Millions of workers have not been credited with nearly �1.3 billion paid in national insurance (NI). This could mean reduced state pensions if you fail to act.

Millions of workers have not been credited with nearly �1.3 billion paid in national insurance (NI). This could mean reduced state pensions if you fail to act.

It potentially affects workers of all ages, see below to find out if you're hit and what you can do to get it fixed.

Q&A;

| Tweet | http://mse.me/natins |

What's the problem?

You don't automatically get the full state pension on retirement, it depends on how many years you've paid national insurance for - less years means your pension is cut. See below to find out how many years you need to have worked to get the state pension.

It's been revealed tax authorities have not tracked 9 million employees' payments between 2004 and 2009 which could affect workers of all ages, in total they're worth around �1.3 billion.

This isn't the first fiasco HMRC has been caught in. A massive 5.7 million paid the wrong amount of tax during the 2008-09 and 2009-10 tax years because their tax code was wrong....

Are you due a tax rebate?

Use our free tax code checker to find out now

What is HMRC's explanation?

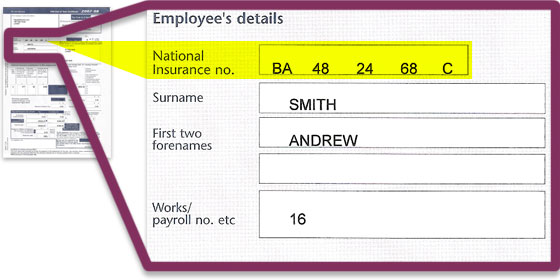

The government department says problems arise when P14 forms it receives from employers contain the wrong NI number for an employee. This is the version of the P60 sent to HMRC detailing what tax and NI a worker has paid.

HMRC contacts employers where there are discrepancies but critics have pointed out why so many errors, dating back seven years, are therefore still prevalent.

An HMRC spokesman says:

HMRC receives around 48 million P14 forms every year from employers.

"HMRC then matches these to individuals' records. In a small proportion of cases, we cannot match these records because employers provide insufficient details.

"We make every effort to match these records. However, where that's not possible, contributions are retained until they can be matched. This is a normal part of the PAYE process.

"No-one will have a reduced pension. We write to people where we see there is a gap in their contributions and if they contact us to report a gap, we deal with the situation immediately.

How do I know if I'm missing NI years?

HMRC regularly writes to people where a gap appears in NI contributions, so if you've had one of these letters it's quite possible you've been affected by this. Ensure you check whether you actually worked during these years. If you want to check your situation you can contact it on 0845 915 5996.

Ask it:

Which years have you got me down as paying national insurance?

Check the details it gives you are correct and compare with how many years you've worked. See below for what counts as a qualifying year.

The Department for Work and Pensions also provides a state pension forecast to those approaching retirement which details missing NI years.

Also, check your P60 from your employer, which you get at the end of the financial year (in April), which details the tax and NI you've paid. Check the NI number is correct. If it's not, your NI may not be credited.

How to find your NI number

HMRC no longer issues replacement national insurance cards. However you don't need to have a card - it's the number that's important. If you don't know your national insurance number you might be able to find it on official paperwork such as:

your P60 (end of year tax statement, given to you by your employer)

a payslip

-

a copy of your annual Self Assessment tax return

other official correspondence

If you still can't find your number, you can ask HMRC to confirm it by:

-

completing and returning a CA5403 form

-

calling the national insurance registrations helpline on 0845 915 7006 (lines open from 8.30 am to 5.00 pm Monday to Friday). HMRC can't confirm your NI number by phone, but it'll write to you instead.

How do I correct an error?

You should contact HMRC's NI helpline on 0845 302 1479. It may ask you to simply inform your employer of your correct NI number.

You should contact HMRC's NI helpline on 0845 302 1479. It may ask you to simply inform your employer of your correct NI number.

But where an old employer has gone bust, been taken over or destroyed records, you may need to dig out the evidence yourself from old P60s or wage slips.

HMRC holds payments that have not been credited in a suspense account until they are matched with the correct person.

What if I don't have my old documents?

There's still a chance you can get your contributions. All you have to do is write to the national insurance contributions office with all the details you can find (including full name, address, date of birth, where you worked, copies of pay slips). It should be able to match your missing contributions to you.

What is the basic state pension?

To get the full basic state pension, currently �97.65 a week, anyone who reached, or reaches, the state retirement age (currently 65 for men, 60 or 61 for women) after April last year needs to have paid NI for 30 years.

To get the full basic state pension, currently �97.65 a week, anyone who reached, or reaches, the state retirement age (currently 65 for men, 60 or 61 for women) after April last year needs to have paid NI for 30 years.

Men who retired earlier need 44 years and women who retired earlier need 39.

If you're short you'll usually get a pro-rata sum. So if you have half the number of NI years you'll get �48.83 a week.

If you hit retirement age before 6 April 2010 and you've fewer than 25% of the required NI years you're not entitled to a basic state pension. Read the full State Pension Boosting guide.

What is a qualifying NI year?

To gain a qualifying year, you need to earn a set minimum during a tax year (April to April) and pay the required NI. For 2010-11, this is �5,044 for employees or �5,075 for the self-employed. In past years, the amount was lower, but it has always been a similar figure in relation to average salaries. So only those on very low wages could have missed out.

If you were working full time, even on the minimum wage, or even just a few days a week throughout the year, it's likely you earned a qualifying year.

What about full time parents & those who can't work?

Here, you may be eligible for national insurance (NI) credits, which counts as a qualifying year.

-

national insurance (NI) Credits

These are normally automatically awarded for the weeks you were claiming and receiving any of the following benefits: Carer's Allowance, Jobseeker's Allowance, Incapacity Benefit, Employment and Support Allowance.

You also get them if you are a full-time parent who claims Child Benefit for someone under 16, or a full-time carer who claims Income Support. However, foster carers and others may have to claim it (find out more). Until 5 April 2010, these were called Home Responsibilities Protection (HRP). Years of HRP built up before then will count as qualifying NI credits.

Check your tax code � millions have overpaid

This is the not the first storm HMRC has been caught in.

This is the not the first storm HMRC has been caught in.

A whopping 5.7 million paid the wrong amount of tax during the 2008-09 and 2009-10 tax years because their tax code � which determines their tax free allowance � was wrong.

While those errors were spotted in 2010, it was revealed in early 2011 that 450,000 people face extra tax demands for similar errors in the 2007/08 year. See the full Tax Code guide to find out if you've overpaid.

Are you due a tax rebate?

Use our free tax code checker to find out now