Motorbike, scooter and moped cover can be hard to find cheap, as many big names steer clear. Yet it's still possible to get scores of quotes in minutes, saving you �100s.

Step-by-step

Find cheapest quote

Motoring MoneySaving Checklist

Step 1: Getting the right cover

Insurance premiums (the payments you make to insurers) depend on three things:

By reducing insurers' perception of your risk, you can reduce the price you'll pay.

Bike insurance rates are set by actuaries, whose job is to calculate risk. Each insurer's price depends on two things; their underwriters' assessment of your particular risk focus, and then their own pricing model which dictates what customers they want to attract. See the following for ways to reduce your risk.

Men, act NOW! Gender neutral pricing now law

A change in the law means now means all insurers must follow the European Court of Justice gender equalisation ruling. It means all things being equal, men and women must pay the same. Women have typically paid less than men, so can expect big rises in costs.

So, if you're a man - get a quote now and compare it against your last renewal, even if your next renewal is months away. If it's less, consider cancelling and starting a new policy.

As long as you've not claimed, check you'll get a pro-rata refund, and factor in any exit fees. Remember you won't earn any no-claims during that insurance year.

Use the system in this guide to hopefully beat your current price, or at least find the cheapest you can.

The older you are, the cheaper it costs

The cost of insurance jumps for under-30s, and even more for under-21s. There's not much you can do about your age, but generally, cheaper third party insurance is still worth a look for younger riders.

Remember this only pays for damage to other people's bikes or property, and not yours.

Don't overestimate your mileage

While many riders don't use their motorbike as their main form of transport, they use their car mileage to estimate the bike mileage. Often, it's far less. As you pay less if you drive less, this mistake can lead to you paying too much.

Can you park it in the hallway?

Security is one of the biggest problems for motorbike owners, and less secure bikes are more expensive to insure. Ideally keep it inside the house (!) or, if not, in a locked garage. If you can't do this, some insurers won't cover you for theft.

If it has to stay outside, use an insurer-approved anchor lock or security device. This will help reduce the quote, though they can be expensive and it may take a while for reduced premiums to cancel out the cost of the lock.

The more points on your licence, the higher the cost. While speeding points remain on your licence for four years, insurers usually check for convictions during the last five before they are removed from your record.

DO work out how much you'd really claim for

It's worth considering going for a policy with a higher excess (the amount of any claim you need to pay yourself). Many people will find claiming for less than �500 of damage both increases the future cost of insurance and can invalidate no-claims bonuses, meaning it's not always worth making a claim.

So why pay extra for a lower excess? A few policies will substantially reduce premiums for a �1,000 excess, so try this when getting quotes. The downside of this is if you have a bigger claim you'll have to shell out more, so take this into account.

You'll pay extra to cover helmets and other gear

It's unlikely that damage to your riding helmet and specialist clothing will be covered as standard � though more and more insurers are giving the option to include these as at an optional extra cost.

Consider temporary cover if you don't use your bike all year round

For some, jumping on the saddle is a summer-only activity. If your bike goes into winter hibernation, take a look at cheaper temporary insurance that just lasts six months.

There are two things to be aware of though.

-

You won't build up a no-claims bonus. This will mean you won't be eligible for no-claims discounts in future years.

-

When not insured, you must get Sorn. Rules came into force in 2011 saying all vehicles must either be insured - even if no one rides them - or you must get a a Sorn (Statutory Off Road Notification). See Gov.uk for how to do this.

DON'T think you'll pay the same by instalments - most charge big interest!

Whoever you insure with, if it gives an option to 'pay monthly', be careful. What usually happens is the insurer actually loans you the annual cost and charges you interest for the privilege.

Occasional promotions are interest-free, but otherwise the interest rates are usually hideous. So either pay it off in full, or if you can't afford it in one go it's actually cheaper to pay with a 0% credit card for spending and make the same repayments to that.

DO tell insurers about changes and special circumstances

If you haven't got normal circumstances - perhaps you've made a claim in the past few years, have a modified bike or expect to ride 100,000s of miles a year - then tell the insurer. If you don't and then try to claim, even for an unrelated issue, your whole policy may be invalid.

Plus you should also tell your insurer about any changes. This is crucial as it reduces potential problems in the event of a claim, even if it's just your address. Trying to get insurance after you've had a policy cancelled due to a fraudulent claim is very difficult, very expensive and will follow you for the rest of your life.

A change in circumstances includes moving jobs, as insurers believe this can affect your risk. Scandalously, the unemployed often (though not always) pay higher rates for insurance, so tell your provider if you're out of work.

Tweaking your job description could save you cash and to help, we've built a fun Car Insurance Job Picker tool to show the riskiest jobs and see if small tweaks to your job description could save you cash.

You may also save on insurance if you're in stable relationship - living with a partner rather than listed as single.

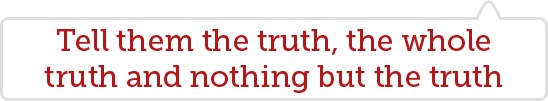

DON'T lie when getting a quote

With insurance, remember - the golden rule is:

If you've read these tips and thought, "it's easy to lie about this", then of course, you're right. Yet lying on your insurance form is fraud. It can lead to your insurance being invalidated and, in the worst case, a criminal prosecution for driving without insurance. Don't do it.

Step 2: Find the best bike quote

As insurance prices depend on an individual's own circumstances, there's no one single cheapest provider. The key is to use screenscraping websites to get the most quotes in the shortest amount of time. Here, you enter your details and their software automatically fills in the required info at a host of brokers' and insurers' websites, grabbing you a quote.

If you are a fair-weather rider and only use your bike in lighter, brighter months of extra daylight, also get a quote for temporary insurance.

Compare in the following order

This guide has recently been updated with a new order, and information, but we'd love your feedback on if it works for you, if there's anything you would change, or feel we have missed.

-

Always double check your results. What to check

-

Your data is being given to insurers. What insurers may do

1. Gocompare

Get quotes from 36 brokers

In our test, obtaining a quotation took approximately six minutes, but the excesses were considerably lower across its panel.

It clearly states through a tick and cross system if additional cover is provided. But if you're comparing between insurers, it's fiddly to select different options for the type of cover you want.

2. The Bike Insurer

Quotes from 35 brokers

The process took no more than five minutes from start to finish for us. Results are available for all three levels of cover by clicking on a tab. The edit option is simple and efficient. Special offers are clearly laid out. But the voluntary excess defaults to �500.

Tesco Compare also uses The Bike Insurer to provide quotations.

3. Confused.com

Quotes from 31 brokers and 2 direct insurers

The process took us three minutes with a simple edit option. You're also able to view premiums for each cover level by clicking on a drop-down box. Voluntary excess defaults to a high �500.

Also, if you buy via Confused.com*, you'll get 1,000 Nectar points.

4. MoneySupermarket

Can get quotes from 31 brokers and 1 insurer

In our test, the five-minute process returned a clear result, and lets you alternate between cover levels by using a drop-down box.

Additional costs are also clearly displayed, should you want to add benefits which are normally excluded.

5. The pick of the rest

A couple of insurers aren't included on comparisons and are worth checking separately for a final push. So if you have a few minutes spare, try Aviva and broker Carole Nash*.

If you're desparate to squeeze the pennies off, there are also a few more comparisons to try: BeatThatQuote*, Quote Zone*, Compare The Market*, Tiger.co.uk* and MCN Compare* (which currently offers for a free biking magazine when you get a quote).

Step 3: Check out special policies

Once you've tried the comparison sites, it's worth trying these extra ways to see if they undercut your best price.

Temporary insurance

For some, jumping on the saddle is a summer-only activity. If your bike goes into winter hibernation, take a look at cheaper temporary insurance that just lasts six months.

There are two things to be aware of, though.

-

You won't build up a no-claims bonus. This will mean you won't be eligible for no-claims discounts in future years.

-

When not insured, you must get Sorn. Rules came into force in 2011 saying all vehicles must either be insured - even if no one rides them - or you must get a a Sorn (Statutory Off Road Notification). See Gov.uk for how to do this.

The top short-term solution

eBike: If you need short-term cover, eBike* offers a pay-as-you-go policy where you can buy cover one month at a time and there are no cancellation charges. There is, however, a �6 per month admin charge which makes the cover more expensive than a standard policy if you'll need insurance for more than about eight months a year.

Be realistic, though. Six months of cover won't simply be half the cost of 12. You'll pay proportionally extra to save yourself needing to hand over the full whack.

Get a 'six-wheel' policy

If your bike isn't your only form of transport, and you use a car too, get a quote for a policy that covers both. The only 'six-wheel' policy we've found is from Carole Nash.

Though having both vehicles on one policy may be convenient, check that it's actually worth it. Get a 'six-wheel' quote, then total up individual ones for your bike, using the comaprisons above, and your car, using our Cheap Car Insurance guide.

Speak to a broker

Brokers and screenscrapers may seem like they're doing a similar job, as each search a number of different insurers. But they're radically different beasts. A good analogy for this is to compare it to searching for the cheapest loaf of bread.

Individual insurers are like bakers, your choice is simply to buy the cheapest loaf that suits.

Brokers are like supermarkets. They stock a range of bakers' loaves and the price charged depends on their relationships with suppliers.

Screenscrapers are like sending someone round supermarkets and bakers to note all their prices.

So, with your tastebuds whet, we'll get to the point.

To really hone the price to the nth degree, it is worth picking up the phone and calling a broker. Here's a selection: BikeSure, Endsleigh*, Footman James or search on the British Insurance Brokers Association website for a local broker.

Special deals

Swinton Bikes: Until further notice, if you buy a Swinton Bikes* policy (using the code MBWTDR274), and you'll get �30 cashback.

Be Wiser: Insurance broker Be Wiser has a number of incentives to tempt you into signing up. You'll automatically get free helmet and leathers cover (up to �1,000), legal protection service, RAC roadside assistance (worth �29.99) and personal accident cover (up to �10,000).

MCE Insurance: MCE Insurance* is also offering free RAC roadside assistance (worth �29.99), a courtesy bike in case of an insurance claim, personal injury cover (up to �1,000) and helmet & leathers cover (up to �500). Also, if you buy online, you'll get a 30% discount.

Once you've found the cheapest

Once you've found the cheapest from the screenscrapers, there are two important checks to make:

-

Double-check the quotes

Click through to the insurance provider's own website to double-check the quotes, as to speed up searches some comparison sites make a few assumptions.

-

Examine the policy's coverage

Is the policy suitable for you? If you want "pillion cover", is it included? Plus while you're there, it's worth playing with the policy details to see if you can slim the price down. Look at the excess, and if extra security will help to drive the cost down.

Step 4: Grab cashback and haggle

By now you'll know the cheapest available provider. But you may be able to cut the cost even further.

Try cashback websites

Once you know who your cheapest provider is, you need to check there aren't any hidden cashback deals, as these can be as high as �100. If your second or third cheapest quotes weren't too much more expensive see if cashback's available for them too, and find the overall winner.

These sites carry paid links from some retailers and financial services providers. In other words if you click through them and get a product they get paid. They then give you some of this cash which means you get the same product, but a cut of its revenue.

Don't choose based only on cashback, see it as a bonus once you've picked the right cover.

Those new to cashback sites should ensure they read the Top Cashback Sites guide for pros and cons before using them.  Otherwise use the Cashback Sites Maximiser tool to find the highest payer for each insurer.

Otherwise use the Cashback Sites Maximiser tool to find the highest payer for each insurer.

Things you need to know before doing this...

- Never count the cash as yours until it's in your bank account. This cashback is never 100% guaranteed, there can be issues with tracking and allocating the payment, plus many cashback sites are small companies with limited backing, and you've no protection if anything happens to them.

- Withdraw the cashback as soon as you're allowed. Money held in your cashback site account has no protection at all if that company went bust, so always withdraw it as soon as you're eligible.

- Clear your cookies. While it shouldn't be a problem, if you've used comparison sites beforehand, there is a minor risk that the cashback may not track due to cookies - so its good practice to clear those first (read About Cookies).

Haggle on your insurance

The insurance market is very competitive and companies are desperate to retain business. So once you've got your overall cheapest price, get on the phone and try to haggle. There's often price flexibility, but be fully armed with the screenscrapers' cheapest quotes and any available cashback first.

The first port of call should be your existing insurer. If it can beat or even match the best quote it saves the hassle of switching policy. If that doesn't work and you're still in the mood, take it to a broker. For more haggling tips, read the full Haggle On The High Street guide and 2013's top 10 firms to haggle with.

What if my insurer goes bust?

The economic times we live in mean you never know which company might be the next to have problems. Fortunately, insurance providers are covered by the government-backed Financial Services Compensation Scheme, meaning if they go into default, you're protected.

The FSCS will usually try to find another provider to take over your policy, or issue a substitute policy. However, if you have any ongoing claims, or need to make a claim before a new insurer is found, the FSCS should ensure these are covered. For full details, read the insurance section of the Savings Safety guide.

Step 5: Remember next year

Providing you drive well and don't have any accidents, your insurance premium should get cheaper after the first year. However, don't automatically stick with the same provider - it may not still be the cheapest.

Apply for cover from your existing insurer as a new customer and its likely you'll be given a cheaper price. This is because insurers, like any company, will happily profit from apathy if they can.

Insurers must send out renewal notifications at least 28 days before renewal. This doesn't leave much time, and you can end up rushing to find a cheaper price.

To avoid being forced to decide quickly, put a warning in your diary six weeks before your renewal date, so there's plenty of time to sort out a new provider. Alternatively use the free Tart Alert, which sends a reminder text or email.

PizzaExpress 3 courses �13

PizzaExpress 3 courses �13 �9.50 train credit

�9.50 train credit M&S; �10 dine-in

M&S; �10 dine-in try it*

try it*  try it*

try it*  try it*

try it* try it*

try it*