This is our toy chest of over 50 tips to save cash with kids.

In this guide

Top Tips

Save when having a baby

If you're having a little'un, it's essential to get your finances sorted as early as possible. Use these quick tips to help make your new arrival more affordable.

Check your maternity or paternity pay

Quickly find what you'll be earning if you get pregnant

How much will I get?

For 2011/12, it's �128.73 per week or 90% of your average earnings, whichever is lower. Maternity Pay is higher in the first six weeks if you earn above �143 a week.

How long will I get it for?

- Statutory Maternity Pay is for if you're pregnant and employed (Adoption Pay has similar rules for those adopting). You'll be paid for up to 39 weeks whilst you're on leave.

- Paternity Pay is paid by an employer for two weeks, usually to the baby's father, once the child has been born.

The statutory level's the mininimum that should be provided, but your individual contract may provide more.

Do I qualify? Maternity and Paternity Pay both have the same qualifying rules. You must have worked for the same employer for 26 weeks by the time the baby's due-date is 15 weeks away.

How do I get it? Payments are made via your employer, so speak to your manager or human resources department. For more info on each, see the Directgov pages for Statutory Maternity Pay, Statutory Adoption Pay and Statutory Paternity Pay.

How to have a MoneySaving pregnancy

Tips 'n' tricks to cut the cost of having a baby before it arrives

-

Don't overbuy. Babies are big business, and baby stores are designed to get you caught up in baby fever, particularly if it's your first.

- Make a list of essentials. Before you rush out, think carefully and only get what you'll definitely need; you can always add to it later. A drawer full of tiny bear outfits may be cute, but it isn't as important as a good supply of nappies! The What baby essentials to stock up? forum has some useful tips.

- Factor in any gifts. Clothes and toys are common gifts from friends and family for newborns, and mean you need to buy less. Plus babies grow rapidly; if you buy masses of newborn gear they may grow out of it before they've worn it all.

-

Say yes to hand-me-downs. Think of it as 'baby vintage chic' � and it can save a small fortune on kitting out your new arrival. If you've got clothing stored from previous kids, now's the time to dig it out and reuse.

- Borrow where you can. Don't be afraid of asking family and friends if they've any spare baby equipment you can borrow. Often they'll be happy to see them put to good use again.

- Look out for inclusive bottles. If planning to breastfeed, you may not need to buy lots of bottles as breast pumps often come with these; check before you buy.

- Keep the boxes. If you're buying baby equipment that you plan to sell after you've used it, hang on to the boxes if you've room. These may help to fetch a better price, though only sell when you're sure you won't need the items again. Check out the eBay Selling Tricks guide for more.

Here's one MoneySaver's tip:

When I had my son in 2006 I spent an absolute fortune which I now realise was totally pointless as babies do not care how many items of clothing they have or if they are sleeping in a second hand cot etc.

Thanks to forumite susiebaby2011 and all who suggested tips on the MoneySaving in pregnancy forum thread; feel free to join in and add your own!

Bag extra discounts at Boots, Mothercare ...

Use hidden baby promos to cut the cost of essentials

As a new parent, retailers are super-keen to bag your custom with promos � just make sure you only take them up on the good ones.

- Boots Parenting Club. Sign up to the Boots* parenting club for offer mailouts, free mags aimed at your child's age group, plus 10 Advantage points for every �1 spent on baby products (you'll get a coupon to scan in store to activate this).

- Mothercare price promise profit! Mothercare online promises to match a competitor website's price if you find the same product for less within seven days. The real bonus is you'll get a �10 Mothercare voucher if the price difference is �20 or more; phone to claim. Share your finds on the Mothercare deals forum.

- Asda baby discount events. Asda* has regular baby discount events in store and online. These are hugely popular with MoneySavers, with discounts on items such as nappies, baby wipes, walkers and safety gates.

- Tesco, Sainsbury's & Asda baby clubs. These big supermarkets have online baby and toddler clubs which send money-off coupons and free samples to members. To join, just sign up online on the Tesco*, Asda* and Sainsbury's* baby club websites.

The MSE Pregnancy Club forum discussion is a fantastic place to share baby club discounts, pregnancy tips and chat with other mums 'n' dads to be, and it's free to join.

Get free support & tips for new Dads

Download free PDF booklets with help on becoming a daddy

Parenting charity National Childbirth Trust (NCT) has two handy free downloadable booklets, 'Becoming a parent' and 'Early days with your baby', with advice and support for dads-to-be and new dads.

The NCT website also has a range of useful info on all aspects of becoming a parent, from fathers and breastfeeding to bathtime tips. Plus the MoneySaving in Marriages, Families and Relationships board is a great place to get support and share your thoughts on family life with others.

Find the cheapest baby clothes, toys & more

Bag hidden discounts, use free tools & nab eBay bargains

- Find secondhand treasure online. There's often masses of cheap baby clothes, toys and accessories on eBay* and Gumtree, as these tend to be only used briefly before they're outgrown.

- Free tool to nab hidden discounts. We've built the Amazon Discount Finder tool to uncover massively discounted items on Amazon. Use its ready-made links to quickly search for discounts of 75-99% in its Baby* and Toys and Games* sections, or have a play to see what you can uncover across its departments.

- Check out charity shops and car boot sales. Don't forget you can also top up your funds and make more space by selling old baby items at these, or online, when they're no longer useful. See the eBay Buying Secrets and eBay Selling Tricks guides for a full how-to.

- Find the latest discount vouchers and sales. Check the High Street Sales and Discount Vouchers deals pages for the latest discounts, as these can really help if you're buying new kidswear, toys and more.

- Use a shopbot. Our free MegaShopBot tool instantly searches loads of comparison sites to take the mousework out of online shopping. Just type in what you're looking for and it searches the internet to find the best prices.

- Protect your purchases. Always make sure you pay the right way to get free spending protection, and check out the Money Mantras below before you buy.

Disposable vs. reusuable nappies?

Yep, we're talking poo. And lots of it ...

Reusables. These can be much cheaper; don't think old fashioned cloth, as their look and operation's surprisingly modern.

- How many? This depends on how often you're prepared to do washes, but as a rough guide you'll need about 25-30 nappies and at least 3 wraps.

- Which type? It's tough to get out of the mindset of a sheet and a pin, yet modern re-useable nappies work and look almost identical to disposables. The only difference is bits of them are washed rather than chucked. There are several types available; see the Cheapest Nappies guide for the pros and cons of each.

- Clean 'em for less. Wash less soiled nappies at 60 degrees rather than 90. Wash covers (wraps) at 40 degrees if possible, so they last longer. Use quick drying liners so you can dry them without using a tumble dryer.

Disposables. If re-usable nappies aren't up your street, there are a few tricks you can use to slash the cost of disposables:

- Try own brand nappies. Shops' own brand nappies are much cheaper than some other well known brands and are often made by the same manufacturers. The price difference can run into the �100s when you're buying 5340 nappies per baby!

- Be a nappy tart. Companies offer money off and freebies for new mums in the hope they'll get hooked on their brand, so try 'em all (see extra discounts). Plus GP surgeries often give out starter packs � check whether they're available at yours.

- Bulk buy BOGOFs. This stands for buy one get one free. These deals are a great way to save on consumables that don't go off and you use regularly. When you see these offers, it's a good idea to stock up.

Always be careful to check your baby's botty has no adverse reactions to shifting brands.

Also see the Rash of Savings forum thread to read others' feedback and add your own.

Bag free baby booty!

Use local giveaway sites for free baby clothes, toys & more

These are a great way of picking up freebies of all kinds, from toys and baby clothes to computer games and PCs, plus it's also a handy way to have a clearout while helping others. Here are some success stories from the MSE forums for inspiration:

We kitted out baby's nursery with a jungle theme from Freecycle, matching cot bumper, curtains, clock, cot mobile, washable playmat, animal soft toys, toy boxes, moose rug, two bouncy chairs (which went back on Freecycle when he outgrew them), baby monitors, a breast pump, and moses basket/stand.

I love Freecycle! I've used it loads to get baby things for my first which has been so helpful. We've also given away a lot of things too.

Share your finds in the Freecycle successes forum discussion, and see the Freecycle and Giveaway Sites guide for full info.

Free dental treatment for new mums

Plus check your entitlement to free prescriptions & eye tests

If you're pregnant or a new mum, you can get free dental treatment and prescriptions throughout the UK, plus free eye tests depending on where you live:

- England: Women who are pregnant or who've had a baby in the past 12 months get free prescriptions and dental treatment. To get it, you need a valid maternity exemption certificate � get form FW8 from your doctor, midwife or health visitor. Full info on the NHS website.

-

Scotland: Everyone gets free prescriptions and eye tests. Plus pregnant women or women who've had a baby in the past 12 months get free dental treatment with a valid maternity exemption certificate � get form FW8 from your doctor, midwife or health visitor. Full info on the Scotland.gov website.

-

Wales: Pregnant women, or women who've had a baby in the past 12 months get free NHS dental treatment with a maternity exemption card. To get one, ask your doctor, midwife or health visitor for form FW8W.

See NHS health costs help.

Prescriptions are also free regardless of your age if you have a Welsh GP and get your prescription from a Welsh pharmacist, or if you're a Welsh patient with an English GP and an accompanying entitlement card. See Wales.gov for full info.

- Northern Ireland: Prescriptions are free for all. Pregnant women and women who've had a baby in the past 12 months can also get free Health Service (HS) dental treatment. Just get form HC11 from your GP, midwife or health care specialist to get a maternity exemption certificate. See NIDirect.gov.

See Cheap Prescriptions and Medicine for more ways to save on meds.

Free return-to-work cash & help

Get tips on getting back to work if you've taken time out

If you've taken time out of work, going back can be a daunting task. Yet there's free cash to help.

If you've taken time out of work, going back can be a daunting task. Yet there's free cash to help.

Job Seekers Allowance is the benefit given to those looking for work. To apply, claim via DWP online or on 0800 055 6688, or find more info on Directgov:

- The income-based allowance is for if your household's on a low income. It's paid for as long as you show you're trying to find a job. For singles, the weekly amount for 2011/12 is �53.45 if you're 24 and under, or �67.50 if you're 25 or over. Couples and civil partners (both aged 18 or over) get �105.95.

- There's also a contribution-based allowance paid for six months, regardless of how much you have in savings, but there are other rules to check. Contact the Job Centre to see if you're eligible. The amount's the same as above (individuals only).

Also see the Benefits Check Up guide for info on return to work grants � these can really help to take the pressure off if you're on a low income. Plus there's plenty you can do to boost your income while you're applying, see the boost your income box. There are also some handy resources to make the transition back to work easier:

- Parenting charity National Childbirth Trust (NCT) has free downloadable PDF guides on Returning to work after having a child. These have useful info on rights in the workplace, including entitlements before, during and after maternity leave.

- The MoneyAdviceService website's 'Parent's Guide To Money' section also has info on your rights when returning to work, and what to do if things go wrong.

Teach MoneySaving to kids, teens & students

It's never too early (or late) to teach your kids how to deal with money. There's no better way than leading by example, and there's plenty of free resources to help.

Earn up to 6% tax free on kids savings

Use children's savings accounts to teach 'em about money

It's possible for kids to earn up to 6% in the top savings accounts � yet many have cash in accounts that pay dismally. This doesn't just deprive them of interest, but the chance to learn that your money can work for you.

It's a common myth that kids don't pay tax. This isn't true, as they're taxed in exactly the same way as adults, which means each child can in the 2011-12 tax year earn up to �7,475 tax free from salary, savings or investments.

The difference is, unlike most adults, most children don't use up their allowance, so their savings interest is tax free. Here are some quick tips on how to explain the key facts simply � find more, and a full list of best buys 'n' freebies in the Children's Savings guide:

- Piggy banks vs. real banks. "If you put your cash in a piggy bank it just sits there, but put it in a real bank and you're actually lending them your money � so they need to pay you for it."

- Interest-ing. "When you put your money in a bank, the extra amount you're paid is called interest. The higher the interest, and the longer you keep your savings with them, the more they are paying you. If the interest is 10%, that means they pay you 10p a year for every pound that you save with them."

- Pick the account together. Look through best buys together, explaining pros and cons � if you're unsure, see the interest rates for beginners guide � and make the decision together. Even better, visit your local bank or building society so your child can ask for an account, then compare this with the best in the guide.

- Play the field. If you've a budding entrepreneur, there's nothing stopping a child opening a range of accounts with the minimum deposit, usually �1, and grabbing the freebie for each. Just make sure you keep track of them all!

- Get them to monitor the rate. If you go for an easy access or variable rate deal, put your child in charge of checking the interest every month to see if it's still paying a decent rate � and move it if not.

Check out Martin's MoneySaving tips for nine-year-olds blog and forum discussion to see more tips, and share your own.

Find top kids prezzies under a fiver

Edible art, monster-killing spray, make your own slime ...

Birthdays and Christmases can be eye-wateringly expensive if you've got kids, yet there's masses you can do to keep them happy for next to nothing.

To help, we've put together a mammoth database of sub-�5 gift ideas, compiled from our Festive Fivers competitions. As well as a list of ingenious present ideas for adults, you'll find oodles of ideas to put smiles on kids' faces. Here's one tip to inspire you:

Balloon Surprise

Cost: c. �1 Contest Entry Year: 2005

Get the biggest box you can and fill with blown up balloons. Then wrap the box in Christmas paper. Small children are often more interested in the packaging than the product; they'll get excited by the massive box and then jump and play with the balloons.

As a huge pressie for a few pounds, this is very cheap, easy to do and will absolutely delight any nippers under five; after all, they do say "they prefer the wrapping to the present!". Do carefully supervise though, as balloons can choke young children.

Give pocket money as pay

Give your kids the tools to become MoneySavingExperts

We're not talking Justin Bieber-sized amounts of income here, but pocket money can be incredibly useful in helping you teach kids about managing their own cash. As Martin says in his Give pocket money as pay blog:

Pocket money is under-rated as a way to teach kids core money lessons. The idea of them having their own cash is beneficial �

-

It teaches them about regular income. By having a regular amount of money you start to learn the concept of saving versus spending.

It teaches them about regular income. By having a regular amount of money you start to learn the concept of saving versus spending. - It incorporates 'opportunity cost'. It encourages 'em to consider whether they could get better benefit spending the same cash on something else.

- It's a beginners guide to saving. Pocket money helps kids to start tackling more complex questions on how and where to save their cash.

See Martin's blog for full info on all of the above, and share your thoughts in the pocket money forum discussion.

Teach your teens about money

Free PDF guide to help teenagers become MoneySavers

Companies spend billions of pounds a year on marketing, advertising and teaching their staff to sell, yet we don�t get any �buyers� training�.

To help, we've a free printable Teen Cash Class PDF to help you make your family into MoneySavingExperts. In it, you'll find easy-to-follow, real-life lessons on debt, how to break the impulse shopping chain, and more.

In 2007, the ITV1 Tonight programme gave Martin a challenge: take a class of ordinary teenagers for one day and turn them into junior Money Saving Experts. The results were astonishing: after class, the 12 pupils saved their families a whopping �5,050!

This is a real practical teenage survival guide to living in one of the most competitive consumer economies in the world.

Also see 5 things teens should be taught about money forum discussion to share your ideas and pick up more tips.

Join the fight for financial education

We need your help! Take 20 secs to sign the e-petition

In the UK we've educated our youth into debt when they go to university but never about debt, leaving a debt-illiterate nation. Yet it's not just about debt; it impacts every area of our lives.

We need to break the cycle of financial ignorance by making financial education a compulsory part of the curriculum, so the fight to get financial education in schools is on.

We�re working with the All Party Parliamentary Group for Financial Education to lobby to make it a compulsory part of the curriculum, so young people are equipped to make informed financial decisions.

Take 20 secs to sign our financial education petition to make this compulsory in schools � 100,000 signatures forces MPs to listen.

- Get involved! Spread the word about the petition to friends, family and the milkman, and follow our progress in the free weekly email. Check out MSE�s full Financial Education Campaign page for resources, news and lots more.

Student loans myth-busting

Use the new tool to instantly see what it'll really cost

The cost of a university education's enough to make even Wills and Harry wince. Yet there's plenty you can do to make it affordable � from borrowing and budgeting to nabbing extra discounts.

The Student Loans 2012 guide's a one-stop-shop for all you need to know about the 2012 English student finance changes. It's crammed with key facts on who's affected, how much your loan will really cost, living costs and more.

Use the new Student finance 2012 calculator tool to quickly find the true cost of uni tuition fees.

In 2012 all institutions will be allowed to charge up to �6,000 and many will charge up to �9,000 providing they make extra provisions for bursaries for poorer students. Yet some students won't ever need to repay at all, others will pay far less than the fees and some will pay back much larger amounts. Read the full guide to find which you're likely to be.

- For Sept 2011 students: there's also the Student MoneySaving guide, a one-stop-shop for Sept 2011 students with info on grants, scholarships, living costs and how to get through uni without a serious debt hangover.

- Get the free printable PDF guide. We've also put together a free printable Student Finance guide for parents, an invaluable read if you're thinking of sending your kids to uni in the next few years, or they're already there.

- Should I pay off my student loan? Many students take out official Student Loans Company (SLC) loans, yet a loan this cheap shouldn't be paid off more quickly than is necessary. See the full Repay my student loan? guide for info.

Get free cash you're entitled to

Yet gaining a bundle of joy doesn't have to mean losing a bundle of cash. There are masses of grants, benefits and extra payments available to help with everything from fuel bills to further study. It's well worth a quick check to make sure you aren't missing out.

Gain �1,000s with tax credits

Get extra help with regular payouts � check you're eligible

Tax credits are payouts made regularly into your bank account from the state to support you if you've got kids, or if you work but have a low income. How much you'll get depends on your circumstances; plus the more kids you have, the more you could get. There are two types, and you can be eligible for none, one or both:

Eligibility:

Anyone with children, whether working or not, could be eligible

Eligibility:

Anyone who works, whether they've got kids or not, could be eligible

You need to renew every year. If not, your repayments could stop completely. Always tell the tax office if your circumstances change to avoid overpayment hell.

Check what you're entitled to. Find info on how to check your entitlement, how to renew your claim, and frequently asked questions in the full Tax Credits guide.

Get �1,000s extra cash for childcare

100,000s of working parents are missing out, check now

Whether you've a wee tot or a stubbly teen, childcare costs can be hefty. Yet 100,000s of working parents are missing out on �1,000s of easy cash to help.

- Childcare vouchers. Childcare vouchers are a little-known scheme, and can save many parents with kids aged up to 15 up to �920 a year on childcare. They need to be offered via employers, but many large and small companies take part.

The key is it enables you to pay for childcare out of your pre-tax and National Insurance income. While this doesn�t sound much, the benefit is huge. See the Childcare Vouchers guide for full info on how this works. - Childcare tax credit. It's a common misconception that tax credits are for the unemployed. Yet for childcare help it's the opposite � you have to be in work. The payment's part of working tax credit (see the tax credits box above for more).

The money available's huge, so it's vital to check you're eligible. It's possible 100,000s of families are missing out, so spread the word. See the Childcare Costs Help article for more, plus info on free childcare schemes and classes.

To qualify for childcare tax credit you must:

To qualify for childcare tax credit you must:

Be a single parent working 16+ hours a week

Be in a couple both working 16+ hours a week

If that's you, and your total household income's under �42,000, you should DEFINITELY check your entitlement

Check for family & child benefits

You may be entitled to �100s - use free tool to quickly check

A treasure trove of benefits is available to help families � use the Benefits Check Up tool to quickly find out if you can get extra help. Just enter your details and the tool will help benchmark how much you may be entitled to.

This'll help check your eligibility for all the main benefits, including council tax and housing benefit, income support and many, many more.

There are masses of benefits available to help families

and those on lower incomes. Here are just a few ...

-

Child Benefit. For parents with dependent children. It's paid until the 31 August following your child's 16th birthday, or until the age of 20 if they're in full time education or approved training.

2011/12 weekly amount: Eldest child �23.30, other children �13.40. -

Maternity Grant. A one-off payment if you've had a baby or adopted in the last three months to help pay for baby equipment. From April 2011 this has been restricted to the first child only, so you won't be able to apply if you've already got kids under 16.

2011/12 amount: One-off �500 payment. -

Free school meals, clothes, milk and more. Households earning under �16,190 or on income related benefits can get cash to help with sending their kids to school. This includes cash for meals, free milk, uniforms and fruit 'n' veg vouchers.

2011/12 amount: Varies.

Find full info on all of these, and how to apply, in the Benefits Check Up guide; also see the Grant Grabbing article for more info on other funds available.

Get free cash to study

Fund your learning with grants and free short courses

- Educational Grants Advisory Service: This service offers students, especially disadvantaged ones, guidance and advice to enable them to secure funding for education and training. Its site, part of Family Action, has a searchable database of about 1,200 educational trust funds.

- Scholarship search: There's some nifty search tools on the Scholarship Search and Studentcashpoint websites, including bursaries, scholarships and award funding for students. You'd be surprised what's available! Some are very specific, eg, aimed at specific religions, locations, parental occupation and many more.

- Study in Europe: If you want to study part of your degree in one of 30 participating European countries, grants are available from the British Council as part of the Erasmus scheme.

- Free numeracy and literacy courses: Virtually every college in the country has free courses to help improve maths and English skills, from basic literacy and numeracy up to GCSE level. See Learndirect and Hotcourses for local classes. Try this online quiz from Move on, or get a free cd on the scheme from the Get on website.

- Learn a language for free: There's lots of free websites and online tools to make it easy to pick up a new language � see Learn a language for free.

Grants are dependent on individual circumstances, so it's worth noting it may not be easy to get one, though there's certainly no harm in trying; see the Education Grants article.

�1,000s energy grants for your home

Save an average of �200 a year & increase property value

- Free insulation for ALL: EDF's offering everyone free cavity wall and loft insulation, and what's more, you don't need to be an EDF customer to get it. It says it'll review the offer if more than 200,000 people apply, so go quick. See the Free insulation guide for details.

-

Search for grants: The government, energy suppliers and local authorities provide grants to help you implement energy saving measures. The Energy Saving Trust search tool lists most, or call 0800 512 012 (info for Scotland and NI).

A further scheme is from Enact Energy. This provides grants for loft and cavity wall insulation to homeowners, private tenants and landlords for those on a low income (in receipt of qualifying benefits) or over 70. - Solar energy discounts: See the Free Solar Panels guide to find out if you could be eligible for free panels, though this'll only let you use the electricity and not keep the money generated via the Feed In Tariff scheme.

Though grants may not cover the full amount of the item or repair you need, they're almost always completely free.

Find more solar energy options in the Home and Energy Grants article, plus full info on all the above.

�1,000s free cash for your home

Millions available in grants for home improvements

There are loads of organisations offering free cash to use on your home, whether to improve safety or just make essential repairs, but sadly many go unclaimed.

There are loads of organisations offering free cash to use on your home, whether to improve safety or just make essential repairs, but sadly many go unclaimed.

Here's a rundown of the top home grants � get claiming!

-

Search for grants: Charity-run Turn2us has a grant search to check for charities that can help with things like furniture, decorating or bills. Grants depend on individual circumstances, illnesses, nationality, occupation or age and are usually, but not always, for those on a low income or means tested benefits.

-

Fire safety check: Many fire stations give free Home Fire Risk Assessments to check for risks and help you plan what to do if there's a fire. You'll usually get a free smoke alarm if you don't already have a working one. Find info and book an appointment at Fireservice (or call a local fire service to check it's participating).

-

Help with utility arrears: Some utility companies also offer grants to help if you have large arrears on your gas, electricity or water bills. You'll usually need to be a customer of the company, but even if yours isn't listed it's worth contacting it to see if it has a similar scheme. For full info, see the Home and Energy Grants article.

Get a family money makeover

Running a household can be expensive, but by setting aside some time you can save �1,000s, totally pain-free. Spend time plugging leaks in your finances. Battle your bills, sort out your savings and ditch your debts, and you'll soon have more cash in your pocket.

Do a proper family budget!

Make yourself �1,000s better off in just one day

Looking after a family can be incredibly expensive, so it's crucial to make sure you're budgeting correctly.

First, use the free Budget Planner tool and guide to help work out exactly where your cash is going.

Don't ask "What's the cheapest way?",

ask "What can I afford?"

Next, give yourself a full Money Makeover. This guide overhauls your finances, taking you through everything from debts to utilities. It'll take time to work through, but it's time well invested � some end up thousands better off in a single day.

Save �1,000+ on your supermarket shop

Take the downshift challenge & bag the latest coupons

Over the years, supermarkets have hypnotised us into spending more and moving up the brand chain. Many people gradually buy increasingly more expensive versions of the same thing. The challenge:

Drop one brand level on everything and see if you can tell the difference. If you can't, stick with the cheaper product.

Drop just one brand level on everything and the average bill's cut by a third. On a �100 weekly shop, that's a whopping �1,700 a year less. Remember, supermarkets are experts at getting us to buy more than we need:

If you want to teach an eight-year-old about money, the best place to start is a supermarket. Ask them what they can smell: it'll usually be bread or a bakery. The scent makes us hungry and likely to buy more food, so the supermarket profits.

Plus don't forget to grab the latest Supermarket Coupons before you go. Find full info on the challenge and masses more tips in the Supermarket Shopping guide.

Quickly slash car insurance costs

Correctly combine comparison sites to drive down the price

Comparison sites zip your details to hosts of insurers' and brokers' websites, scraping their data to report back the cheapest.

Comparison sites zip your details to hosts of insurers' and brokers' websites, scraping their data to report back the cheapest.

Yet as they don't all compare the same sites, you need to combine them to maximise the spread of quotes. We've analysed the order that gets the max quotes in the min time. Here are the main ones to try:

- First use GoCompare* and MoneySupermarket*, which compare 145 providers between them. Then check Aviva* and DirectLine* � the ones they don't include.

The full Cheap Car Insurance guide has a powerhouse system to nab the very cheapest insurance, and you needn�t be at renewal. Provided you haven't claimed, most policies can be cancelled with a refund. A few do charge penalties, but you�re still likely to save.

The record using the full system is 96p for a year's fully comprehensive cover � let us know if you beat it!

Need to insure under-25s or learners? Try specialist young driver policies. 'Pay when or how you drive' schemes are well worth checking to see if they undercut comparison sites. With these, a GPS or tracking device is fitted to your car, so what you pay depends on milage, time or driving style; see the Young Drivers' Car Insurance guide.

Switch 'n' save �200 on gas & elec

Plus how to grab cashback or wine when you switch

-

Energyhelpline* pays �15 cashback (once) per switch, and has good reliability and feedback.

-

Moneysupermarket* pays �30 cashback for duel fuel (getting both gas and electricity from one provider).

-

Uswitch* gives 12 bottles of wine (worth about �40) for duel fuel.

Plus there's loads more you can do to hammer down costs, from switching to monthly direct debit payments to taking a meter reading every time you get your bill. Find full info on these and loads more in Cheap Gas and Electricity.

Free family medical cover on Euro hols

Ensure your family have European Health Insurance Cards

- It's valid across the EU. It can get free or discounted medical treatment in state-run hospitals in any European Union country, plus a few others.

- It doesn't cost a penny. Yet it entitles you to the same treatment that local citizens are entitled to, which is extremely useful in emergencies. Make sure you keep it on you at all times when you're away, as you won't be covered if you don't.

- Kids need one too. Though you must be over 16 to apply, every family member needs one. To apply on behalf of a child, include them as a 'dependant' in the relevant section of the application and you'll each receive a separate EHIC.

- It isn't a substitute for travel insurance. While very useful, it�s only about medical cover. Find how to apply and full pros 'n' cons in the Free EHIC guide.

Boost your savings interest

Make your savings work harder by switching

If you're building a family nest egg, don't neglect it. With interest rates at horrendous lows, the only way to get a decent amount is to treat your savings a bit like a job. You need to put time in to maintain the best rates:

If you're building a family nest egg, don't neglect it. With interest rates at horrendous lows, the only way to get a decent amount is to treat your savings a bit like a job. You need to put time in to maintain the best rates:

-

Find the best rates. These change daily, so to instantly find the best payers see the Top Savings Accounts and Top Cash ISAs guides. Every UK adult aged 16+ can save �5340/year tax-free in a cash ISA to boost the interest.

-

Don't leave it sitting in a high street bank. This is the easiest way to earn a paltry amount. Most accounts only stay competitive for a year or so, then the rate plummets. Though it may've been a golden deal once, if you haven't switched in a while you're almost certainly earning nowt.

-

Always check safety. Remember, these days all UK regulated savings accounts are protected up to �85,000 per person, per institution. For safety don't save more than this with any one banking group, see Safe Savings for full details.

-

Transfer old cash ISAs. If you've been saving in cash ISAs, don't assume you can't touch them. You've a right to transfer your cash ISA, which can instantly boost your interest. To transfer the cash you'll need to set up an account with a new provider and ask it to transfer the cash across for you, see the Top cash ISA transfers guide.

Protect your family's finances

Consider life insurance to ensure loved ones are provided for

- Term: This means you only get a payout if you die within a fixed term, eg, 18 years.

- Level: This means that because the payout you get doesn't vary, it's always at a set amount. So level term assurance guarantees a lump sum payout upon death within a fixed time, eg, �150,000 if you die within the next 18 years.

Nearly one child in 20 loses a parent before they've finished

full time education.

Of course, it's the one policy you hope won't pay out � yet it's well worth looking into. See full info on all the options, how to find the cheapest policies and the key factors to take into account in the Life Insurance guide.

Nab cheap family travel insurance

Save �100s a year by choosing the right cover

-

Should I cover the family together? Policies can be for singles, couples or full families. As a rule of thumb, the fewer people travelling nearer to home the cheaper it'll be, so don't over-cover unnecessarily.

-

Globe trotting needn't cost the earth. While some policies come with a price tag that would make even Richard Branson blush, family cover can start from �30-�40, depending on circumstances. Find full best buys in the Travel Insurance guide.

Save even more cash on family hols:

-

Get a free travel tips guide. The Little Lifesaver is a free passport-sized, printable travel tips guide to store key details. It's packed with key info, including flight cancellation rights. Just print and keep it in a safe place to refer to, if needed.

-

Find the cheapest way to spend overseas. Debit cards can be the worst way to spend, but the right credit card can mean perfect exchange rates that beat even the best bureaux. See Cheap Travel Money for full info, and use the free Travel Money Maximiser tool to quickly find the best holiday cash deals.

Also see the Cheap Package Holidays and Cheap Flights guides to cut the cost of your getaway, plus use the Flightchecker tool to find the very cheapest flight deals.

Pay off debts before saving

Plus do the 'credit card shuffle' to slash debt interest

Yet pay off your debts before you start to save and you should be better off in the long run.

For example, if you had �1,000 credit card debt at 18%, the interest would be �180/year, yet �1,000 in a 4% savings account after tax would earn just �40. Pay off the debt with savings and you're �140 a year better off! See the Pay off debts with savings guide for full info.

If you've debt on credit cards, there's a nifty trick to slash up to 70% off the cost without getting new cards or credit. For a full how-to, see the Credit Card Shuffle guide.

Feed your family for less

Nab a free fridge memo to help stop food waste

Do you know the difference between a best-before and a display-until date? If not, it's likely you're binning a lot of food unnecessarily. To help, we've designed a free printable food saving memo; stick it on your fridge to check before you chuck.

If you need inspiration on how to turn last night's leftovers into a family banquet, the using up leftovers forum thread is a great place to get ideas.

Also see the how to start meal planning and complete menu plans collection discussions, which will help you to only buy food you need.

Haggle to save �100s on family hols

Drive down the cost of last-minute package deals

If you're jetting off with your family, it's possible to haggle already cheap package holiday late deals by a further 10% using the technique in the Cheap Package Holidays guide.

One MoneySaver who "had no idea this�d work" reports �600 off a Crete holiday, just by calling three travel agents. Package holidays can yield huge savings:

As a rough rule of thumb, packages are usually cheapest for seven, 10 or 14 days away in a traditional holiday destination.

In general, the later you book, the cheaper it'll be, but the more you'll need to be flexible with dates and destinations. So if cr�ches or kids clubs are a must, you may be better off booking as much as nine months in advance instead to get it for less.

DIY breaks: If you're off for a different length to a less visited spot, on a city break, or multi-stop holiday, you'll tend to be better off with a DIY break. Read the Cheap Flights and Cheap Hotel guides, as well as the Hotel Sales deals note, for more on these.

Are you in the wrong council tax band?

Check now � you could save �1,000s by lowering your band

Many homes are in the wrong council tax band, and have been since 1993. The reason? Valuations were done at speed in time for the launch of the new system, so bands were merely allocated with a drive-by glance.

Many homes are in the wrong council tax band, and have been since 1993. The reason? Valuations were done at speed in time for the launch of the new system, so bands were merely allocated with a drive-by glance.

Yet in ten minutes you can check �n' challenge your council tax band. Thousands have already tried this and many succeeded in getting �1,000s back. One MoneySaver reports:

Last week got the letter from VOA saying we were being reduced to [band] E effective from when we moved in in August 2000.

Next day got the letter from the Council stating the same and that the refund was �2369. Money was paid into my account yesterday. Total time less than 4 weeks.

It won't cost you a penny to check your band, and it could get you a backdated payout if you've overpaid. See the Council Tax Rebanding guide for a full how-to.

Get a free first-time buyers guide

Plus free tips 'n' tools to help value your home

If you're setting up home, taking your first steps from renting to buying can be daunting.

To help, we've put together a free mortgage guide downloadable PDF for first-time buyers and first-time buy-to-let mortgages. The savings can be huge:

For every 1% you can cut off your mortgage deal, you'll save

�1,000 a year on a �100,000 repayment mortgage

Plus there's loads of other tips and tricks to help find your dream home:

- Value your house for nowt. The free house price valuations guide has a goldmine of free online tools to help you work out what your digs are really worth, from free house price valuers to crime and flood risk assessment, plus how to work out what the neighbours really paid.

- Use the essential home-buying checklist. The House Buying MoneySaving guide has a full checklist of what to look out for when buying a new home, from initial checks and budgeting right through to completion.

- Make your mortgage work harder. If you've already got one, the Remortgage Guide is a free downloadable PDF on how to get the very best deal, whether you're moving, consolidating debts or simply want to bag a cheaper mortgage.

Stop spending!

Tips 'n' tricks to help you fight yourself

If you've a family, it's likely your wallet's under more pressure than ever before. But before you rush to the shops, check out Martin's Money Mantras. We've also designed a free printable wallet-sized version for you to pop in your purse as a useful reminder:

If you still find it difficult to keep cash in your pocket, there's plenty of ways to help. See the Stop Spending guide for full info on both pain-free and painful ways to halt your spending, and use the free Demotivator tool to learn the real cost of everyday habits.

Choose the right pet insurance

There's no NHS for pets, yet it's possible to save �100s

Whether you've a family tomcat or a turtle, pet insurance can be incredibly useful if it falls ill as vet costs can be huge, and with dogs you can be liable if it injures others (but not cats as they're free spirits!).

When choosing your policy, always read the small print to make sure it's right for you. There are three main types:

- Basic annual cover. This tends to be the cheapest, but offers the least cover as it puts a time bar on how long you can claim for a particular condition or ailment (usually 12 months) and a cap on how much you can reclaim in vets' fees.

- Mid level cover. This limits vets' fees for any one illness, but doesn't apply any time limit on how long the treatment lasts.

- High level cover. These are the priciest policies as they offer the most comprehensive cover. They insure your pet for illness or injury up to a maximum amount each year, or to an overall high sum (say, �40,000) throughout its life.

See the Pet Insurance guide for a full step-by-step system to cutting pet insurance costs, as well as best buys and what to watch out for. Here's a quick tip from Martin:

If you have a tarantula (as I did aged 14) and like to show it off, perhaps consider third party insurance in case it takes a chomp out of one of your guests. Or then again, ensure the tank is very secure (my sister wishes I'd taken this advice!)

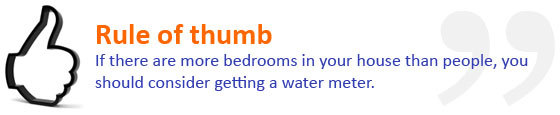

Consider switching to a water meter

Save up to �200 a year if you've more bedrooms than people

For some in England and Wales, switching to a water meter could save hundreds. A quick tip can help you work out if you could be better off with a meter:

So if your kids have left home, for example, leaving two people in a three-bedroom house, it's well worth looking into. Sadly, in Scotland it isn't free to have a water meter installed (it's actually quite expensive) so unless you live alone in a manor-type property, you should stick to billed payment. For full info see the Cut Water Bills article.

Sort your will

Act now to secure your children's future

If you've assets such as savings or a house, and others you'd like to look after, consider making a will. It's easy to put this off, but it's well worth tackling as soon as possible, both for your kids and for your peace of mind. A will has three main functions:

- It names your executors. These are the people you choose to sort out your finances after you've gone.

- It distributes your estate. A will lets you state where everything you own will go, from property to pets.

- It mitigates inheritance tax. If you die without a will, strict rules mean your assets may not go where you want them to, so if you haven't planned for it inheritance tax may take a hefty, unexpected chunk.

Don't leave a financial nightmare for your family � even if you've already got one, make sure it's current. Solicitor-drafted wills can be cheap or free to make or amend. For example, UK-wide scheme Will Aid runs every November, providing a basic will for a donation of about �85. Find full info on all the options in the Free and cheap wills guide.

If you have children or step-children under 18, you should choose who will look after them and ensure there are funds to help.

Boost your income � from home

Make �100s from flogging old gadgets, reviews, comping ...

Whether you want to pay off debts or just spend more time with your family, there's a huge amount you can do to bring in extra cash � even if you're at home looking after kids.

Whether you want to pay off debts or just spend more time with your family, there's a huge amount you can do to bring in extra cash � even if you're at home looking after kids.

Here are a few to get you started, see the Boost Your Income guide for the full list:

-

Rent your parking space. This could earn you �200 a month or more, depending on your area. To quickly find what yours is worth, for longer term parking try ParkLet's interactive map, or Parkatmyhouse* for short term parking. For full info, see the Rent Your Parking Space guide.

-

Get paid for your opinion. It's possible to earn �100s a year, without any special skill or talent. You could be paid cash to take part in online surveys, which are often short enough to fill in during breaks at work. Some surveys can pay �1 to �3 for just a few minutes of your time. Find the top paying sites in the Survey Sites guide.

-

Recycle old gadgets. This is the easiest way to declutter, as there's a whole industry set up to help. If you've unwanted gadgets, eg, mobiles, cameras or MP3 players lying around the house, several companies will happily take the relegated beast off your hands for cash. To help, we've built the MobileValuer tool to find the best payer.

Also check out eBay Selling Tricks for how to easily declutter your home and make money at the same time, whilst the Gold Selling guide has a full run down of the best ways to turn old jewellery into extra cash. Plus get tips to earn more through online competitions in the Comping for Cash guide.

Save �1,000s on a wedding

How to tie the knot without breaking the bank

Aptly dubbed 'the big day', the average UK wedding costs a whopping �20,000+. You don't need to be married to have a family, but if you (or a family member) decide to get hitched, there's plenty you can do to make it more affordable.

To help, we've put together a guide with over fifty top tips, from where to save the wedding cash to how to nab a ready-made wedding for a grand.

While a wedding is a wonderful dream day, it's important to remember one of the biggest causes of divorce is debt and financial worries. If the cost of your wedding leaves you financially crippled and in debt for most of your married life, it's a pointless waste.

For masses of handy ways to save, see the full Cheap Weddings article.

Cut home costs with 'old style' tips

Find a wealth of wisdom for families on a budget

It has plenty to offer families looking to cut back � whether you want to learn how to clean with vinegar or just make cheap and healthy packed lunches.

From keeping chickens to feeding a family of four for �2, how to make homemade fabric conditioner, or even becoming self sufficient, you'll find a wealth of wisdom. Feel free to join in and add your own tips � it won't cost a penny!

Stop smoking!

Improve your health and your wealth

The MoneySaving gain from quitting isn't just about spending less in newsagents. There's a further, hefty cost; many financial products add a huge whack on smokers.

The health risks are well-known, but if you've kids in tow the stakes are much greater. Stopping smoking may not be easy, but your family (and your wallet!) will be much better off. You could easily save �30,000 over 20 years when you add up not buying cigarettes, plus savings on common financial products, eg, life insurance. One forumer reports:

It's the best decision I ever made - without it my daughter would go to school smelling like a dirty ashtray [...] I'd smoked since I was 12, came from a house where both parents smoked even though we had no money for holidays etc. I never realised how bad the smell was until I stopped.

There's loads of free and cheap support available to help you kick the habit for good. See the Stop Smoking guide for full info.

Grab family freebies & discounts

There's plenty of freebies and discounts specifically for kids or families if you know where to look, from free prescriptions and cut-price train travel to totally free family days out, free cinema entry for tots and many more.

Free kids prescriptions, dental check ups ...

Save up to �7.40 per batch of meds, plus free kids' eyecare

It isn't all doom and gloom when it comes to the cost of family healthcare. Young people can get free prescriptions, dental and opticical check ups across the UK, though how it works depends on where you are:

England

In England, under-16s (and under-19s in full-time education) get free prescriptions, NHS eye tests and optical vouchers. Under-18s (and under-19s in full-time education) get free dental treatment too.

How do I get it? Just tick the box on the prescription form, fill in the form at the dentist's, or for free eyecare fill in form GOS1 from the optician. See the NHS website for more info.

Scotland

In Scotland, everyone gets free prescriptions and eye tests. Under-16s (and 16s-18s in full-time education) get free NHS dental treatment, and vouchers towards glasses or contact lenses.

The NHS Minor Ailment Service also entitles under-16s and over-60s to free medication for minor illnesses from 1,200 pharmacies. See Scotland.gov.

How do I get it? You don't need to do anything � there's simply no charge.

Wales

In Wales, under-16s (and 16s-18s in full-time education) get free NHS sight tests and help with glasses and contact lenses costs. Under-25s also get free dental examinations, though you'll have to pay for subsequent treatment.

Prescriptions are free regardless of age if you've a Welsh GP and get your prescription from a Welsh pharmacist, or if you're a Welsh patient with an English GP and an accompanying entitlement card. See Wales.gov for full details.

How do I get it? There's no charge for prescriptions, or just fill in the form at your dentist or optician - see NHS health costs.

Northern Ireland

In Northern Ireland, under-18s (and under-19s in full-time education) get free Health Service dental treatment. Under-16s (and 16s-18s in full-time education) get free sight tests, and vouchers for glasses or contact lenses. Prescriptions are free for all, see NIDirect.gov.

How do I get it? You don't need to do anything � there's simply no charge.

See Cheap Prescriptions and Medicine for more info on how to save on meds, and see the new mums box above for info on free healthcare entitlements while pregnant.

Nab big savings on family days out

Discounts on zoos, theme parks, and totally free days out

Keeping your kids entertained doesn't have to be pricey. There are masses of tips 'n' tricks to cut the cost of a family day out:

- Free kids activities are a great way to keep your children entertained for nowt during the hols. Find the full list of free activities, as well as theatre discounts, free sports coaching and many more in the full Cheap Days Out compendium. Also check out the free museums and galleries box below.

- Zoo discounts can mean big savings if you're taking your little monkeys along. See the Cheap Zoos deals page for the latest nationwide deals and vouchers.

- Theme park tickets can be hair-raisingly expensive if you buy them on the day, yet you can often easily cut the cost with 2for1 vouchers. Find the latest ticket offers, and a full UK theme park deals map on the Cheap Theme Parks page.

- Free audience tickets are a great way to have a family day out for nowt. You can watch TV shows, sitcoms and comedies being recorded; some offer travel and even provide a cuppa and biscuit. See Free TV Tickets for how to apply.

- National Trust offers free entry to all its properties for under-5s, no proof of age needed, as part of its ongoing offer. See the National Trust website.

- Restaurant vouchers can slice the cost of a family meal, and are a must if you're ending the day with a family meal out. Find masses of printable 2for1s, kids eat free and 50% off deals in the Restaurant Vouchers deals page.

- Get creative! There's plenty more low-cost ways to keep the kids entertained. Trips to the library, walks in the woods and picnics in the park are just a few, while the great 'free weekend activities' hunt has more ideas � feel free to join in!

Tots go free at Odeon & Cineworld

Plus nab discounted rates for families, kids, teens & more

A family night at the movies doesn't have to be pricey � there's often extra discounts available if you've tots in tow:

A family night at the movies doesn't have to be pricey � there's often extra discounts available if you've tots in tow:

-

Odeon

admits under-2s for free to all screenings, no proof of age needed. Odeon Newbies also runs weekday morning parent 'n' baby screenings across the UK. Babies get in free, and you can still use cinema discounts on your ticket as usual.

This can be a handy way to get to the cinema if you're a new parent, as you don't need to worry about your baby making noise, the film's quieter, and lights raised more than usual. Screenings are at selected cinemas; all films are 12A or lower. - Cineworld also offers free entry for babies under 18 months, with no proof of age required.

-

Check for extra discounts. Cinemas can offer special rates for kids, teens, families, students and off-peak films, so do check with your local before you go.

See the Cheap Cinema Tickets page for the latest discounts, including school holiday deals, free preview tix and many more.

Free UK museums, galleries & festivals

Quickly find your nearest for a free family day out

In it you'll find masses to choose from, with museums dedicated to everything from Roman forts and railways to forensic science and footie. To find your nearest, just click on your area on the in-guide map for full listings, plus location, opening times and more.

If you're after free outdoor events, check out the Free Festivals guide for a round-up of the top gigs nationwide, with festivals across the UK on everything from jazz 'n' blues to carnivals and outdoor theatre performances. Again, there's area-by-area listings on the in-guide map.

Get a third off train travel

Spend over �84 a year on tickets? Consider a railcard

This means that if you'd usually spend over �84 on train tickets in a year � even just in a single trip � it'd be worth it, as you'd save more than the cost of the railcard. See the Railcard website for full info. The two types of railcard that are generally most useful for families are:

- For travelling with kids: Family & Friends railcard. This can be used on all tickets when one adult and a minimum of one under-16 travel together (borrowing a child for a day could save you money!) The max is four adults and four kids.

- For teens, students & young adults: 16-25 railcard. This is for under-26s or full-time students of any age. Renew just before your 26th birthday to grab another year. The same applies to older cardholders about to finish uni.

Look out for further travel concessions. Other services can offer reduced rates, so always ask. For example, National Express offers �8 and �16 family coachcards that let up to two kids go free for a year when accompanied by up to two full paying adults. See Cheap Train & Coach Deals for the latest discounts.

Fill yer boots with freebies

Get free nappies, pet food, beauty products & more

You'll also find sections just for baby and family freebies, as well as free games and indoor entertainment to keep the kids busy for nowt. If you're spoilt for choice, try the fun Freebie Roulette tool for a random freebie!

If you're after something bigger, the Freecycle guide explains how to make the most of giveaway sites. These are great if you're looking for free furniture, electricals, garden gear and more, whilst they're also handy if you're having a clearout. For totally free activity ideas, see Free Museums and Galleries and Free Gym Trials.

Get back lost Tesco Clubcard vouchers

Then triple their value on family days out, restaurants ...

If you've ever lost vouchers you can access the codes online for instant redemption, or get the vouchers re-issued.

If you've ever lost vouchers you can access the codes online for instant redemption, or get the vouchers re-issued.

You can then exchange your vouchers so that they're worth up to four times as much via Tesco Rewards. This can be a great way to get a family day out, as the scheme includes cinema tickets, theme parks, restaurants, sports and more.

It's fast and free to check your account for old vouchers � see the Get back lost Tesco vouchers guide for a full how-to. Some MoneySavers found over �100 of vouchers they didn't know they had! One reports:

Thanks to your article, we found we had nearly �150 of unclaimed Tesco vouchers! We have already used them to double the vouchers value online, which has been incredibly useful for Christmas.

Family bowling for under a tenner

Use a special discount to bag cheap off-peak bowling

Hollywood Bowl has an ongoing family special offer running nationwide, offering a game for a family of four for �9 off-peak (weekdays before 6pm), or �10.60 off-peak at South East and London venues.

Hollywood Bowl has an ongoing family special offer running nationwide, offering a game for a family of four for �9 off-peak (weekdays before 6pm), or �10.60 off-peak at South East and London venues.

It varies by venue, but as a guideline an off-peak bowling game is usually about �2.50 for juniors or �3.50 for adults, so a family of two adults and two kids would save about �1.40-�3 with this offer.

To get it you'll need to bring a minimum of two under-16s; proof of age may be required. You'll pay more at peak times (weekdays after 6pm, all weekend and bank hols) at �15, or �15.60 at South East and London venues.

Free high-tech treasure hunts

Get instant access to global treasure hunts via GPS

It�s a giant high-tech treasure hunt for �geocaches� � boxes filled with tiny treasures hidden by other geocache fans (we�re talking plastic kids' toys, not iPods).

There's a huge online Geocaching community � to get started, sign up for a free membership on the Geocaching site then enter your postcode to find geocaches near you. Enter the coordinates of your chosen site on your GPS, and off you go!

Treasures are hidden at spots like waterfalls and parks � forumers report it's a great way to explore the local area with family.

After you've found one, put it back as you found it. The rules of the game state you can take an item from it if you wish, but if you do, leave something of equal or greater value for the next person. Discuss your finds in the Geocaching tips forum.