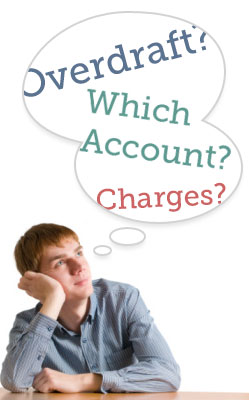

0% overdrafts, freebies including cash - big banks love enticing new students with goodies. Don't just take the first, though. This is a 2012/13 guide to bagging the most, whether you're a new student or you're already there.

In this guide:

The five BIG facts

Go for the biggest 0% overdraft deal possible

Most students will need an overdraft, so make sure you're not getting charged for it. Aim to get the biggest guaranteed amount that lasts as long as possible.

Be wary of banks offering bigger overdrafts than our top picks - some give 'guaranteed' amounts, others 'up to' amounts - so ensure you're comparing like with like. However, you must ask for the extensions each year, even on guaranteed limits - they're not applied automatically. NEVER go beyond your 0% limit or you'll face nightmare bank charges. If you're desperate, get the bank's permission to extend your limit.

Never go over your overdraft limit

This isn't a rule just for students, it's a rule for life. The game changes totally if you go beyond your overdraft limit - charges shoot up and you can be caught in a vicious cycle that's tough to ever escape from.

If you're struggling, at least talk to the bank. Try to agree an extension but remember, you are likely to be charged interest, up to a huge 24% AER. It's always far better to plan and budget to avoid this.

If not, or if you go over without permission, the charges can be enormous - up to £25 per transaction (so a shopping trip spending £30 in five debit card transactions could see you facing £125 of charges!) - beware! More info in Bank Charges Compared.

Beware, you will be credit scored

When you apply for any debt product, including a bank account with an overdraft, the lender will credit score you. This is to decide how desirable a customer you are based on behavioural predictions from all your prior financial data.

As a student, it's likely there will be very little data on you, which makes credit scoring very difficult. Sadly this can leave some students rejected due to ridiculous anomalies, and there may be no rhyme, reason or solution to this. Read the Credit Scoring guide.

DON'T base your choice on the closest branch or ATM

Just because there happens to be a particular bank on the campus you'll be going to, or a conveniently located cashpoint nearby, DOES NOT mean you should choose an account with them.

You can withdraw cash free of charge from any bank's ATM and almost every bank gives online access. Branch location has little relevance for able-bodied students. To compare, examine what's on offer and go for the best deal.

After graduating, switch to a top graduate account

You'll be pleased to know that for at least a year after finishing your course, you're still eligible for preferential terms, including 0% interest overdrafts, allowing you to gradually pay off the debt.

Switch to the Top Graduate Account to continue getting the benefits.

Student accounts: The basics

-

What is a student account?

What is a student account?Student accounts are bank accounts made for those in higher education. They let you pay money in and out, and offer additional benefits such as an interest-free overdraft.

-

You'll get a debit card, which allows you to pay for things in shops and online without the need to withdraw cash. Read Who Counts As A Student? for further details on who is eligible to open a student account.

What is an overdraft?

An overdraft facility allows you to spend more money than you have in your account, up to a certain limit. Student accounts provide a set level of overdraft interest-free for the duration of your course.

Remember the bank is just lending you this money. It will need to be paid back, so don't get too comfortable. Always keep in your mind that's it's not actually yours, it's the bank's.

-

It costs nowt... UNLESS you exceed your overdraft

The cost of banking is measured in terms of interest rates and fees. Interest is the cost of borrowing money (or the reward for saving it). So 5% interest on savings means you earn £5 per £100 per year on the cash.

All of our top pick accounts provide an agreed interest-free overdraft limit, and anything up to that will not be subject to fees or interest - good news.

However, this is all provided you stay within your overdraft limit. Exceed it and doing so can cost up to £25 per transaction plus interest on top.

You'll need Ucas confirmation to open an account

Usually, to be accepted you'll need a Ucas confirmation letter offering either a conditional or unconditional offer. As soon as you've got this, you can open an account, allowing you extra time to make full use of the account benefits before the start of term.

Make sure you've got the right ID

As with all bank accounts, you'll need proof of address and who you are. This can include: passport, birth certificate, current UK photocard driving licence or full UK paper licence.

Existing students can switch to grab same deals as freshers

Existing students can switch their account to get the same terms as others in the same year of study. If you're a second or third year student, be sure to check the new account at least matches what you're already being offered.

For more details, see the top accounts below.

Max the gain, then ditch & switch after uni

Banks know most customers remain loyal. If they get you now, they can make serious money out of you for a long, long time.

However, savvy students can take advantage. Choose the right student account, max your gain from it, but don't let their short-term bribe buy you for life. Grab what's on offer, then after uni ditch and switch to the Top Graduate Account then the Top Bank Account.

The overdraft cash ISN'T yours, but you CAN repay gradually

You should be aiming to pay off the overdraft before the the 0% period ends. To help, switch to one of the Top Graduate Accounts once uni is over to extend the 0% overdraft for up to three years. The limit you get will reduce each year, allowing you to gradually pay it off before the interest-free period ends.

When the interest-free period ends, any remaining overdrawn balance will be subject to interest and charges, some of which are huge. Work out exactly how much you'll need to clear each month to have it paid off by the end of the 0%, and stick to it.

After the graduate account, your bank will transfer you to their regular bog-standard bank account. See bank accounts for the top picks.

Check how much money you'll have coming in.

If you're going to university in 2012 or are currently studying, funding is obviously a key issue. Make sure you're aware of the loans and grants available to you and plan accordingly. Also see our guides to Student Finance and Student Loans 2012.

Best buys: Top student accounts 2012-13

The high street banks compete in a red-hot battle, publishing ever bigger overdraft limits, then sneakily not allowing all students to have them. The key is whether the overdraft is 'guaranteed' or 'up to' - the latter means it's just a reported maximum. All accounts require you to pass a credit score.

-

Biggest 0% overdraft

- The Co-op: GUARANTEED £2,000 by year 3

-

Up to £3,000 Overdraft

- Halifax: £1,000 guaranteed initially

The Co-op Bank - £2,000 0% overdraftHighest GUARANTEED limits, plus good customer service

- In-credit interest: None

- Arranged overdraft cost: 9.9% EAR.

- Unarranged overdraft fees: 18.9% EAR plus £15 unpaid item fee (max £150 per quarter).

- 0% overdraft: Year one: £1,400 Year two: £1,700 Year three: £2,000

The highest guaranteed overdraft limit comes from the ethical Co-operative Bank. Successful applicants are allowed a £1,400 0% overdraft in year one, £1,700 in the second year and £2,000 in the third (as long as you pay in your student loans, and don't incur charges). To get the increases, you must ask at the beginning of each year.

Biggest GUARANTEED 0% overdraft

Any agreed borrowing over the limit costs a reasonable 9.9% APR. But if not agreed, the rate jumps to 18.9% plus big charges on top, so don't do it. If you apply for this, please let us know your experiences and any problems getting the full overdraft limit: Co-op feedback.

The Co-op doesn't have an official graduate account, but you can keep the student 0% overdraft for a year after graduation - though other graduate accounts are likely to beat it.

| Customer services poll (in credit and overdrawn) |

||

|---|---|---|

| Great | 74% | |

| OK | |

19% |

| Poor | |

7% |

| Date: Feb 2012 | Voters: 478 | ||

Customer service feedback

In our February 2012 poll of the top nine banks, Co-op came second with a big 74% of customers who voted saying they got great service. The Co-op has consistently come second in our customer service polls.

Ethical rating: The Co-op is Ethical Consumer's top pick for its campaigning brand. The score isn't great at 7.5 (out of 20), though, as it's lowered by Co-op's retail arm.

Halifax: Highest 'UP TO' overdraft limits.0% overdraft up to £3,000, though likely you'll get less

- In-credit interest: 0.1% AER

- Arranged overdraft cost: 7.2% EAR.

- Unarranged overdraft fees: 24.2% plus monthly fee of £28 and additional fees up to £20.

- 0% overdraft: All years: £1,000 initially, up to £3,000 (not guaranteed)

The Halifax student account gives overdraft limits of 'up to' £3,000, yet this is NOT guaranteed. Initially, you'll be given £1,000. You must then ask for further increases although the feedback from last year tells us it's not likely to go higher than £1,000 in year one.

Highest potential overdraft limit, but NOT guaranteed

Never EVER go over the interest-free limit or you'll be stung with rates up to 24.2% AER plus a monthly fee of £28, and additional fees up to £20.

Those that want to take a punt on getting a higher limit in the future could try one of these, but feedback from previous years shows very few people got even close to the the limit. If you apply for this, please let us know the size of the overdraft you get: Halifax feedback.

| Customer services poll (in credit and overdrawn) |

||

|---|---|---|

| Great | |

33% |

| OK | |

46% |

| Poor | |

21% |

| Date: Feb 2012 | Voters: 715 | ||

Customer service feedback

In our February 2012 poll of the top nine banks, Halifax showed a decline from previous votes, with 33% of in-credit customers rating it great (previously 42%). 21% rated it poor, worse than the August 2011 result of 15%.

Ethical rating: Halifax has a fairly low score of 4 out of 20 from Ethical Consumer.

Alternative: HSBC

- In-credit interest: 2% AER

- Arranged overdraft: Can only borrow up to £3k

- Unarranged overdraft fees: return fees of up to £15.

- 0% overdraft: All years: £500 initially, Up to £3,000 (not guaranteed)

The HSBC account also shouts loudly about a maximum interest-free overdraft up to £3,000. You must then ask for further increases yourself. The feedback from last year tells us it's often only up to £1,000 by the end of year one.

If accepted, you'll initially get just £500,. You must then request further increases, but you won't be guaranteed to get the full amount. We welcome your feedback, detailing if you were accepted and the overdraft limit you were offered.

Also, as an added bonus, the account pays 2% interest on the first £1,000 credited, but only in your first year of study.

| Customer services poll (in credit and overdrawn) |

||

|---|---|---|

| Great | |

42% |

| OK | |

40% |

| Poor | |

18% |

| Date: Feb 2012 | Voters: 561 | ||

Customer service feedback

In our February 2012 poll of the top nine banks, 42% of HBSC customers (down from 45%) voted that the customer service they received in the past six months was great, with 40% voting ok (previously 35%).

Ethical rating. HSBC has a low score of 2.5 out of 20 from Ethical Consumer.

Nine high street banks offer student accounts, each with varying overdraft limits, incentives and terms & conditions.

Compare student accounts Check up to three at a time to compare below

| Account Name | ||||||||

|---|---|---|---|---|---|---|---|---|

Student Additions |

Student Account |

Student Current Account |

Student Current Account |

Student Bank Account |

Student Account |

Student Account |

Student Royalties |

Student Account |

| Eligibility criteria (plus min age 18) | ||||||||

In full-time higher education in the UK, studying for a degree/degree-equivalent or post-graduate course. Pay your main source of funding into the account. Permanent UK resident. |

UK citizen or UK resident for a minimum of 3 years. Over 18 years and in full-time higher education. Must make an initial deposit of £300. |

Must have a confirmed place at a Higher Education Institution and going to study for a degree or HND course. Main source of funding must be paid into account. |

Min 18 years, UK national studying full-time min 3 years at degree or equivalent. Letter of confirmation from university is required. |

Min age 17, resident in UK/channel Islands/Isle of Man for min. 3 years, must not hold any other student account. Must have proof of entry onto full-time higher education course. |

Customer must be 17 or over, have lived in the UK for the past three years and be studying on a full time course that is at least two years in duration or on a one year access course leading onto a full-time degree. |

1st year undergraduate

Student Accounts are available only to permanent UK resident students (min 3 years) who are completing: (a) a full-time undergraduate higher education course of at least two years duration; or (b) a full-time postgraduate course, at a university or college of higher education in the UK. Unconditional letter of acceptance required as proof of student status. |

1st year undergraduate

Student Royalties Accounts are available only to permanent UK resident students (min 3 years) who are: (a) a full-time undergraduate higher education course of at least two years’ duration; or (b) a full-time postgraduate course, at a university or college of higher education in the UK. Unconditional letter of acceptance required as proof of student status. |

A UK citizen or resident for a minimum of 3 years, over 18 and in full-time higher education. Must make an initial deposit of £300. |

| Sign up/other incentives | ||||||||

Personalised debit card. |

N/A |

N/A |

Personalised debit card. |

N/A |

3 year NUS Extra Card. One-off £75 discount on STA holiday. |

Free student discount card and £100 off ASUS laptop. |

ALL customers: 25% off selected gigs. £100 off ASUS laptop |

N/A |

| Minimum interest free overdraft limits | ||||||||

Year 1 |

||||||||

Up to £2,000 |

£1,400 |

£1,500 |

Up to £3,000 |

Up to £3,000 |

£1,500 tiered in the first year: £500 for the first 6 months £1,000 in months 7 to 9 £1,500 after that |

Up to £1,000, tiered by term; £500 limit in first term, £750 limit in second term, £1,000 limit in third term |

Up to £1,000, tiered by term; £500 limit in first term, £750 limit in second term, £1,000 limit in third term |

£1,000 |

Year 2 |

||||||||

Up to £2,000 |

£1,700 |

£1,500 |

Up to £3,000 |

Up to £3,000 |

Up to £1,500 |

Up to £1,250 |

Up to £1,250 |

£1,400 |

Year 3 |

||||||||

Up to £2,000 |

£2,000 |

£1,500 |

Up to £3,000 |

Up to £3,000 |

Up to £1,500 |

Up to £1,500 |

Up to £1,500 |

£1,800 |

Year 4 |

||||||||

Up to £2,000 |

N/A |

£1,800 |

Up to £3,000 |

Up to £3,000 |

Up to £2,000 |

Up to £1,750 |

Up to £1,750 |

£2,000 |

Year 5 |

||||||||

Up to £2,000 |

N/A |

£2,000 |

Up to £3,000 |

Up to £3,000 |

Up to £2,000 |

Up to £2,000 |

Up to £2,000 |

N/A |

| Interest Free Average | ||||||||

3 Year Course |

||||||||

Up to £2,000 |

£1,700 |

£1,250 |

Up to £3,000 |

Up to £3,000 |

£1,500 |

Up to £1,250 |

Up to £1,250 |

£1,400 |

5 Year Course |

||||||||

Up to £2,000 |

N/A |

£1,510 |

Up to £3,000 |

Up to £3,000 |

£1,700 |

Up to £1,500 |

Up to £1,500 |

N/A |

| Interest free limits guaranteed or case by case? | ||||||||

Subject to application and status |

Guaranteed |

If application is successful they will be eligible for the overdraft tiers depending on their year of study. |

£1000 overdraft will be guaranteed upon account opening. Further increments will need to be applied for. Credits of £500 per quarter will be required to consider extension of overdraft. Overdraft limit will be increased over time and based upon account conduct. |

Guaranteed at least £500 upon opening of account. All overdraft requests are subject to status and assessed on an individual basis. |

No, case by case. |

Guaranteed however customer is expected to use account as main current account by: Depositing at least £750 every 6 months and making at least 3 debit transactions every month. |

Guaranteed however customer is expected to use account as main current account by: Depositing at least £750 every 6 months and making at least 3 debit transactions every month. |

Guaranteed |

| Agreed overdrafts beyond the 0% limit | ||||||||

8.9% above the interest free limit, up to a max of £3,000 |

9.9% |

0% |

7.2% |

Can only borrow up to £3,000.

|

8.21% |

0% |

0% |

9.9% |

| Unauthorised overdraft rate & fees | ||||||||

£22 fee every five working days your account is in the 'Personal Reserve', until account is credited to clear the reserve. You'll be advised of your personal reserve limit once an application is successful. Any payments debited from the personal reserve will be honoured. £8 per transaction outside 'Personal Reserve', max 5 per day. |

18.9%, unpaid items £15, max £150 per quarter. |

£5 per day, max 10 days per month. Paid item fee: £5 Unpaid item fee: £10 |

24.2%

£28 fee per month |

Returned items (inc. cheques, direct debit, standing orders): Up to £10 - no charge. Up to £25 - £10 per item. £25 plus - £25 per item. |

8.21%

£10 buffer and a grace period until 3.30pm to pay and avoid overdraft fees.

Monthly fee: £6. Returned item fee, £10. Daily fees: Up to £10 - no charge Up to £25 - £5 £25 plus - £10. |

0% Unpaid fee, £6 per item greater than £6 (max £60 per charging period). |

0% Unpaid fee, £6 per item greater than £6 (max £60 per charging period). |

18.9%

Unpaid items £15, max of £150 per quarter. |

| In-credit interest rate | ||||||||

0% |

0% |

1% AER on balances up to £500 no interest paid on balances above £500 |

0.1% |

1.5% above base rate on balances up to £1,000 (in 1st year only). 0% on all other balances |

0% |

0% |

0% |

0% |

| Transfers from other banks and get this year's deal? | ||||||||

|

Yes

|

Yes, the overdraft will be in line with year of course |

Yes but the student must switch their existing student account to Santander using the Account Transfer Service for a guaranteed £250 interest free overdraft. Once account has been credited with £500, correct level of overdraft will be given. |

Yes. Overdraft will be based on personal circumstances |

Yes, subject to status, assessed on an individual basis. |

Yes. This will be based on the year of their study |

Yes, but they won't be eligible for the free incentives (unless in 1st year). Overdraft limit is based on year of course |

Yes, but they won't be eligible for the free incentives (unless in 1st year). Overdraft limit is based on year of course |

Yes, the overdraft will be in line with year of course |

| Do t&cs; outlaw opening a student account with another bank | ||||||||

No |

Yes |

No but they can't have more than one Santander Current Account |

Yes |

Yes |

Yes |

No, but must use the account as main bank account.

They reserve the right to remove 0% rate. |

No, but must use the account as main bank account.

They reserve the right to remove 0% rate. |

Yes |

| Anything else? | ||||||||

| 10% discount on Student Possessions Insurance (until 31 Dec 2012) and Student Travel Insurance (until 30 June 2013). |

N/A |

N/A |

N/A |

25% off Lonely Planet Travel Guides. |

N/A |

N/A |

N/A |

N/A |

It's also worth remembering that next year, even better accounts are possible so it's worth checking whether you should switch. All next year's top deals will be in the free weekly email.

| Tweet | mse.me/students |

Don't need an overdraft? Maybe try stoozing...

For that rare student breed, the ones who are always in-credit, there are very few choices (even if you're occasionally overdrawn, go for the top overdraft deal).

For that rare student breed, the ones who are always in-credit, there are very few choices (even if you're occasionally overdrawn, go for the top overdraft deal).

No student accounts pay any significant interest if you're in credit and most top standard accounts require an income over £14,000 to open.

The prime option is get a normal student account, and if you've got any spare cash, dunk it in the top saving accounts. But there is a way to boost even that.

How to stooze your student account

Please don't even read this unless you're an anally-retentive financial superhero. The consequences of getting it wrong can be a real problem and with low savings rates the current returns just aren't that good anyway.

Those always in credit could PROFIT (provided they're financially disciplined) by opting for the account with the biggest and longest lasting interest-free overdraft and using a budgeting technique we call 'current account stoozing' (see the Stoozing guide for a full definition of the word).

Once you get your account, take cash out of it and plop it into a top-paying instant access saving account (see Top Savings and Cash ISA guides) leaving yourself reasonably near, but never over your overdraft limit. Make sure you also manage any changes in limits and leave enough room to do your normal spending.

As a result, you're earning interest on money the bank lends you for free. Done right, this can add around £120 to a student's coffers over the length of a course. Similar tricks are possible with student loans (see the Student MoneySaving article). However, this isn't an excuse for spending or borrowing more. If you're not financially disciplined please DON'T try it.

Do a budget the right way

It's a mantra parents push at their student offspring all the time. "You've got to do a budget young Johnny, it'll all go to hell if you don't, please do it Johnny, please..."

Yet "do a budget" is a meaningless phrase unless you understand your income.

With people who work it's easy:

You shouldn't spend more than you earn.?

But when it comes to those going to university:

Students shouldn't spend more than they... ??

That's the big question that's never specified. Martin has a rule of thumb on it.

Add up student loan + grants + employment earnings + money from family, and that is your income. That's the amount you should try to budget to spend less than.

While 0% overdrafts are very useful and should help with cash-flow issues while you're a student, they're never part of your income. Always remember an overdraft is a LOAN and must be repaid (its rate will jump once you graduate).

Don't miss out on updates to this guide Get MoneySavingExpert's free, spam-free weekly email full of guides & loopholes

PizzaExpress 3 courses £13

PizzaExpress 3 courses £13 O'Neill's free whiskey

O'Neill's free whiskey Zizzi 20% off food

Zizzi 20% off food