Taking a day to cut your bills, treating it like a job, saves many £1,000 over the year. And unless you earn £525,000+, that's the best paid day of the year.

Taking a day to cut your bills, treating it like a job, saves many £1,000 over the year. And unless you earn £525,000+, that's the best paid day of the year.

This isn't by 'cutting out cappuccinos', it's by systematically working through all bills & products to ensure you've the best deal on everything. This is a five-step plan to overhaul your finances and save £1,000s.

In this guide

Quick Links

Money Management Checklist

Watch the video guide

Courtesy of Watchdog (Jan 2010)

Radio special - Save £1,000 in a day

On 13 January 2012, Martin was on a special Jeremy Vine Radio 2 slot, telling people all about the Money Makeover technique, and loads of folks phone in with their inspirational acts...

Will it really make a difference?

Be under no illusion, a full money makeover will take a good eight or 10 hours, but it'll be worth it. In my ITV1 series Make Me Rich, I was challenged to go to families' homes and save them as much as I could in a day.

The average saving was a little over £5,000 a year; and this was before I started to say "cut back". Now, suppose by doing it yourself, you only do half as well, saving £2,500 (though hopefully you'll do better); compare that to what you earn!

The average saving was a little over £5,000 a year; and this was before I started to say "cut back". Now, suppose by doing it yourself, you only do half as well, saving £2,500 (though hopefully you'll do better); compare that to what you earn!

And remember this saving is without tax so unless you're paid £3,500 a day (just under £900,000 a year) it's likely to be the best paid day of your year!

What if I don't have the time?

Then make the time. This is incredibly important. However, if you simply can't right now and just need a quick MoneySaving hit then shimmy straight along to Step 2: Pain-free savings and you should still manage to gain serious cash.

Can I get someone to do this for me?

"Aaaarghhh!" I'm asked this all the time, and hate this question; asking it means you've missed the whole point of MoneySaving. The process doesn't just save you cash, it empowers you to understand how companies will take your cash through ignorance, apathy and inertia. Yet even if that wasn't the case, there aren't any MoneySaving advisers, the service doesn't exist, and even if it did, their cost would eat up much of the gain.

Step 1: Do you spend more than you earn?

This isn't a trite question. Unless you know the answer, we can't work out how militant the savings must be. Standard MoneySaving is about cutting your bills without cutting back; it involves changing your finances, not your life.

Yet if after that you're still spending beyond your means, there's a major problem and cutting back may be necessary too; meaning lifestyle as well as MoneySaving changes.

Of course those spending less than they earn may only need to free up wasted cash, so it stays in your pocket, not in that of big companies. This is why it's important to know where you stand.

How to find out.

There are two ways:

- The BIG danger signal.

Are you in debt? If you are, and can't answer the question, "what are your debts from?", in other words you didn't 'buy a car or a conservatory' but simply used cards or loans to fill the gap; then this sounds an ear-piercing alarm.

It means your debt comes from systematically spending more than you earn. If this is the case, no further investigation is needed, we know the answer and you need to skip straight to pain-free savings.

- Accurately assess your spending.

If you're not sure where your finances stand, you need to add it up. The specially designed Budget Planner calculates your genuine annual income and then tells you exactly how much more you spend than you earn.

Most people are shocked by the result, as many who think they're within budget month-by-month, aren't when it's done over a year. This is the start point of sorting out your cash, so spend the time to do the budget.

Step 2: Pain-free savings

The essence is simple. If you can get the same thing paying less; then do so. Yet it's not only about car insurance and credit cards. Saving money stretches to cutting childcare costs, cheaper contact lenses or checking your council tax bill. It's what this whole site is dedicated to.

Don't miss out on updates to this guide Get MoneySavingExpert's free, spam-free weekly email full of guides & loopholes

How to do it

This site has well over 100 detailed MoneySaving articles each picking the best deals. Below I've deliberately selected some that enable big and easy savings on current outgoings. Yet check every section (using the tabs at the top of the page) for your specific needs.

You can cut your energy bills and get cashback on top in minutes. Remember, it's the same gas, same elec, same pipes and safety; only the price & billing processes really change.

Read it: Cheapest Gas & Elec plus cashback

It's not about buying lower quality goods, but beating the way supermarkets hypnotise us into unnecessarily paying more for premium brands.

Read it: Supermarket Secrets: Cheaper Food Shopping

The council tax system in England & Scotland is fundamentally flawed. Many people are in the wrong band. It only takes 10 minutes to check.

Read it: Council Tax: Check your band

There's no need to pay more than £15 per month for a top home phone package and broadband combined.

Read it: Cheapest Home Phone

There's £1,000s of hidden free cash for childcare. Whether it's tax credits, "childcare vouchers" which enable you to pay for childcare from pre-tax income or free summer school places, the savings are huge.

Read it: Cut Childcare Costs

Don't assume you need to get boiler cover from the same company that supplies your gas & electricity.

Read it: Cheapest Boiler Cover

You can call abroad for free via the internet, or call almost anywhere for 1p/min via the normal phone.

Read it: Cheapest International Calls

It's possible to instantly halve the cost of calling mobile phones, without changing your home phone provider. Over a year the savings are huge.

Read it: Calling Mobiles Cheaply

If you've more or the same number of bedrooms in your house than people, you're probably better off with a water meter.

Read it: Water Meters

A simple phone call and the right haggling technique could halve your bill.

Read it: Sky & Virgin Media TV Cost Cutting

Done right and you can save hundreds with regular payments. But take your eye off the ball and you could be wasting hundreds in cash seeping from your account unnecessarily.

Read it: Direct Debit

Simply shift the debt to a new card at the cheapest possible rate.

Read it: Best Balance Transfers

Mortgage savings can be massive, and they're much easier to achieve than you might think.

Read it: Remortgage Guide and Cheap Mortgage Finding

Cutting existing loans' costs is much more difficult than mortgages or credit cards, but it's still possible.

Read it: Existing Loan Cost Cutting

Check if you've got insurance on any loans. If so it's very likely you're being ripped off. Big savings are easy.

Read it: Cheaper Loan Insurance also see Loan Insurance Reclaiming

Credit card minimum repayments are a trap to keep you permanently in debt. It's possible to escape this trap even if you can't afford to pay more.

Read it: Danger Minimum Repayments

Almost everyone with both debts and savings, is wasting a fortune. Pay off the debts and save.

Read it: Pay Off Debts With Savings

There's a white heat of competition in the mobile marketplace. Push the right buttons to stamp down the cost.

Read it: Cheapest Mobile Phones and Free Texts

You can get 6% interest or a 0% overdraft without paying a fee.

Read it: Best Bank Accounts

If you need regular prescriptions buy an annual certificate. Plus don't buy branded medicine, identical products are available at a fraction of the cost.

Read it: Cheaper Prescriptions & Medications

Never assume all banks are the same. The difference in the interest paid out is huge.

Read it: Top Instant Access Savings or Top Cash ISAs

The train ticket system is complex, but play it right and there are massive loopholes to exploit.

Read it: Cheapest Train Fares

There are lots of ways to add to your income; whether it's home-working, using the web to profit or getting paid for your opinion.

Read it: The Boost Your Income Guide

Anyone with family income under £70,000 (mainly those under £40,000) may be entitled to get benefits; ensure you're not missing out.

Read it: Benefit Check-up and Pension Boosting

Stop using debit cards, cash & cheques for spending and use a cashback credit card - you get paid each time you spend. Very profitable as long as you always pay the card off in full.

Read it: Best Cashback Cards

Employees who wear a uniform, who wash, repair or replace it may be able to reclaim tax of £12 to £56 per year. You can claim back a rebate for up to the past six years.

Read it: Work Uniform Tax Rebates

If you're struggling to repay your mortgage, and have savings under £16k, you may be eligible for state help to make the interest payments (plus other, more severe, help).

Read it: Mortgage Arrears Help

There have been millions of mistakes with tax codes, meaning a huge chunk of UK population has paid too much (or too little) tax. We've built a unique checker to help work out if you're owed

Read it: Tax Code Calculator

If you're financially savvy, and debt-free it's possible to get a 0% spending credit card, then use it instead of your debit card (always repay at least the monthly min). Then stash your salary in a top savings account to earn interest.

Read it: Stoozing: Free cash from credit cards

There are £1,000s of unclaimed grants out there for energy efficiency, homes, businesses and study.

Read it: Find all grants

The Childcare tax credit is designed to help working parents cover some of the cost of getting kids looked after, so that they still gain by working.

Read it: Childcare Tax Credits

There are over 90m old mobiles sitting in people's drawers; it takes five minutes to convert these to cash.

Do it: MobileValuer.com

A raft of tactics to help you to list auctions effectively and smash down eBay fees. Plus list automatically, profit from bizarre items you thought wouldn't sell and much more.

Read it: eBay selling tricks

If your endowment is underperforming and you weren't told this was a possibility, it was mis-sold. Send a simple letter and you may be entitled to huge money in return.

Read it: Endowment Misselling Compensation

If so then you could have been overcharged on the 'exit fee' and you can get this cash back with a quick phone call or letter.

Read it: Mortgage Fee Reclaiming

If, during the past six years, you've been hit with bank charges and are in financial hardship, you can ask for them back.

Read it: Bank Charges Reclaiming

In 2006 the OFT said credit card charges were unfairly high and providers reduced them. Thus if you had late payment fees pre-2006 it may not be too late to get them back.

Read it: Credit Card Reclaiming

It's never been easier to get your or deceased relatives' money from old bank accounts, pensions, life assurance and investments. Just click on some websites, fill in your details, and it should come to you.

Read it: Reclaim Forgotten Cash

It's possible to easily cut car insurance costs. Don't think "it's not time to renew now", you can still ditch, switch & save.

Read it: Cheapest Car Insurance

Like car insurance you can ditch, switch and save at any time. Using the full system you can sometimes get building and contents insurance for under £100 a year.

Read it: Cheapest Home Insurance

Forget the big boys, similar cover, with full service and just as quick call out times is available for a quarter of the cost.

Read it: Cheapest Roadside Assistance

Many people rightly get life insurance to protect their loved ones. Sadly banks take advantage and often charge twice as much as needed. Ditch, switch & save.

Read it: Cheapest Life Insurance

Did you get your mortgage payment insurance from your lender? If so you're probably paying way over the odds, but it's easy to save.

Read it: Mortgage Payment Protection Insurance

If you got life insurance to protect your home from your mortgage lender, you're paying massively over the odds!

Read it: Mortgage Life Insurance

Did you save big? Please report your savings

Step 3: Still spend more than you earn?

Now you've done all the main pain-free savings, your new expected monthly outgoings should be significantly lower. What to do next depends on you:

Were you already spending within your means?

If so, you should now have more money to spend, save or repay debts. However, remember things change, you need to keep on top of your finances. Today's best deal isn't necessarily tomorrow's.

Ensure you get the free weekly MoneySaving email; which includes any changes and new top deals to help you save even more.

Don't miss out on updates to this guide Get MoneySavingExpert's free, spam-free weekly email full of guides & loopholes

Yet even though you're now spending within your means; you may still be in-debt or wanting to quickly save for something specific. In that case, some of the techniques in Step 4: Painful savings may still be useful.

Were you spending more than you earned before?

We now need to know if you've brought your spending under control. This again means calculating an accurate answer based on your new expenditure levels. If you did the budget planner earlier, all you need do is change the values for areas where you've made savings. If not, then it's time to start the budget planner process.

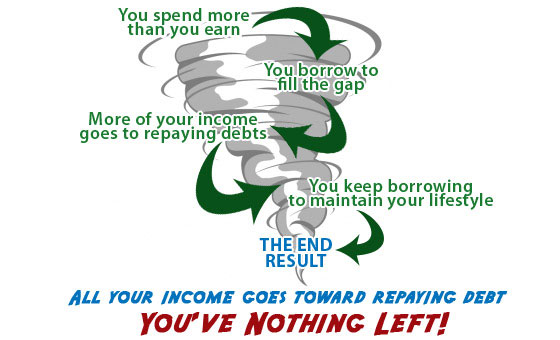

You may consider this to be a bit unnecessary, after all you've done the savings, so do you really need an accurate answer? My response is an unrelenting yes; and as I explain in many other places on the site, the reason is because of what's called a "debt spiral"; one of the nastiest, most unrelenting, life-destroying, financial problems you can have.

You may feel this is over-dramatising. Yet when there's no money left, you can't borrow more, and the creditors are asking for money back which you've no ability to repay, it touches every element of your life. The danger is what's called a 'debt spiral'. It works like this:

All this means we need to know whether you still spend more than you earn, which means filling in the budget planner. If it says you're now spending within your means... hoorah! Though you may still be in debt or wanting to save for something specific; thus you may still find some of the painful savings below useful.

Alternatively, you may consider the job is done. Yet even in that case, remember things change, you need to keep on top of your finances. Today's best deal isn't necessarily tomorrow's.

To help, ensure you get the free weekly MoneySaving e-mail; which includes any changes and new top deals to help you save even more.

Don't miss out on updates to this guide Get MoneySavingExpert's free, spam-free weekly email full of guides & loopholes

If you're still spending more than you earn; there is no option - you need to rein in your expenditure, so keep reading….

Step 4: Painful savings

These are changes that involve curtailing or changing elements of your lifestyle. It sounds horrid, but actually it can be much easier than you think. Small changes on things you do regularly, for example cutting from two takeaways a week to one, can save you £250 a year.

These are changes that involve curtailing or changing elements of your lifestyle. It sounds horrid, but actually it can be much easier than you think. Small changes on things you do regularly, for example cutting from two takeaways a week to one, can save you £250 a year.

The place to start is the Stop Spending article, which is specifically designed to challenge your spending impulses and includes The Demotivator: a tool to stop you spending what you can't afford. Yet it's all about asking yourself the right questions...

"Do you really need all your Sky TV channels? Can you make food rather than get takeaways? Do you really need the cappuccino? Why not start making sandwiches for lunch? Do you need the weekly celeb gossip magazine? Do you need a car - could you sell it? Can you get a second job? And why not stop smoking?"

You'll find many MoneySavers' top suggestions for these in the Great Ways To Cut Back Hunt. Yet it's actually about asking two questions for every element of your life... Do I need it? Even if I do need it, can I still satisfy the need, even though it mightn't be as good, in a cheaper way?

Seek help from other people in a similar boat

There are two sections of the site's Forum where you can seek help and suggestions from others on cutting back.

- Debt-Free Wannabe.

This Forum Board is dedicated to paying back debt, many people have already turned around huge deficits to pay back all they owe. As such the regulars in there have redefined the term "necessity"; for them it isn't the creature comforts we all need, but the bare minimum requirements.

So go into Debt-Free Wannabe and post your 'Statement of Affairs' detailing everything you spend money on and how much (without giving away any personal details), and then be prepared to have your habits torn apart; but all constructive ways to cut your outgoings.  MoneySaving Old-Style.

MoneySaving Old-Style.

This Forum Board has its own philosophy, separate to the rest of the site all about thrift. Rather than just saving money it's about cutting back, being less consumerist and more environmentally friendly, making, cooking and growing things rather than buying them.

If you want to know how to clean your house using only white vinegar, get stains out without Stain Devil, cook for a family of four for under £15 a week, make your own clothes, then MoneySaving Old-Style is for you. There's also the Thrifty Ways for Modern Days book (all proceeds to charity) based solely on the wisdom of this board.

What if all these cut backs still aren't enough?

My first answer is "try a little harder". Many people think they've cut back on everything, but there are still little things that could go and as the Demotivator shows, over time the little things add up.

If things are so serious, it's very likely you're also in significant debt. If that's the case and you can't afford to make even the minimum repayments on your standard outgoings; you need to urgently take action. A range of non-profit debt counselling agencies can help you. For more on this read Debt Problems: What to do and where to get help.

Piggybank budgeting

Budgeting isn't just a way of calculating your expenditure, it's also a way of controlling it. One of the ways to do this is to start living with a philosophy that says "what can I afford to do?" rather than "how can I do what I want for less?"

To help with this I've designed a special 'piggybank budgeting' technique, which helps you easily allocate and manage your money, a detailed explanation is in the Piggybank Budgeting section of the main budgeting article.