Kindle vs Kobo: Which is best?

As MoneySavingExpert.com’s resident tech writer, I often get asked: “Which is better, the Kindle or the Kobo?” My honest answer is: it depends what you’re looking for.

Many people (including MSE’s head honcho – who is firmly on Team Kindle, see his comment below) favour the ubiquitous Kindle, and it has been one of the UK’s most-wanted Christmas gifts for a couple of years.

But with the arrival of the slightly cheaper Kobo last year, a battle for the title of best e-reader began, sparking much debate on our Cheap e-readers forum discussion.

So, if you’re considering swapping paperbacks for something a bit more hi-tech, here’s my take on the UK’s two biggest e-readers.

Price

Cost is obviously going to be a big factor for many when choosing an e-reader.

Amazon’s newest Kindle (the wi-fi model, without keyboard) is £89, though it is often possible to pick one up for slightly less with a discount code from Tesco.

In contrast, the standard cost for the Kobo wi-fi is around £70, with the cheapest we’ve found at Asda (£59) if you bag it at the right time. For a round up of all the deals available, read the Cheap e-Book Readers guide.

My choice: Kobo

Books

The Kindle has space for around 1,400 books, and the Kobo 1,000. But this should be more than enough for even the fastest of readers.

If it’s not, the Kobo has an SD card slot, which can expand your library up to 32GB, or 10,000 books. The Kindle doesn’t have an SD card slot, but I’m not going to mark it down for this (who really needs more than 100 books, let alone 1,400?). And you can also store files on your PC to free up room on your reader.

Free e-books are available from a whole load of websites, including Amazon and the Kobo site, so there’s no need to spend money buying something to read. The Kobo even comes pre-loaded with 100 classic novels, such as The Hound Of The Baskervilles and Anne Of Green Gables.

If you do want to buy the latest Kinsella or Grisham bestseller, bear in mind Amazon’s Kindle store is competitively priced, offering a lot of the newest releases a lot cheaper than other online sites, so I’d suggest you compare e-book prices before downloading anything.

If you have a Kindle, unless you buy your books from Amazon’s Kindle store (as AZW files), you may have to spend time converting e-books to a readable format, as Amazon restricts the use of ePub files.

It allows for MOBI and PDF files though, so if you want to get books that aren’t available on the Amazon site (or are cheaper elsewhere), you’ll have to download a file convertor program. I’m a big fan of Calibre, which is really easy to use and transfers books to the Kindle in seconds, once converted to a MOBI file.

The majority of free e-books on the web are in the ePub format, which can be put directly on to the Kobo, but will have to be converted if using a Kindle.

Similarly, if your local library offers free e-books, you may experience problems if you have a Kindle, as they tend to be in ePub format, and copyright laws prevent you from converting them.

For me, the openness of Kobo’s file format gives it the edge over the Kindle in this category.

My choice: Kobo

Size

If you plan to use your e-reader while travelling, size is important.

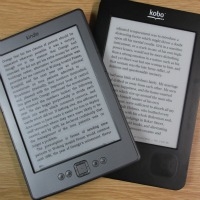

And, if you’re used to reading paperback books, you may find an e-reader takes a bit of getting used to. Both the Kindle and Kobo have a 6-inch screen, which is a lot smaller than the size of a standard book.

At 170g, the Kindle is the lighter of the two though, weighing a lot less than the average paperback. And the Kobo is not that much heavier, at 221g.

The Kindle is also a fraction smaller, so will take up less suitcase space — meaning more room for flip flops/bikinis/inflatable crocodiles etc.

But neither e-reader is waterproof, so don’t attempt to read in the pool (or bath), unless you’ve got one of these.

My choice: Kindle

Look & feel

The e-reader is a big favourite with daily commuters (myself included), so being able to hold it in one hand while frantically gripping an overhead bar/briefcase/scalding cup of coffee is a must.

In my ‘holdability’ test, the Kobo came up trumps with its soft rubber finish. The raised pattern on the back makes it really comfy to hold, perhaps more so than an actual book, though it’s been a while since I’ve held a paperback.

As both devices feature a 6-inch e-ink screen, and both let you choose your font and size, there are no differences here.

Buttons were next up on my test list, which for me is where the Kindle lost serious brownie points. I am not a fan of the page turn buttons on the Kindle. There were way too many of them for a start.

I often lost my place in the book I was reading and found myself pressing the wrong buttons all the time. Annoying.

The onscreen keyboard on the Kindle was also slow, and a pain to type with.

The Kobo was a lot simpler, with the five-way controller doing page turns and navigating the menus.

When it comes to turning the page, Amazon claims the latest Kindle has 10% faster turns than its predecessor, the Kindle Keyboard, but to the naked eye — well, mine — page turns were still pretty slow.

The Kobo was even slower to load pages than the Kindle though, which I found broke my reading pace. I also didn’t like the way the Kobo screen flashed black and white with a sort of ‘ghost’ text when turning the page. Creepy.

My choice: Draw, but the Kobo wins for the daily commuter.

My verdict

With an RRP of £69.99, the Kobo is not only cheaper than the Kindle but I think better for books, with thousands of titles available to borrow for free at a growing number of libraries.

It’s not the Kindle, though, and that’s what most people seem to want.

If buying an e-reader for yourself, the Kobo wins hands down in my opinion. Save yourself the extra £20 and buy a nice case for it.

But if you’re buying an e-reader as a present, it may be worth spending that extra £20 and getting them what they really want. After all, you don’t want to be known as the person who gives the cheap Kindle substitute.

Do you agree with me? You can leave your feeback in the comments section below or in the MSE Forum.

Habitat 25% off

Habitat 25% off Superdry 15% off

Superdry 15% off �10 off iPods code

�10 off iPods code

Pushy timeshare reps often use bribes to lure unsuspecting holidaymakers into parting with their life savings. But unfortunately for them, they’d picked up a MoneySaver…

Pushy timeshare reps often use bribes to lure unsuspecting holidaymakers into parting with their life savings. But unfortunately for them, they’d picked up a MoneySaver…

Comments

This is an open discussion; anyone can post. Please report any spam, illegal, offensive, racist, libellous posts (inc username) to fbteam@moneysavingexpert.com