isn't a bottomless pot of money, so if the Job Centre decides your circumstances aren't urgent or you're not struggling, you may not get anything. But if you think you qualify and really need the cash, it's definitely worth a shot.

To apply fill in the Department of Work & Pension’s claim form for the crisis loan or budgeting loan (if you're in Northern Ireland use these crisis loan and budgeting loan versions) and take it into your nearest Jobcentre.

If you weren't able to get a Social Fund grant or loan check to see if you can get a Save the Children grant in the Grant Grabbing guide.

Have you been rate jacked?

Many card providers have written to their customers saying their APRs will increase by up to 10%. This is the growing phenomena of 'rate-jacking'. Yet, under-publicised rules can be deployed to stop rate-jackers in their tracks - these include an absolute right to reject rate rises for existing debts. If you've had a letter you have several options on how to fight back.

Full guide: Reject credit card rate hikes

Is your credit agreement challengeable?

Any credit agreement, for example credit cards, loans and catalogue agreements signed before 6 April 2007 have to adhere to a strict format set by the Consumer Credit Act.

If this format is not followed, many argue you can challenge the enforceability of the agreement with your lender. Many people see this as a solution, however it won't work. See the full guide for all the details.

Even though it has been widely advertised by many claims handling companies, recent court cases have not been favourable to the debt claim back system – and the number of firms taking these cases seems to be shrinking. So it is unlikely to be a good idea to plan your finances around this solution.

Full guide coming soon: Can You Wipe Out Debts?

Carefully check secured loans.

Suitable for: Very poor to poor credit scorers, but be careful

Secured or 'consolidation' loans are something to beware of. We've campaigned against many elements of them, and they can be dangerous. They are at best a loan of last resort and if you fail to repay it you can lose your home. Plus, unlike personal loans, the rate is variable, so it may sound cheap at the start, but soon they can push it up.

However, in a few, very limited circumstances, they're a good solution. If you've got expensive debts and some (not too substantial) credit history problems, you may be able to cut their interest rate this way.

Full guide: Cheapest Secured Loans

Sell and rent back.

Suitable for: Very poor to poor credit scorers, but be careful

This is where you sell your house to a company, but then are allowed to continue living there paying rent. It seems an attractive option for some, but as shown in a strong feature by BBC Radio 4’s Money Box programme in Feb 08 it's nowhere near as good as it sounds for many people.

You could only get 50% of your home's value, the rental agreement mightn't be secure and there's even a risk that the person you sell the house to may have it repossessed themselves. Consider with care.

Further info: MoneyBox's Article, MoneyBox report

Is an IVA or DRO right for you?

If you’ve seen the adverts on TV, you’d be forgiven for thinking that an Individual Voluntary Arrangement (IVA) is the answer to all debt worries. The promise of a ‘little known government loophole that can write off 75-90% of your debt’ is not to be taken lightly.

An IVA is a serious financial arrangement and is only suitable for a small number of people. If you are in debt crisis read the guide to find out if it could be the right thing for you, it's also worth talking through with one of the debt counselling agencies.

Since 1 April 09, a new type of insolvency (of which IVAs and bankrupcy are another) called a Debt Relief Order (DRO), has been available. It's specifically aimed at those with debts of less than £15,000 who do not own a house (or have any other assets, such as savings).

To get a DRO you need to go via an approved intermediary, such as the CCCS or many Citizens Advice bureau. See their contact details in the free debt counselling section.

Full Guide: IVAs: Are they worth it? Forum Info: Debt Relief Orders

Free debt counselling

If you've exhausted all the options above, and things are no better, even if you're not in debt crisis, at this point it's worth talking to one of the debt counselling agencies... see below.

Debt Counselling, get free one-on-one help

For those in debt crisis (see debt crisis definition) who are consistently struggling with debts and meeting repayments, free personal help is invaluable. Though if you'd like to see roughly where you stand before you start, there's a DIY guide below.

The right people to go to...

The aim is to find non-profit debt counselling help, in other words a one-on-one session with someone paid to help you, not to make money out of you. Be careful not to confuse this with ‘free help’: many commercial companies say they’re free as you’re not charged directly, but you’ll still pay somehow.

Stop debt collectors harrassing you for 30 days

These non profit agencies are also the ideal people to go to if you're being harassed and bullied for payments by debt collection agencies.

An agreement between the Government and Credit Services Association, the body that represents debt collecting agents (see its Code of Practice), gives new power that guarantees debt collectors won't contact you for at least 30 days, provided you've sought debt help.

The debt counselling service will inform collectors, who'll then give you a month's breathing space to get yourself on better footing.

The places we'd suggest contacting are:

Christians Against Poverty

Debt counselling agency, which specialises in helping those who are emotionally struggling too. The religious focus is why they do it, not how they do it.

Debt counselling agency, which specialises in helping those who are emotionally struggling too. The religious focus is why they do it, not how they do it.

- Link: Christians Against Poverty

- Tel: 01274 760720

- Opening times: different for each bureau

Citizens Advice Bureau

Full debt and consumer advice service with many bureau having specialist caseworkers to deal with any type of debt including repossessions and negotiation with creditors.

Full debt and consumer advice service with many bureau having specialist caseworkers to deal with any type of debt including repossessions and negotiation with creditors.

- Link: Citizens Advice or visit your local CAB centre (find nearest)

- Opening Times: different for each bureau

Community Legal Advice (includes Housing Duty Scheme)

Legal advice on a wide range of issues, including debt (usually for those on benefits or a low income). The Housing Duty Scheme gives free advice by phone or at around 100 courts across England and Wales if you are in danger of eviction or repossession.

Legal advice on a wide range of issues, including debt (usually for those on benefits or a low income). The Housing Duty Scheme gives free advice by phone or at around 100 courts across England and Wales if you are in danger of eviction or repossession.

- Link: Community Legal Advice

- Tel: 0845 345 4345 (or text 'legalaid' and name to 80010 to get a call back)

- Opening times: M-F 9am-6:30pm, Sa 9am-12:30pm.

Consumer Credit Counselling Service

A full debt help service in England, Scotland, Wales and Northern Ireland. Online support is also available via its Debt Remedy tool.

A full debt help service in England, Scotland, Wales and Northern Ireland. Online support is also available via its Debt Remedy tool.

- Link: CCCS

- Tel: 0800 138 1111

- Opening Times: M-F 8am-8pm

Debt Advice Foundation

A debt advice and education charity offering one to one advice.

A debt advice and education charity offering one to one advice.

- Link: Debt Advce Foundation

- Tel: 0800 043 40 50

- Opening times: M - F 8am to 8pm, Sa 9am to 5pm

National Debtline

A full debt help service in England, Scotland and Wales. Online advice is also available via its My Money Steps tool.

A full debt help service in England, Scotland and Wales. Online advice is also available via its My Money Steps tool.

- Link: National Debtline

- Tel: 0808 808 4000

- Opening Times: M-F 9am-9pm, Sa 9.30am-1pm (or see Business Debtline for business debts).

Northern Irish residents

Two free, confidential and independent schemes in Northern Ireland are: advice4debtNI, a government funded service offering phone and email advice and AdviceNI, local centers that offer face to face advice and the ability to chat online to an advisor via its 'beattherecession' scheme.

Two free, confidential and independent schemes in Northern Ireland are: advice4debtNI, a government funded service offering phone and email advice and AdviceNI, local centers that offer face to face advice and the ability to chat online to an advisor via its 'beattherecession' scheme.

- Link: advice4debtNI

- Link: AdviceNI

- Tel: 0800 917 4607

- Tel: 028 9064 5919

- Opening times: M-F 9am-5pm

- Online: beattherecession

Payplan

Free debt advice and solutions for those in financial difficulty.

Free debt advice and solutions for those in financial difficulty.

- Link: Payplan

- Tel: 0808 280 2816

- Opening Times: M-F 8am-9pm, Sa 9am-3pm

Local agencies

There may be a local debt help agency in your area, if so check it is non-profit or a charity, before signing up. Try entering your postcode into Money Advice Map to find free independent financial advice centres in your area.

There may be a local debt help agency in your area, if so check it is non-profit or a charity, before signing up. Try entering your postcode into Money Advice Map to find free independent financial advice centres in your area.

What they do to help

These counsellors use a variety of techniques. It could be simply negotiating with creditors to freeze your interest, you may be put on a debt management plan, where they negotiate with your creditors. You may be pointed toward an IVA (Individual Voluntary Arrangement), Debt Relief Order or even bankruptcy (not as scary as it sounds).

They will certainly show you how to prioritise the most important debts to enable you to keep food on the table and a roof over your head.

I know many people are nervous about going, and imagine it'll be like being in the headteacher's office at school, but they're not judgmental, they're not there to tell you off, just to help you sort out the problem. Talking to them may help you sleep at night.

Yet unfortunately the counselling services can be oversubscribed. If it takes time to get an appointment with them, use the info on their websites to start to plan.

The wrong people to go to...

Avoid any debt help or loan consolidation companies that advertise on the telly or in some newspapers. Their job is to make money out of you, plain and simple. While in the short term their plans will make your payments lower, in the long run it'll cost you dear. Avoid them. Don't touch them. Don’t go near them.

I think this post from the Forum explains it better than I ever can:

"We, my wife and I, are on a seven-year plan with CCCS" (the Consumer Credit Counselling Service, one of my suggested agencies – Martin) "having recently changed from a commercial debt management company after hearing Martin on Radio 2's Jeremy Vine show. The simple action of swapping to the CCCS has shaved over two years off the length of our plan as the money we were paying the management company now goes to our creditors instead! Of course, that also means a financial saving of nearly eight grand over the term of the original plans 10 year period."

This includes IVAs and debt wiping companies. While they sound good, they're only for a few people. If either is for you the debt counselling agencies should suggest it.

DIY Online Debt Crisis Plans

A variety of info and help is available online to help manage your debt problems, or check out your options before contacting one of the debt agencies above.

Step 1. Do a detailed budget

You can't even start to sort out your finances unless you've done a detailed budget, to understand where your money goes. To help first use the specially designed free Budget Planner. The aim is to show you whether you spend more than you earn, can afford what you currently spend and exactly how much you have left to repay any debts.

You can't even start to sort out your finances unless you've done a detailed budget, to understand where your money goes. To help first use the specially designed free Budget Planner. The aim is to show you whether you spend more than you earn, can afford what you currently spend and exactly how much you have left to repay any debts.

Knowing your genuine monthly outgoings will then feed into the next steps.

Step 2. Online debt help tools

Debt counsellors don't have special powers, though they are taken a lot more seriously by creditors than individuals acting by themselves. If you want to, it is possible to make your own arrangements to try and freeze interest and make special repayment plans.

Debt counsellors don't have special powers, though they are taken a lot more seriously by creditors than individuals acting by themselves. If you want to, it is possible to make your own arrangements to try and freeze interest and make special repayment plans.

In general the free help is a usually a better idea, however if you're keen to do it yourself do read the summary guide from Citizens Advice. Working through the techniques by yourself to see what's available is a useful guide, and should help you understand what the debt counsellors will do.

There are a few nice tools to help:

CASHflow. You need to set up an account with this tool via a registered debt agency (such as National Debtline) to check it's right for you, but once you're set up you can use CASHflow to agree a payment plan with your creditors. It includes template letters and a debt advisor will be able to monitor your progress and provide some support. Link: CASHflow

-

Debt Analyser. This is a quick tool from the Debt Advice Foundation, that'll help work out how much you can afford to pay back to your priority debts, eg mortgage and utilities, and other creditors. It can then create a statement of affairs and individual creditor letters if you want to write to your lenders. The tool is best used in Excel (once saved to your computer) but there is an 'Open Office Calc' version too. Link: Debt Analyser.

-

Debt Remedy. This is a tool from the Consumer Credit Counselling Service, to help you decide what action to take about your debts, based on your individual circumstances. It takes about 20 minutes to get through, but if at any point you get stuck, between the hours of 8am to 8pm Mon to Fri, you can have an online chat with a counsellor. The service is completely free and anonymous so is great if you want to ask a question in complete confidence. Link: Debt Remedy.

iMoneyManager. This is a downloadable tool that creates a financial statement and template letters for you to send off to your creditors. Link: iMoneyManager.

My Money Steps. Unless you’ve got complicated debts (eg a dispute, court proceedings) and in some cases are a small business, if you live in England, Scotland or Wales you can use My Money Steps from the MoneyAdviceTrust to find out how to deal with your debts.

After registering (it only asks for a first name and email so can be anonymous) you’re asked questions about your current situation including debts, income and expenditure, it takes around 15 minutes. You’re then given a personal debt action plan with options on what you can do, including anything urgent, you can come back to it at any time to check or update. Link: My Money Steps

If you arrange your own repayments, either with or without these tools, please add your feedback to the Problem Debts discussion to help others in this situation.

Step 3: Ask the experts a question

If you're going through the scheme alone, almost certainly you will have some questions. There are a number of ways to get expert help while doing this.

If you're going through the scheme alone, almost certainly you will have some questions. There are a number of ways to get expert help while doing this.

Ask a question in the MSE Forum. The Consumer Credit Counselling Service (CCCS) has several counsellors answering questions in our forum. You can ask an open question in the discussion thread or send a private question to one of the counsellors. You need to be registered on the forum to do either of these. Link: CCCS questions

-

Chat to a counsellor anonymously. By using the Debt Remedy tool, again from the CCCS, you can get online help (click on the 'Get Help Now' button to get into the chat function at any time) from 8am to 8pm Mon to Fri.

Become a Debt Free Wannabe

One important thing to remember about debt is you're not alone. In fact amongst the wider group of MoneySavers, this site has a specific community of people in various level of debt (from bankrupts to limited credit card overspending) all working together and supporting each other to get debt free.

One important thing to remember about debt is you're not alone. In fact amongst the wider group of MoneySavers, this site has a specific community of people in various level of debt (from bankrupts to limited credit card overspending) all working together and supporting each other to get debt free.

For support and encouragement and to post your S.O.A. (statement of affairs) to let others who are also in debt and have been through many similar issues, pick through your finances, visit the Debt-Free Wanabee Board (though for specific questions about this article itself click this link.

It’s completely free and you can be anonymous

While it is necessary to register and pick your user name, only MoneySavingExpert.com itself will have access to your e-mail - and the only reason this is needed is to stop people spamming the site. Be assured though you will never be contacted, sold anything, and your e-mail will never be passed on.

Ask a Question / Discuss

Where To Start With Problem Debts Discussion Link

Spotted out of date info/broken links?

Email brokenlink@moneysavingexpert.com to let us know

Always double check the product details before signing up to them

LINKS THAT HELP THIS SITE (all have a * in above article)

(this has no impact on product or pick - see explanation below)

N/a

Explanation (of * links)

How this site is funded. Two types of contacts are listed. The first, which all have a * within the main body of the articles, help MoneySavingExpert.com stay free to use, as they're 'affiliated links' which invisibly take you usually via affiliate linkage or commercial money sites, which then pay this site. It's worth noting this means the third party used may be named on any credit agreements. The second type doesn't help and therefore doesn't have a *.You shouldn't notice any difference, the links don't impact the product at all and the editorial line (the things we write) is NEVER impacted by the revenue - we aim to look at all available products. If it isn't possible to get an affiliate link for the best product, it is still included in exactly the same way. For more details read how this site is financed.

LINKS THAT DON'T HELP THIS SITE

(please only use if necessary)

No * Link Available: AdviceNI , BBC Moneybox , CCCS , Christians Against Poverty , Citizens Advice , Community Legal Advice , ConsumerActionGroup , Credit Services Association , Debt Analyser , Direct.gov , DSDNI , DWP , EDF Energy Trust , imoneymanager , JobCentre , Money Advice Map , National Debtline , NHS , Now Lets Talk Money on 0800 0121656 , Relate , Samaritans , Water Uk

Duplicate links of the * links above for the sake of transparency, but this version doesn't help MoneySavingExpert.com:

N/a