Cashback websites pay you when you click through them, go to retailers or product providers and spend. You can make £100s a year using them correctly.

This is a full guide to the top cashback sites and some serious warnings to protect yourself. It includes the unique Cashback Sites Maximiser tool which finds who pays most for what.

In this guide

| Tweet | mse.me/cashback |

How do cashback sites work?

If you want to buy something online, or sign up to a finance product, rather than go direct click to the company via a cashback site and you get paid. The amounts range from pennies for retail items to, at the very top end, over £100 for some insurance policies.

The site will require you to be a member, which should be free (if not avoid it). Once you are, simply log-in and check if the company you want to buy from is listed, eg, Argos or Tesco Direct and if it is, click the link on the cashback site to go to that online retailer.

Your visit is then tracked and if you transact, once it's processed, an amount is put into your cashback site account - which you can then opt to withdraw once you're over a set threshold.

| Cashback sites: Typical payments | |||

|---|---|---|---|

Dixons |

3% of product's cost |

Tesco Clothing |

5% of product's cost |

|

Aviva Home Insurance |

£50 per policy |

Game |

4% of product's cost |

|

Santander Loan |

£40 per loan |

Marks & Spencers |

5% of product's cost |

| Correct as at September '11 | |||

Why do they pay out?

Cashback sites take advantage of the way commercial payments from one website to another work. They use special links called 'affiliate links' which allow the retailer to track where the traffic is coming from - and then pay the cashback sites for the lead.

This is a common system, used by many sites which send people through from comparison results, unique content (as MSE does) or use links as advertising promotions. Instead of using content, cashback sites simply drive traffic by giving their users some of the money they're repaid.

The amount of money depends on what's spent on and the commercial deal, so can vary widely - it may be paid per click, per transaction, per application, or per accepted applicant.

The technology's rather simple: ready-made paying links are available from links warehouses such as Trade Doubler or Affiliate Network.

Big cashback sites also have direct relationships though, so they can offer a wider range of providers, earn more or negotiate their own exclusive deals.

The 5 MAJOR Cashback Safety Rules!

Don't use cashback sites without reading these!

While cashback sites can and do generate some users £100s a year, it is very important you understand there are substantial pitfalls in using these sites and you need to understand them BEFORE you begin.

Think of cashback as a bonus only - it's not guaranteed

Tracking problems occur for many people using cashback sites - there are times when you'll expect to be paid and won't be. One recent study showed 40% of cashback users don't get paid and while we think those stats are overblown, it shows this is an issue.

If you do have problems getting paid remember you need to contact the cashback site directly, not MSE, we just tell you about the top paying sites.

However, it's not just problems with cashback sites themselves. They get the money from the retailers or product providers and disputes in this area are common, so sometimes they're not paid.

Plus, unlike when you get cashback from a retailer, which is part of the product t&cs;, here you've far fewer rights - therefore the best way to approach this is to consider cashback as a bonus if you get it, but don't allow it to drive your purchasing decisions.

The cashback isn't yours until it's in your bank account

Never count the cashback until it's in your bank account. This isn't just because of tracking and processing issues, cashback sites are easy to set up and many are small companies which can (and some have) go bust.

If it happens you've little protection - you may count as a creditor to the company but in all likelihood your money will be gone.

Never store cash in a cashback site - withdraw it ASAP

Most cashback sites set a threshold which you must earn before you can withdraw cash. The best practice is to withdraw as soon as you hit that level.

Never leave cash building up when you can take it out, not only are you missing out on interest but if the company goes kaput or changes its payout policy then the money's lost.

Focus on the cheapest deal - not the cashback

It's easy to be seduced by £50 cashback for signing up to an insurance provider or an extra 5% discount when shopping. Yet never let the cashback tail wag the dog. Not because of the warnings above, but simply because it may not actually be cheapest for you.

If the cashback doesn't happen, you need to be left with the best deal anyway and it might not be the cheapest without it.

Deal Deirdre wants a telly. A cashback site brings up Asteroid Electricals, offering 5% cashback; meaning a £20 discount off a £399 TV. Yet two minutes using a shopbot would've found her the same TV on sale at £299.

Borris Bargain wants car insurance. Borris Bargain spots the Suffolk Mutual' £100 cashback offer on a cashback website, so grabs its £540 policy via the site. Yet if he'd used car insurance comparison websites he'd have found Hippo Insurance at £370. As Hippo is also on a cashback site he could've returned to get a further £25 off.

This is especially important for bigger financial transactions where the cost of making a mistake can dwarf the cashback received. Thus read the relevant article first, eg, Best Credit Cards, cheapest insurance products, top bank and savings accounts.

Consider clearing your cookies

Cashback sites track your visits by putting cookies (little bits of info that identify you to a specific retailer) onto your computer. Many other sites, eg, comparison sites also add their own cookies.

So always ensure when making your purchase that you click through to a website from the cashback site and not from anywhere else as the rule's normally 'the last cookie win's'. To be doubly safe, if you're expecting big cashback, clear your computer's cookies first to ensure the cashback is tracked.

More on deleting or controlling cookies is available at AboutCookies.

| Tweet | mse.me/hayfever |

The Top Paying Cashbac k Sites

Don't think all cashback sites pay you the same, many pay out 50% or less of what they get paid - commonly those that use newspaper, magazine or other website link-ups to gain traffic.

We checked ten of the biggest cashback sites for the top rates and feedback.

The best sites are 100% payers which ostensibly give all the money they earn to you and we focus on those.

Find out how they do it)

In 2005 Quidco launched the first 100% cashback site. On the surface the system doesn't seem sustainable, yet actually it's a very clever way to work that has built it, and fellow 100% operator Topcashback, a majority share of the cashback market.

These sites do exactly what they say on the tin - they give you 100% of the cashback allocated to you and that means you get a bigger payout, and it's been hugely profitable for many, yet that doesn't mean they don't have income ...

-

They may keep the first fiver or tenner a year. Quidco does this; it retains the first £5 you earn each year. There's nothing wrong with this, it's far better than charging a membership fee up front. Of course it means it earns £5/year from every active member.

-

They get 'bonuses'. Let's say a retailer pays the cashback site 5% of every transaction, well of course all that money is then passed to the individuals. Yet many retailers also pay affiliates bonuses - eg, if £10,000 of sales are made through you we'll pay a bonus. As those aren't and can't be allocated to individuals the cashback sites keep them.

TopCashback The overall winner

Both on user feedback and overall payouts TopCashBack* is the winner. It pays out 100% of the cashback it receives plus it has no annual admin fees.

MoneySavers on average rated it: 4/5 |

|

"Minor glitches, got all / vast majority of my cash through." |

Last Updated: 5 September 2011 |

Quidco In second place

In second place is Quidco*, which has very similar payout levels. The two sites commonly compete on exclusives, but Quidco loses out due to a £5 per year admin fee.

MoneySavers on average rated it: 4/5 |

|

"Minor glitches, got all / vast majority of my cash through." |

Last Updated: 5 September 2011 |

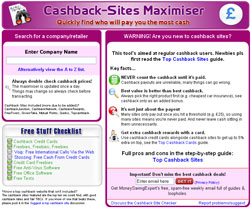

Advanced users only Speedily find the max cashback

Alternatively if you use cashback sites regularly you can use the free MSE Cashback-Sites Maximiser tool to compare how much the top sites pay for each retailer/product provider, thus enabling you to get the best deal every time.

However here there are specific warnings to be aware of if using this tact.

Don't spread your cashback too thin

Most cashback sites only pay out once you hit a certain threshold, so for small transactions trying to maximise the cashback may mean you're never paid. Yet if going for an insurance product or similar which is likely to pay over the threshold in one hit, then go for the highest.

Most cashback sites only pay out once you hit a certain threshold, so for small transactions trying to maximise the cashback may mean you're never paid. Yet if going for an insurance product or similar which is likely to pay over the threshold in one hit, then go for the highest.

Check whether you'll get all the cash

All sites which charge an up front joining fee are barred from the Maximiser. Yet some of the cashback sites do charge an annual fee out of any money you've earned; it's worth remembering this if using multiple sites.

Be careful about reliability

Be careful about reliability

The cashback sites maximiser is simply an automated list of what the sites say they pay, so always double check you will actually get that cashback - technology is never perfect.

Also we include some smaller sites, and as explained in our warnings, that comes with an implicit risk. Plus while it may offer the best payout there can be reliability issues.

Cashback successes

Plenty of MoneySavers have had huge success using casback sites. Here are a couple of stories:

Have been paid out £1,200 + from TopCashback, 110% all round ace from my experience.

On track to clear over £200 in 9 months with Topcashback, don't know why I've not used them before.

How to boost your cashback by £100s more

There are three ways to boost your cashback:

Earn in-store cashback

If you're shopping at Debenhams, Sports Direct, NCP and more, you can get up to 5.4% back on in-store spending with Quidco*.

Simply register your credit or debit card with Quidco, spend on it and your purchase is tracked. Once it's processed, an amount is put into your cashback site account. You can then opt to withdraw once you're over a set threshold.

It says card details are encrypted so no-one can access them. If you don't already have a Quidco account, you need sign up before you can earn, and do note that it takes the first £5 you earn each year as an admin fee.

Where can you get in-store cashback? Retailer Amount Retailer Amount Debenhams 2% Sports Direct 2.25% Halfords 4.5% Blockbuster 2.25% Country Casuals 4.5% Cineworld 4.5% Viyella 4.5% NCP 4.5% Austin Reed Up to 5.4% Direct Golf UK 1.35% Feather & Black 2.25% Little Chef 4.5% Correct as at 6 September June 2011 Try the iPhone app

If you've an iPhone, Quidco's free iPhone app uses GPS technology to pinpoint shops paying in-store cashback near where you're standing. You don't need the app to get cashback, but it's a handy addition.

The app also pays you 10p-25p a time to walk into shops with your iPhone, up to a possible £30/year. Read a full guide to how the Quidco app works.

-

Cashback credit cards: 5% spending boost

Cashback credit cards are a form of reward scheme, yet rather than giving points, you get cold hard cash, tax-free, every time you spend on the card. Although for this to work, always ensure you pay it off in full so you're not charged interest.

There's no conflict between cashback sites and cashback cards, as when you spend money, whomever it's spent with, the cashback credit card gives you some of it back. The top card pays you up to 5% back on your spending. See the Cashback Credit Cards guide for the top payers.

Make free cash from cashback sites

Cashback sites sometimes pay out even when you don't spend money, thus you can make free cash. This is because the advertisers that pay out to cashback sites aren't specifically targeting them; the cashback sites have just grabbed advertising links available to normal websites.

The safety rules above still apply here though.

Cashback loopholes - they pay more than you pay them.

Some companies pay more cashback than the product itself costs. For example, in the past, cashback sites paid up to £25 for Cahoot savings account applications, yet this can be opened with just £1.

Also common are magazine company offers paying up to £3-ish for you to take free trials. These deals often pop up on the Shop But Don't Drop Forum board.

There are two warnings with this particular method though. First, be careful when applying for financial products, especially bank accounts, credit cards and loans. Each application adds a search on your credit file, which potentially diminishes your Credit Score.

Secondly each cashback site has its own rules for members and they may ban you if they think you're abusing the scheme, as, if too many people do this with specific products, they'll lose their links due to a bad ratio of people spending.

Cash for clicks: earn up to £20 a month.

Fiddly but lucrative, the main payouts occur when you click on shopbots, such as The High Street Web, and do a comparison. Yet to make any real money with this, you need to do it every day.

Click through to a specific retailer via a shopbot which you go to from a cashback site and you'll usually earn 2p to 4p for the click (not as complex as it sounds, eg, go to Topcashback* , then click on High Street Web, do a search and click through to a retailer's site). To speed up your daily clicking routine it's worth setting your computer to remember log-ins and passwords.

Do this every day, at all the sites and the cash stacks up, though many cashback sites limit the number of daily paid clicks. However, nothing restricts you from doing the same thing on a number of cashback sites. It's possible to make 6p/day per site from doing this which adds up to over £20 a month.

The more sites you do this through the longer it takes, but the more is available; on top of Quidco*, Giveortake and Free Fivers, other sites include Myshoppingrewards and Loyalty Shopper.

Cash for clicks with Pigsback.

Slightly different to the other cashback sites, Pigsback pays you in high street gift vouchers (like John Lewis or Waitrose) when you click on links from its advertisers. Each week, special adverts (highlighted in the middle of your screen as your featured offers) appear on your homepage. Click these and you'll get ten points (worth around 3p in rewards). Systemically click these links once a week and it's possible to make £100s a year.

To make sure you're offered the most special adverts, tick every category of interest when you sign up. You can also enter daily quizzes to win extra points. MoneySavers very kindly post the answers in the Pigsback thread.

This is nowhere near as lucrative as it was at launch, as points are worth less so it takes longer to earn vouchers, but it's worth taking a punt if you have the spare time.

Survey sites: Make money from giving your opinion

On a similar theme, it's possible to earn £100s a year, without any special skill or talent, by stashing cash from filling in online surveys. For a detailed guide, including the best survey sites to try, see the Survey Sites guide.

For further tips and hints go to the

Cashback Sites' Free Cash Discussion Centre

Return on £300 spending (1) |

Return on £500 spending (2) |

Cashback on five financial products (3) |

Yearly fee |

|

| Topcashback |

£16.35 | £27.25 | £233 | 0 |

|---|---|---|---|---|

| Quidco |

£16.35 | £27.25 | £203 | £5 (4) |

| Fat Cheese |

£15.30 | £19.75 | £132 | £5 (4) |

(1) £30 each at 10 major online retailers per year (2) £50 each at 10 major online retailers (3) Five products at five major providers (4) The first time you're paid out each year £5 is deducted. Correct at Nov 2010 |

||||

Ask a Question / Forum Discussion

Spotted out of date info/broken links?

Email brokenlink@moneysavingexpert.com to let us know

Always double check the product details before signing up to them

LINKS THAT HELP THIS SITE (all have a * in above article)

(this has no impact on product or pick - see explanation below)

Giveortake , Quidco , TopCashBack

Explanation (of * links)

How this site is funded. Two types of contacts are listed. The first, which all have a * within the main body of the articles, help MoneySavingExpert.com stay free to use, as they're 'affiliated links' which invisibly take you usually via affiliate linkage or commercial money sites, which then pay this site. It's worth noting this means the third party used may be named on any credit agreements. The second type doesn't help and therefore doesn't have a *.You shouldn't notice any difference, the links don't impact the product at all and the editorial line (the things we write) is NEVER impacted by the revenue - we aim to look at all available products. If it isn't possible to get an affiliate link for the best product, it is still included in exactly the same way. For more details read how this site is financed.

LINKS THAT DON'T HELP THIS SITE

(please only use if necessary)

No * Link Available: Cashbacking , Free Fivers , Loyalty Shopper , Myshoppingrewards , Pigsback

Duplicate links of the * links above for the sake of transparency, but this version doesn't help MoneySavingExpert.com:

Giveortake , Quidco , TopCashBack